Yesterday was a record-setting day for the stock market. And if history is any guide, it marks the beginning of a big new bull market wherein you could mint a fortune over the next 12 months.

Here’s the quick story.

After October inflation numbers came in much lighter than expected, stocks soared yesterday the most they’ve soared in years.

Frankly, I cannot emphasize how big this stock rally was…

The S&P 500 shot up 5.54%. That’s its biggest single-day gain since April 2020 and its 15th best day of the past 50 years!

It was an historically strong day for the stock market.

Of course, one day typically does not make a trend – but yesterday was no ordinary day.

In fact, our historical analysis suggests days like yesterday do define new trends. And they only tend to happen when stocks are gearing up to soar over the next 12 months.

Here’s the data.

A 30% Stock Rally on Deck?

The S&P 500 rallied more than 5% yesterday while still in a bear market. That’s incredibly rare – and incredibly bullish – price action.

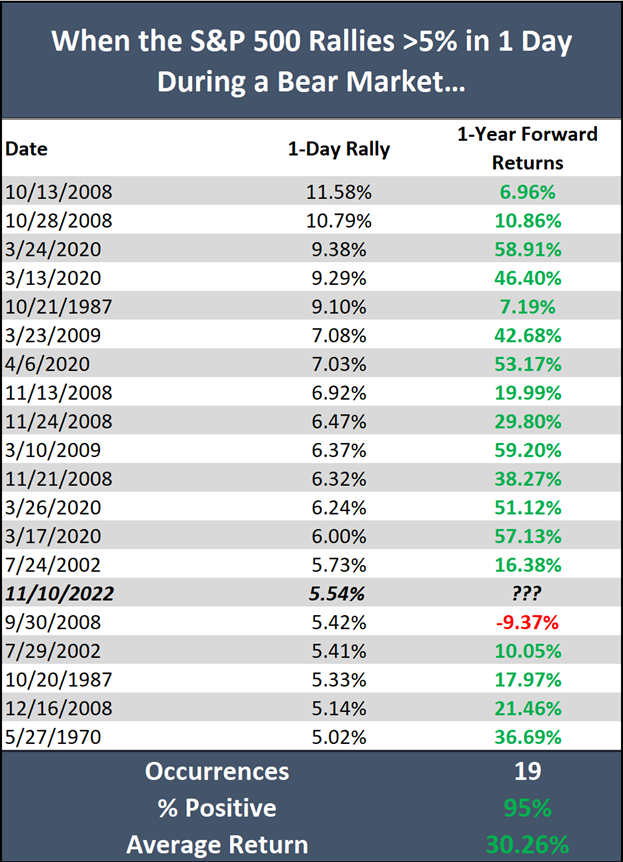

Since 1970, the market has rallied more than 5% in a single day while still in a bear market on 19 separate occasions. Said differently, what the market did yesterday, it has only done 19 previous times over the past 52 years.

What happened next?

In 18 of those 19 previous occurrences, stocks rose over the next 12 months. The average return? A whopping 30%!

Better yet, the only time stocks didn’t rally over the next 12 months – late September 2008 in the midst of the ultra-unique Lehman Brothers bankruptcy – stocks were higher about 16 months later.

In other words, stocks just did something yesterday that they tend to ONLY do when they’re about to explode higher over the next year.

History shows there is a 95% chance stocks soar about 30% over the next 12 months.

It will be a face-melting stock rally. Some investors are going to make fortunes. But are you prepared to capitalize on it?

The Final Word

Let me share a truth that everyone tends to forget when stocks are crashing. Every bear market eventually turns into a new bull market. That’s why the 50-year chart of the S&P 500 goes up and to the right.

Here’s another fact: The best years on record for the stock market are when bear markets turn into bull markets. The S&P 500’s best years of this century (2021, 2019, 2013, 2009, and 2003) pretty much all came after bear markets turned into new bull markets.

Every bear market turns into a bull market, and the best buying opportunities in history happen when bear markets turn into bull markets. Therefore, you need to buy the dip in stocks when bear markets turn into bull markets.

That could be happening right now, and I’ll tell you how to best take advantage of it.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.