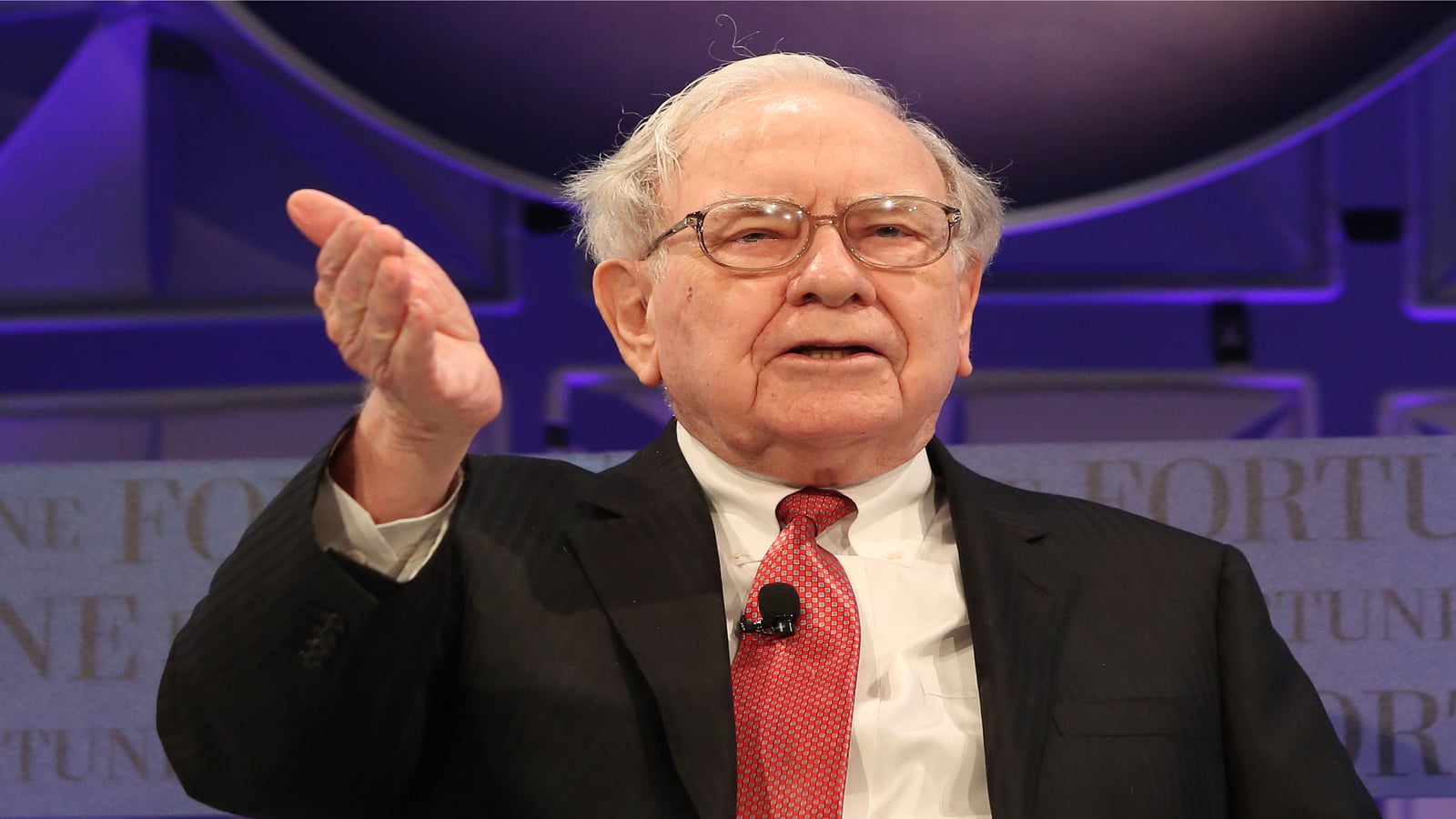

Warren Buffet’s philosophy relies on identifying stocks to buy and hold. He believes that the best names to buy and hold are those of undervalued companies that have high chances of being successful over the long term.

That investment strategy is embodied by Buffett’s Berkshire Hathaway (NYSE:BRK.B) which invests in those types of equities and other varieties of stocks as well. Over the previous decade, BRK.B has provided annualized returns of 11.39%. However, investors who want to find other individual Warren Buffett stocks to buy and hold would do well to consider these seven names.

| KO | Coca-Cola | $55.69 |

| AAPL | Apple | $142.41 |

| AXP | American Express | $141.54 |

| KR | Kroger | $42.11 |

| MCK | McKesson | $354.50 |

| DVA | DaVita | $89.88 |

| CVX | Chevron | $161.31 |

Coca-Cola (KO)

Many investors are aware of the connection between Coca-Cola (NYSE:KO) stock and Warren Buffett. Buffett famously showed Coca-Cola products on TV during his press interviews and reportedly continues to drink five cans of Coke daily.

Buffett clearly enjoys the company’s products. More importantly, for investors, he loves the company’s shares. Berkshire Hathaway owns 400 million of Coca-Cola’s 4.32 billion outstanding shares. Consequently, his views on Coca-Cola’s prospects move its share prices significantly. So any purchase or sale of KO stock by Berkshire Hathaway is consequential.

Berkshire did not buy or sell KO stock in Q2. But the company’s decision to hold onto all of its KO stock shows that it remains confident in the name. Coca-Cola’s long-term outlook remains very solid, and the mature firm is clearly capable of continuing to drive top-line growth and provide investors with returns. Its revenues increased from $37.3 billion in 2019 to $38.7 billion in 2021. During the same period, its earnings per share went from $2.11 to $2.32.

All of this indicates that Coca-Cola will grow steadily over the next decade. The company will continue to return money to investors via its dividend which has not been reduced since 1963.

Apple (AAPL)

Apple (NASDAQ:AAPL) has been one of the most successful stocks over the past decade. During that period, the annualized return of AAPL stock averaged 21.17%. Those returns outpaced those of the tech-heavy Nasdaq by 81%. Capital invested in Apple’s shares multiplied in value by nearly seven times in that span of time. If past is prologue, buying and holding Apple’s shares for the next decade is a smart idea.

The outlook of AAPL stock remains bright moving forward. Quantitative tightening has drastically impacted tech stocks in 2022. But one firm believes that Apple’s shares can more than double in price in the next five years, reaching nearly $360. The same source predicts that Apple could rise to $445 by 2032.

AAPL stock constitutes the largest holding in Warren Buffett’s portfolio, accounting for more than 40% of the value of his stocks. It appears that Apple will remain among the most important companies in the world for the next decade. Consumer demand isn’t waning despite the economy’s slowdown, and Apple reported record revenues when its earnings were released in late July. It’s an easy, smart choice.

American Express (AXP)

American Express (NYSE:AXP) stock is in a unique position. Like all companies, American Express may have to cope with a recession. Almost every company’s financial results are negatively impacted by recessions. American Express could fare better than most companies during an economic downturn, though.

That’s because it caters to relatively high-income earners who are less likely to lose their jobs during a recession. The company provides credit cards that come with high annual fees. The fact that its members can afford those annual fees, as high as $695, suggests that their spending will be more resilient during recessions. So AXP stock is likely to perform better in the short term than other firms.

The long-term outlook of AXP stock is strong as well. Analysts, on average, expect the company’s revenue to exceed $52 billion in 2022 and rise to $58 billion in 2023.

Kroger (KR)

Last month, those who are bullish on Kroger (NYSE:KR) stock contended that shoppers were increasingly purchasing food from the grocery chain. Rather than pay for expensive meals at restaurants, they noted, people were instead shopping at Kroger in order to reduce the amount of money they spend on food.

And indeed, that trend was reflected in the firm’s Q2 earnings as its sales jumped 9.15% YOY in Q2 to $34.6 billion. Strong cooking-at-home trends look poised to continue throughout the remainder of 2022 as September’s inflation data tell a grim story.

Kroger increased its full-year guidance when it released its Q2 earnings in early September. When the company reports its Q3 results later this year, it’s possible that its guidance could increase again. In any case, the short-term outlook of Kroger’s business is positive.

Kroger’s long-term outlook could be especially positive as KR is planning to buy its smaller rival, Alberstons (NYSE:ACI). The $24.6 billion purchase would create a grocery giant. As a result, if the deal is approved, the newly created company could rival Walmart (NYSE:WMT) as the largest seller of groceries in the U.S.

McKesson Corp. (MCK)

Warren Buffett chose another long-term winner in McKesson (NYSE:MCK) stock. Like the other equities on this list, its returns over the last decade have been impressive. Its annualized returns averaged 15.6% over the last decade. Capital invested in MCK stock ten years ago would have more than quadrupled in value.

McKesson is a pharmaceutical supply chain management firm. Specifically, the company optimizes the delivery of pharmaceuticals and other healthcare products. The demand for these offerings does not vary much based on economic growth.

McKesson has built a large network that continues to perform well. In its most recent reported quarter, its revenues increased 7% YOY to $67.15 billion. McKesson was hit by higher costs and its earnings, excluding some items, slipped 3% YOY. However, it meaningfully increased its full-year EPS guidance due to the government’s spending on coronavirus-related items.

Perhaps most importantly for long-term dividend investors, McKesson increased its dividend by 15% from 47 cents to 54 cents per share.

DaVita (DVA)

DaVita (NYSE:DVA) stock hasn’t performed as well as many of the other stocks on this list over the past ten years. Overall, it performed 5% better than the New York Stock Exchange where it is listed. Capital invested in DaVita would have appreciated in value a relatively modest 59% over that period.

But the reason to invest in DaVita for the next ten years relates to America’s obesity epidemic. More than 42% of Americans are now obese, the highest rate ever. That means the rates of heart disease, high blood pressure, and diabetes will continue to increase.

DaVita provides kidney care and dialysis treatments to patients with chronic kidney disease. Chronic kidney disease is caused by several factors. However, high blood pressure, heart disease, and diabetes are the primary drivers of the disease.

Chronic kidney disease is expected to increase over the next decade as America’s obesity epidemic worsens. So the demand for DaVita’s treatments is likely to increase as more and more Americans are diagnosed with the disease.

Chevron (CVX)

Chevron (NYSE:CVX) has become somewhat maligned as the U.S. quickly moves away from fossil fuels and toward alternative-energy sources. However, the importance of fossil fuels remains evident. Recently, Americans have again come to understand how our dependence on foreign oil can negatively affect our lives, as average gasoline prices jumped above $5 in June.

It isn’t the short-term effects of the Russian invasion of Ukraine alone that make CVX stock a buy. More importantly, the U.S. and the world cannot ween themselves off of fossil fuels overnight, and the transition will be much more gradual. As a result, energy companies like Chevron will remain important to the economy, and their stocks will remain good investments for the next decade.

Here’s something to think about: Energy stocks suffered what was termed a lost decade in the 2010s. That said, CVX stock outperformed the market during that period.

It also provides a strong dividend which yields 3.55%. Investors should hold onto CVX stock, reinvest its dividends, and recognize that CVX will remain relevant for a long time.

On the date of publication, Alex Sirois did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.