Wall Street is drifting lower again on Wednesday as President Donald Trump remains unable to juice prices higher with hopes of a U.S.-China trade deal despite his best efforts on Twitter (NYSE:TWTR). The problem with all his obvious market coddling is that China isn’t playing along, with Beijing’s strategy appearing to harden its position and push American share prices lower.

As a result, the Dow Jones Industrial Average is testing critical support near its 200-day moving average.

Despite this, there are areas of the market such as energy that are perking up. Crude oil is challenging down channel resistance that has been in play since April in what looks like a reappearance of fears over tensions with Iran. As a result, a number of extremely cheap oil and gas stocks are perking up.

Here are four worth a look:

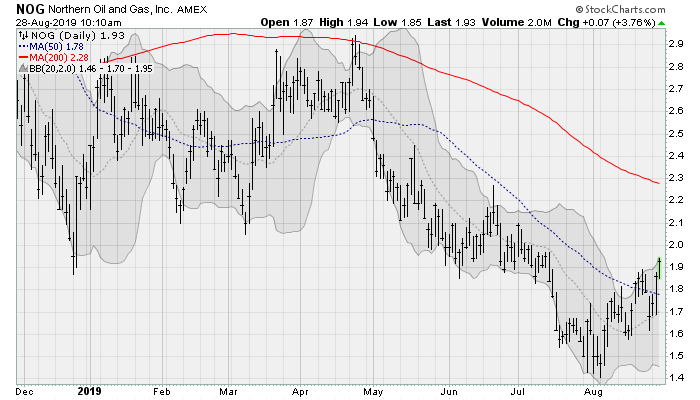

Northern Oil and Gas (NOG)

Shares of Northern Oil and Gas (NYSE:NOG) are extending above their 50-day moving average, breaking out of the downtrend channel that has been in place since late April. Watch for a run to the 200-day moving average, which would be worth a gain of nearly 20% from here. Shares are bounding off of support from the early 2018 lows near $1.50.

The company has been focused on building out its portfolio of properties, expanding it at a time when prices are cheap and sentiment is low. It completed roughly 40 acquisitions since the end of March, adding approximately 6,325 net acres.

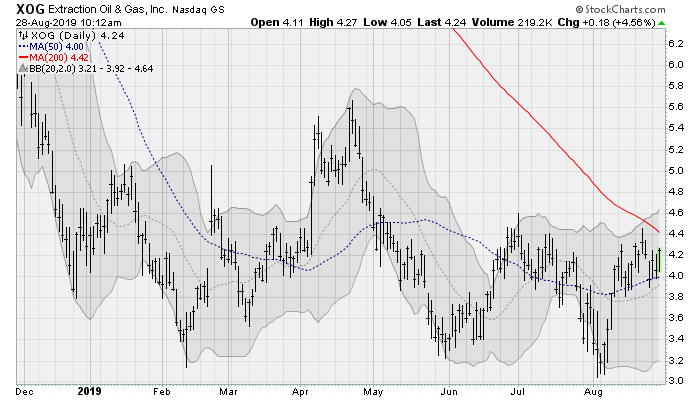

Extraction Oil & Gas (XOG)

Shares of Extraction (NASDAQ:XOG) look set to push up and over its 200-day moving average for the first time since the summer of 2018, ending a tight sideways consolidation that has been in place since December. Coverage was recently initiated by KeyBanc analysts with a buy rating. Wells Fargo resumed coverage in May and are looking for a $8 price target, a move that would be worth a gain of nearly 100% from here.

The company will next report results on Nov. 5 after the close. Analysts are looking for a loss of 10 cents per share on revenues of $236.9 million. When the company last reported on Aug. 1, earnings of 22 cents per share beat estimates by 29 cents on a 14.6% decline in revenues.

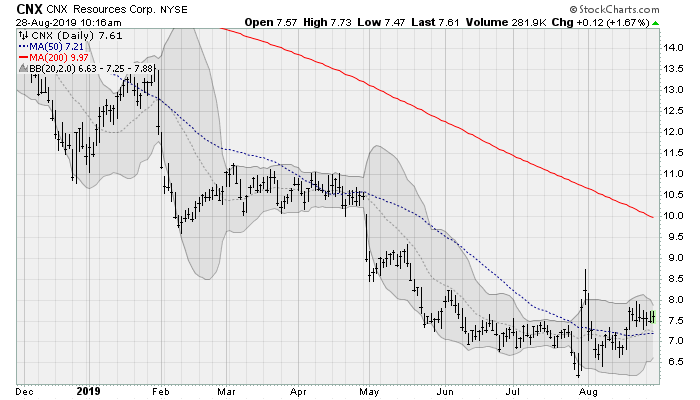

CNX Resources (CNX)

Shares of CNX Resources (NYSE:CNX) have pushed up and over their 50-day moving average, testing the upper end of a multi-month consolidation range in what looks like the end of a downtrend that has been in play since the summer of 2018. Watch for a run at the 200-day moving average, which would be worth a gain of roughly 40% from here.

The company will next report results on Oct. 29 before the bell. Analysts are looking for a loss of two cents per share on revenues of $333.7 million. When the company last reported on July 30, earnings of six cents per share missed estimates by eight cents on a 50.5% decline in revenues.

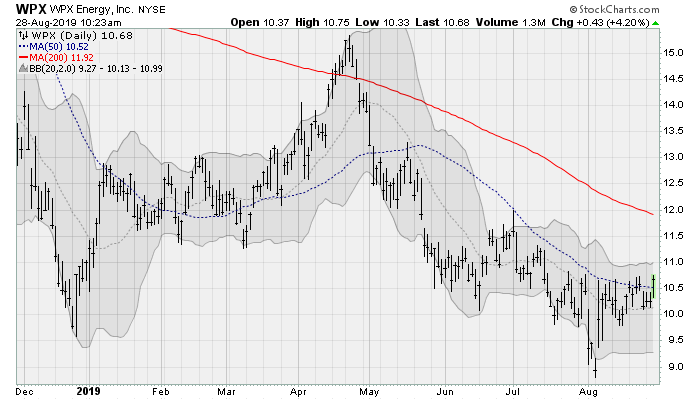

WPX Energy (WPX)

WPX Energy (NYSE:WPX) shares are emerging above its 50-day moving average, ending a downtrend pattern that’s been in place since late April after testing support from its late-December lows. The independent shale oil and gas producer, which is based in Oklahoma and has assets in the Permian and Williston Basins, was recently called a Top Pick by Williams Capital analysts.

The company will next report results on Oct. 30 after the close. Analysts are looking for earnings of 13 cents per share on revenues of $647.1 million. When the company last reported on Aug. 5, earnings of nine cents per share beat estimates by two cents on a 61.6% rise in revenues.

As of this writing, William Roth did not hold any of the aforementioned securities.