Yesterday was an amazing day for the stock market — and especially so for growth stocks. The Fed sparked a massive rally across all asset classes. It strongly implied it’ll slow the pace of rate hikes in the coming months. And it may even turn to rate cuts by the end of the year.

In response, stocks soared.

The Dow added 440 points. The S&P 500 popped 2.6%. The Nasdaq surged 4% higher, and our favorite growth stocks jumped 5.3%!

To be sure, some investors are writing off the big rally as just another head fake in a bear market.

But we’re not.

We think the Fed may have just confirmed the end of the bear market. And it may have kickstarted the emergence of a brand-new bull market.

For that reason, we think it’s time to get aggressive in stocks. Remember: Fortunes are made when bear markets turn into bull markets. And we may be at that generational turning point today.

Follow the Liquidity

When it comes to stocks, lots of investors like to focus on revenues, earnings, insider buying, or dividend payouts. But at the end of the day, the one true force that drives stocks above all else is liquidity.

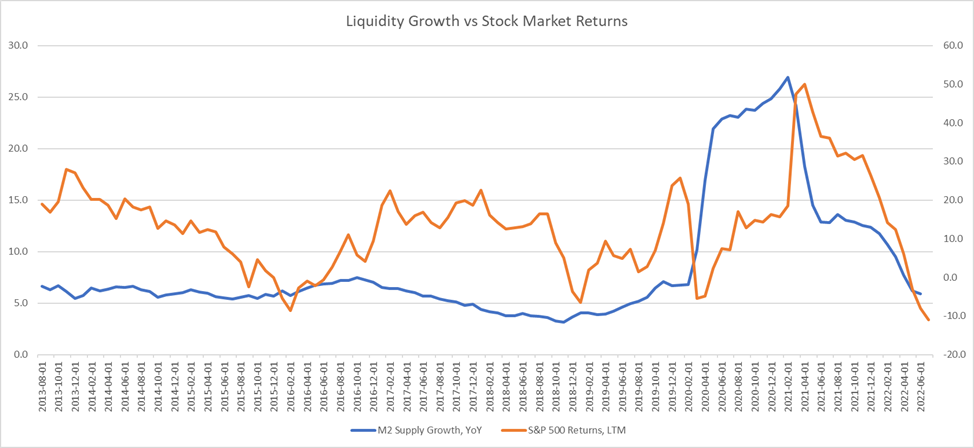

When liquidity expansion is robust, stocks rise. When liquidity expansion cools, stocks fall. This is illustrated clearly in the chart below. It graphs the year-over-year expansion rate in M2 money supply versus the trailing 12-month returns of the S&P 500.

The markets are all about liquidity.

The Fed has been removing liquidity from the markets all year long via rate hikes and quantitative tightening. That explains the big 20%-plus crash in stocks year-to-date (you can see this correlation in the chart above). These liquidity removals have worked to slow the economy and, consequently, slow inflation. Both are meaningfully decelerating right now.

Therefore, over the past month, a visible pathway has emerged for the Fed to start reinjecting liquidity (via rate cuts) into the markets by late 2022 or early ‘23, when the economy is at a standstill and inflation has been crushed. On the prospects of these liquidity reinjections, stocks have been rallying.

Yesterday, the Fed confirmed that it’s looking at things the exact same way as the market.

Specifically, the Fed withdrew its forward guidance and said that it’s moving to a “data dependent” outlook. That opens the door for it to shift to rate cuts within the next six months (if the data shifts). Also, in the Fed’s post-meeting press conference, Chair Jerome Powell said it would be appropriate to slow the pace of rate hikes in the coming months. That also opens the door for rate cuts by late 2022 or early ‘23.

The Fed and market are both seeing a pathway toward liquidity reinjections by the end of the year. And stocks took off like a rocket because of it.

We think this is just the start of a much bigger rebound rally for stocks and, in particular, growth stocks.

Small Growth Stocks Look Primed for a Huge Rally

What goes up, must come down. And conversely, in financial markets, what goes down tends to come back up.

Small-cap growth stocks have been at the epicenter of the stock market selloff in 2022. That’s mostly because they’re rate-sensitive assets whose valuations are most acutely damaged by higher interest rates. And that also means that their valuations are the biggest beneficiaries when rates move lower.

So, if the market starts to price in rate cuts for 2023, which seems increasingly likely, then these beaten-up growth stocks should be the market’s biggest winners in the second half of the year.

The chart tells the same story.

The Russell 3000 Growth Index is the most comprehensive collection of small-cap growth stocks in the market. It tested and held a critical late-2020 support level in June. Then it broke out of its 2022 downtrend channel in July. And just a few days ago, it broke out of a bullish ascending triangle pattern. Indeed, the chart says this index could soar back to new highs by the end of the year.

We think that’s entirely likely. And if it happens, certain high-flying growth stocks are primed to double or triple within the next few months alone.

It’s time to start buying those stocks for the chance to make enormous returns.

The Final Word on Growth Stocks

Listen. We’re not saying the bear market is over… yet.

But we will say that what the Fed did yesterday does meaningfully improve the odds that we’re amid a generational transition from a bear to a bull market.

Remember: Fortunes are made during transition periods like this one. That’s why we’re so excited about the opportunities in the market. We’re seeing dozens of stocks that could soar 2X, 3X, or even 5X higher within 12 months.

Risks remain. Inflation still has to die. We think it will. But it still needs to happen.

However, if and once it does, this nasty bear market will turn into an exciting new bull market. And investors who bought the dip could end up making a ton of money.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.