[Editor’s note: “As Hydrogen Takes Off, Bet Early to Win Big” was previously published in May 2022. It has since been updated to include the most relevant information available.]

In the finance world, when heavyweight asset manager BlackRock (BLK) makes a move, everyone listens. That’s because BlackRock is the world’s largest asset manager, with about $10 trillion in assets under management. If it were its own country, it’d be the third-largest economy in the world behind the U.S. and China. Well, Blackrock recently made a big move — in hydrogen.

Specifically, the firm put $200 million into a tiny energy company that my team believes will be the “next Tesla.” That’s increased its stake by more than 20% over the past few months.

Blackrock owns almost 60 million shares of this company.

And interestingly, this “next Tesla” isn’t an EV maker, battery company, charging station builder or solar project developer.

Rather, it’s a hydrogen company that the world’s largest asset manager bet big on.

And since, there’s been more rumblings within the hydrogen industry. Today, Plug Power (PLUG) and New Fortress Energy (NFE) announced their agreement to build a 120 MW industrial-scale green hydrogen plant in Texas. The facility is expected to be one of North America’s largest. And it aims to produce more than 50 tons of H2 per day.

Indeed, the hydrogen industry is powering forward, and we’re still in its early innings.

The Dawn of a New Energy Economy

Before we go any further, let me first state that, yes, I’m well-aware of the back story on hydrogen.

It’s been touted as a viable clean energy source since the 1970s. Yet, since then, it hasn’t been used to do much of anything as far as powering our world goes. The past 50 years in the Hydrogen Economy have been characterized by little more than a series of false starts.

But there comes a time when each new technology has its “moment.” Previously unproven tech proves itself — and goes on to change the world.

Hydrogen is having its moment.

We sit amid a global energy crisis. Fossil fuels won’t fix it, nor will solar or wind power.

What will?

Hydrogen — and to understand why, we need to revisit Chemistry 101.

Chemistry Look-Back

Recall the periodic table. Hydrogen is the lightest element in the universe. As such, you can fit a lot more H atoms into a finite space than, say, lithium atoms. Therefore, any power source made with hydrogen will be infinitely more energy-dense than one made with something else.

That has enormous implications.

In transportation markets, more energy density means fuel cells have longer driving rangers and faster refuel times than batteries. Therefore, hydrogen vehicles should drive farther, recharge faster, and last longer than EVs.

In stationary markets, it means they have more consistent and robust power output. Hydrogen storage solutions should provide more reliable backup power for data centers and utility companies than battery energy storage systems.

And in energy markets, it means hydrogen fuel is more transportable. It can be pumped through natural gas pipelines (while other “clean” energies cannot).

Make no mistake. Hydrogen has some enormous value-adds in the clean energy world.

So much so, in fact, that my team and I believe our world will inevitably be powered by it. Trucks, planes, ships, heat our homes, backup power — hydrogen everything.

To that end, we’re convinced those stocks will be some of the best-performing stocks of the 2020s.

Alas, the astute investor will be asking at this point: Why now?

After all, the periodic table hasn’t changed over the past 50 years. So, why will hydrogen take over in the 2020s?

The Hydrogen Economy Is at a “Tipping Point”

We believe that the stars have finally aligned, and the Hydrogen Economy will “tip” into hypergrowth mode this year.

Of course, the elephant in the room is the Russia-Ukraine war. This has sent oil and natural gas prices to nearly unaffordable levels. Yet, solar and wind aren’t quite there in their ability to allow the world to fully end fossil fuel dependence.

So, in steps hydrogen. The energy source is simultaneously clean and cheap yet powerful and plentiful enough to fulfill the world’s power demand.

The geopolitical backdrop has never been more favorable than it is today.

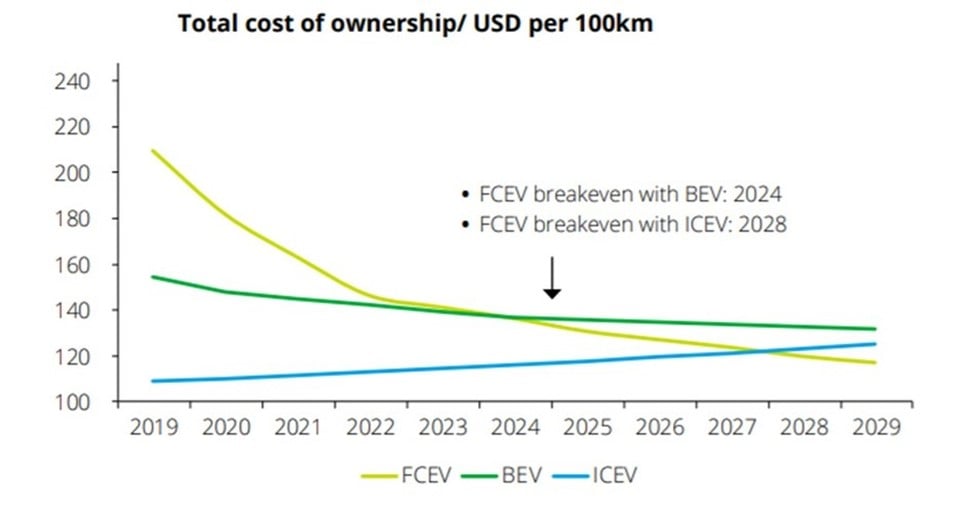

At the same time, the costs have plummeted, too. With advanced tech and economies of scale, H2 fuel cells costs have dropped 60% over the past 10 years. Deloitte expects these costs to drop below electric battery and combustion engine costs within a few years.

The tech has dramatically improved. Technological breakthroughs and falling renewable energy costs have led to a new era of scalable “Green Hydrogen” production. Now it can be produced from renewable energy sources, like solar and wind, cost-effectively. It’s no longer reliant on natural gas, which was historically used to produce most hydrogen.

In other words, while the periodic table hasn’t changed over the past 50 years, everything else has. And for first time ever, all the growth drivers have shown up at the same time.

In the words of Matthew Blieske, Shell’s (SHEL) global hydrogen product manager:

“[In the past] there was a policy missing, or the technology wasn’t quite ready, or people were not so serious about decarbonization. We don’t see those barriers anymore.”

The Hydrogen Economy will tip into its long overdue renaissance in the 2020s, creating what Morgan Stanley (MS) sees as an $11 trillion hydrogen market in the coming decades.

The Final Word on Hydrogen

The history of hydrogen as a viable clean energy source is riddled with empty promises and broken dreams.

But this time is different. Finally, hydrogen is ready to reshape the world’s energy landscape with ultra-affordable, energy-dense, reliable and transportable clean energy. It’s emerging when every country in the world looks to achieve energy independence. And consequently, it’s the only energy source that’s able to do so in a cost-effective way.

Investors who bet early on this revolution will win big. And in our Innovation Investor portfolio, we’re betting big.

But that’s not all.

Alongside the “next Tesla,” we also own one tiny $3 stock that’s pioneering a “forever battery.” Together with hydrogen, it will help redefine the world’s energy grid over the next decade.

As big of a winner as our top hydrogen stock will be, this tiny “forever battery” stock could be an even bigger one. Find out all the details.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.