[Editor’s note: “8 Reasons This Is the Start of a New Tech Bull Market” was previously published in June 2022. It has since been updated to include the most relevant information available.]

Folks, welcome to the new bull market in tech stocks.

I know that may sound crazy to you. After all, tech stocks have been crushed throughout the first five months of 2022. But they’ve soared as of late. And there’s a mountain of evidence suggesting why it’s not crazy to believe a new bull market is emerging. In fact, it’s our reality.

That’s especially important news because the dawn of this new tech bull market offers the investment opportunity of a lifetime.

Bear markets are my calling card. I tend to thrive in moments like these. The biggest calls of my career — calls that allowed investors to consistently snag 1,000%-plus returns — were made during the market selloffs of 2015-2016, 2018 and 2020.

I successfully buy dips in bear markets. It’s what I do.

This time around is no different.

Over the past month, the Dow Jones is up 7%. The S&P 500 is up 9%, and the Nasdaq’s up 12%. Meanwhile, over that same stretch, growth stocks have soared about 20%!

If this really is the dawn of a new tech bull market — which I’ll prove over the next few minutes — then it’s also the dawn of growth stocks soaring thousands of percent over the next few years.

So, let’s dig in.

Bull Market Indicators: A Slowing Economy and Cooling Inflation

Tech stocks have been soaring recently.

Some folks think this could be a head fake — a dead-cat bounce, as they say.

But it’s not. And to prove why, we’ve compiled 10 of the most compelling datapoints underscoring the start of a new bull market.

Those datapoints are as follows:

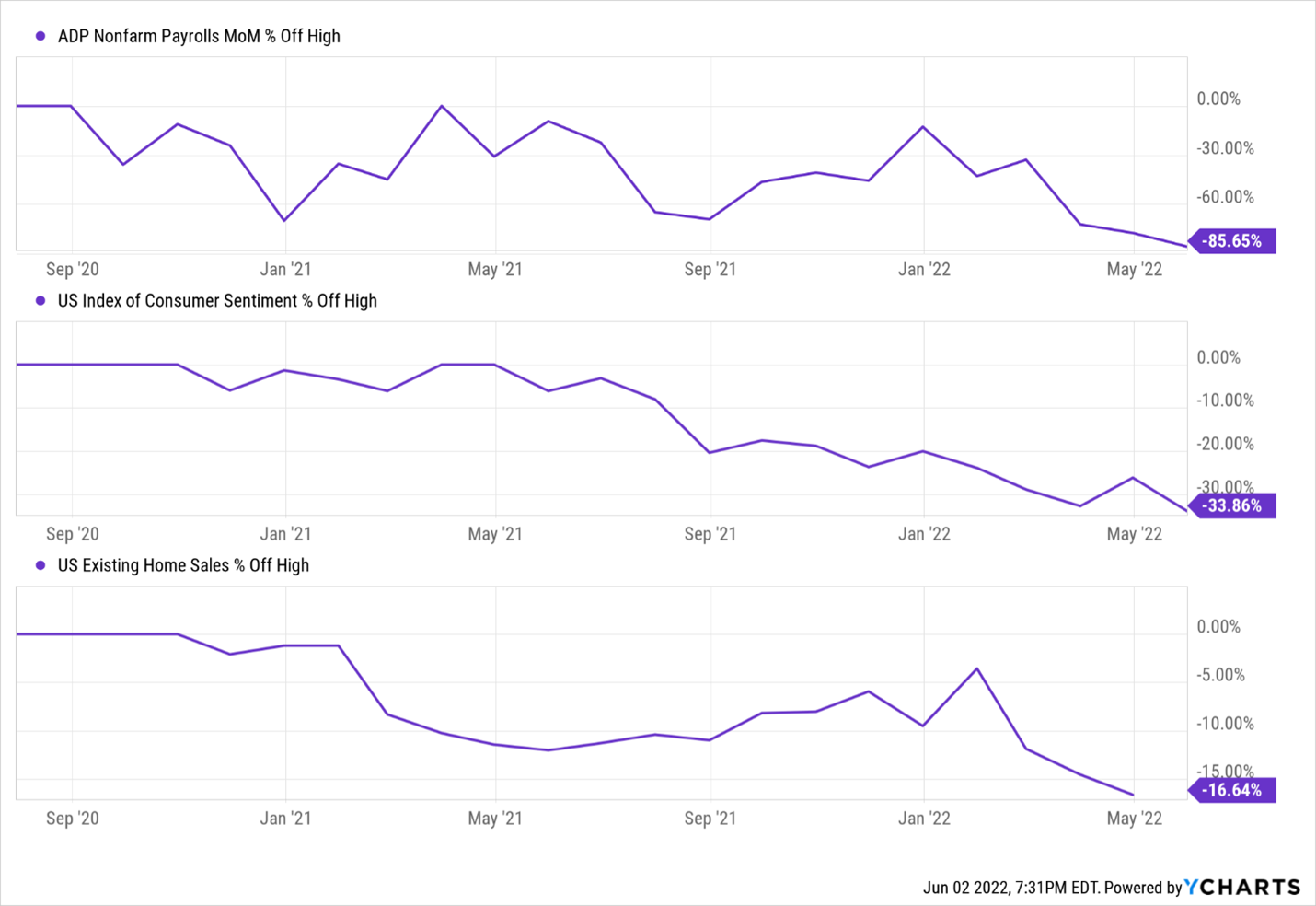

- The economy is rapidly slowing. The economy got too hot in 2021. That’s partly why tech stocks have been crushed in 2022. When the economy gets too hot, the Federal Reserve steps in to put the brakes on expansion through rising rates. Higher rates lead to lower valuations and lower tech stock prices. But amid geopolitical chaos and higher interest rates over the past few months, the U.S. economy has rapidly slowed. Job growth has braked to its slowest pace since the pandemic emerged. It’s the same with consumer sentiment, existing home sales and pretty much every economic datapoint out there. The U.S. economy is slowing rapidly.

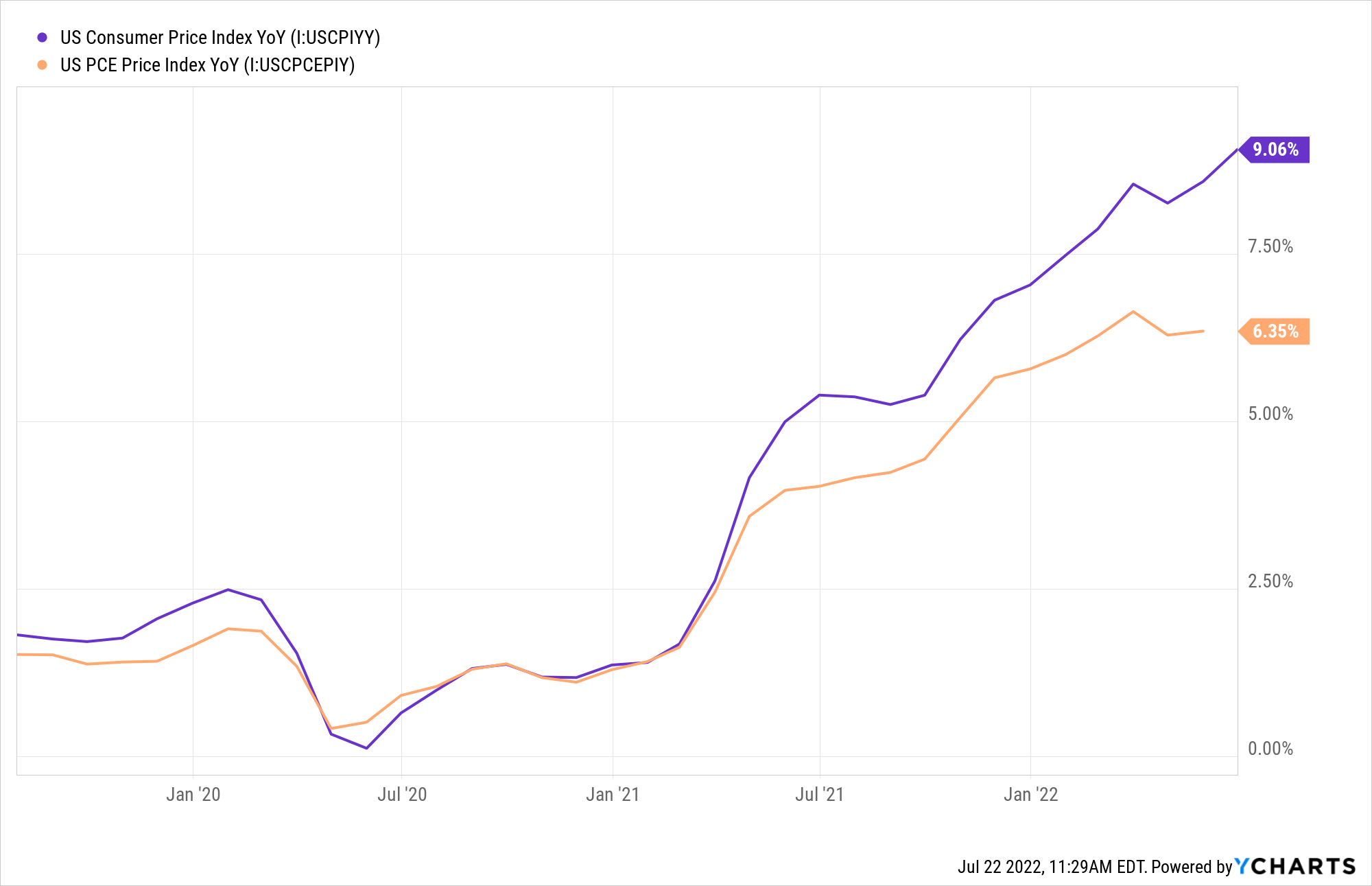

- Inflation has peaked. For the first time since late 2020 — or since the economy has been going through its COVID normalization phase — U.S. inflation rates are dropping. In April, the two preferred measures of inflation, CPI and PCE, both decelerated on a year-over-year basis. With the economy quickly slowing and supply chains swiftly improving, inflation will keep falling over the next few months.

A Dovish Federal Reserve and Topped-Out Yields

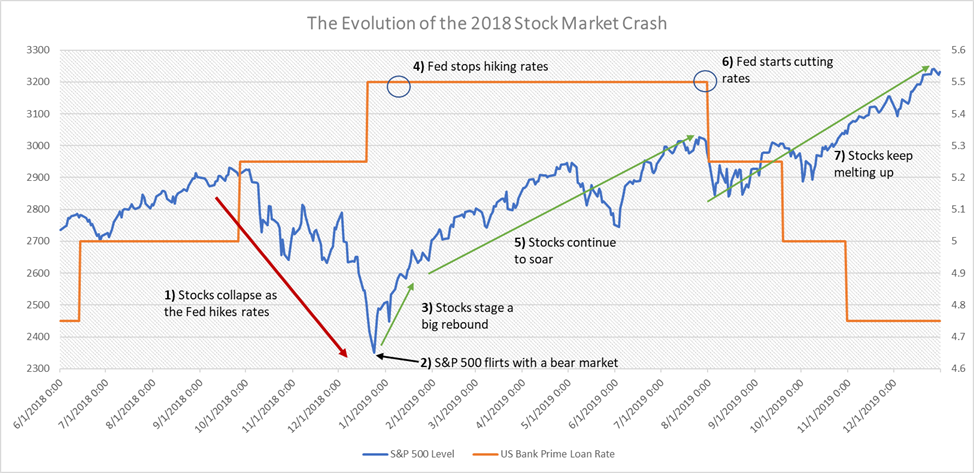

- The Fed will turn dovish. Thanks to a slowing economy and cooling inflation, the once super-hawkish institution will start to turn dovish. Over the past two weeks, three Fed voting members said it may be appropriate to reconsider the pace of rate hikes after July. That opens the door for a potential dovish pivot in Fed policy later in the year, which we think will happen. If it does, then that will set stocks up for huge gains through the end of the year and into 2023. Just look at the last time the central bank made a dovish pivot after a series of rate hikes.

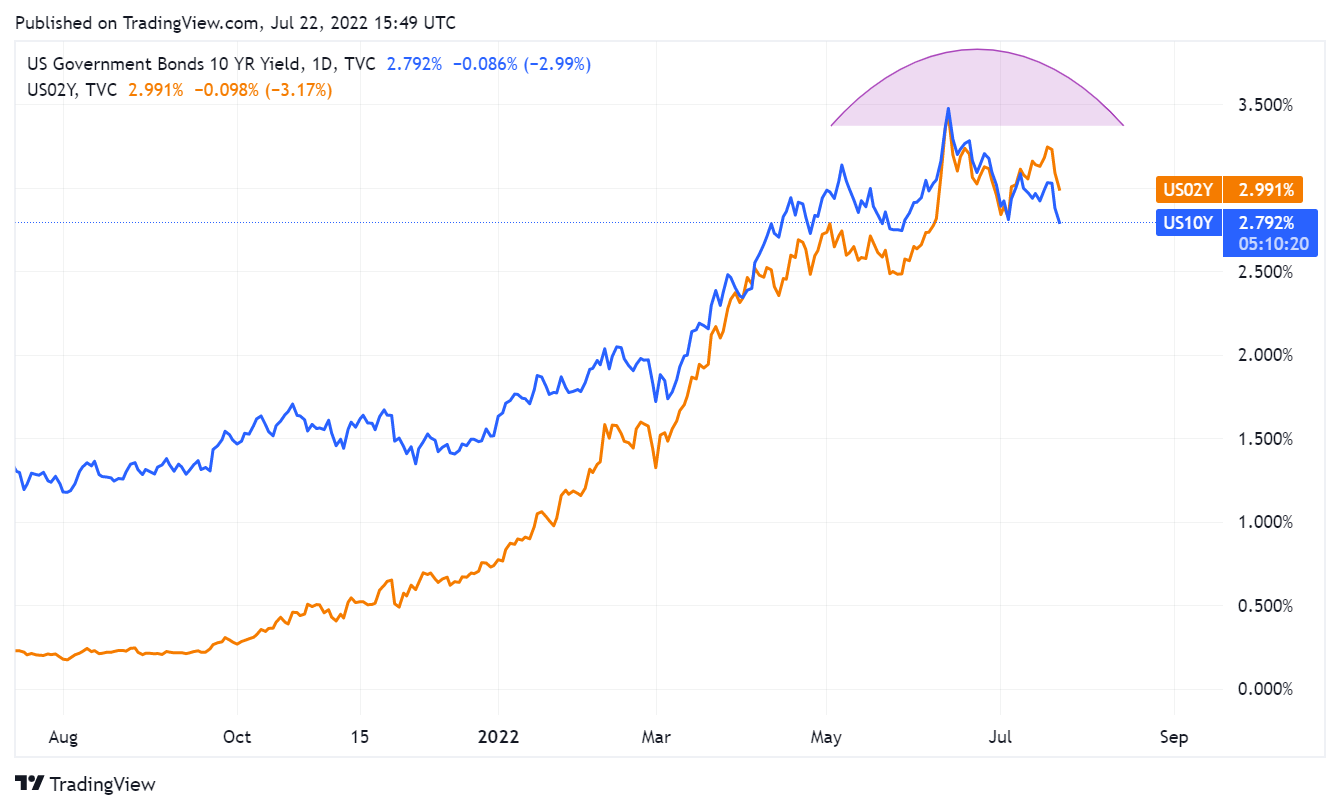

- Treasury yields are topping out. The math strongly supports the idea that if the Fed remains within the guardrails of seven to 11 rate hikes in 2022, Treasury yields have peaked and will move lower in the second half of 2022. Recent commentary strongly implies that the Fed will remain within those guardrails. As such, we continue to believe yields will move lower going forward, providing support for multiple expansion in tech stocks.

Tech Stock Rallies and Insider Buying Sprees

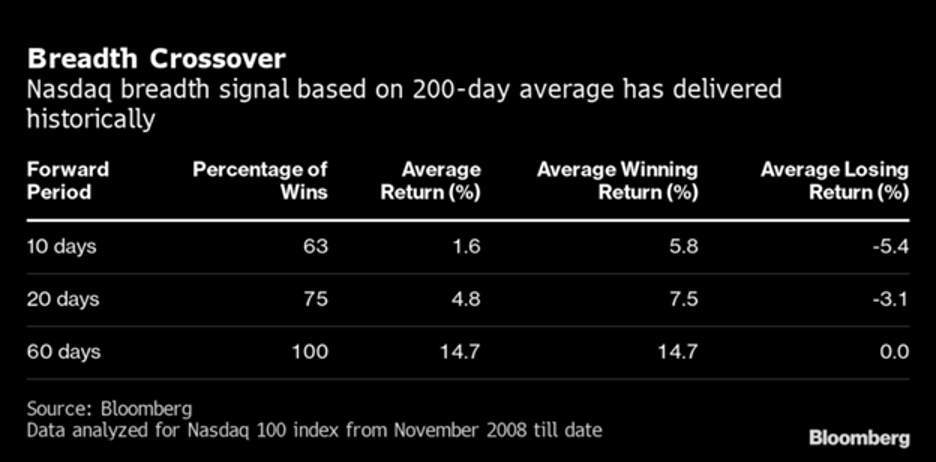

- We’re seeing breadth indicators flashing super bullish signals across the tech sector right now. This week, the number of Nasdaq 100 stocks trading above their 200-day moving average crossed from below to above 20%. That’s a bullish breadth crossover signal that always leads to big rallies. Since 2008, this signal has led to positive tech stock returns over the following 60 days 100% of the time. The average return in that stretch? 15%.

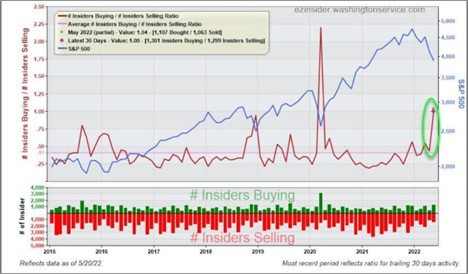

- Insiders are buying the dip at a volume historically consistent with market bottoms. They’re the folks who know the most about the companies in the market. Over the past two weeks, corporate insiders have gone on a huge buying spree. In fact, insider buying has spiked to two-year highs over the past two weeks. That’s bullish because these insiders have a history of calling market bottoms. Every time insider buying has spiked like it is right now, the stock market bottomed after a major selloff.

Better-Than-Expected Earnings and Bullish Indicators

- Tech earnings have topped expectations. Over the past week, Tesla (TSLA) and Netflix (NFLX) have both delivered earnings that beat what analysts anticipated, and the stocks rallied on the news. Technology is the world’s solution to inflation because exponential technologies are the most powerful deflationary tool ever created. As such, we believe increasingly more companies and consumers will turn toward tech in the coming years to beat inflation. Technology’s global societal, political and economic influence will grow exponentially. And tech stocks will soar.

- The advancing volume indicator flashed a “buy” signal for the first time since the COVID-19 crash’s final stages in 2020. When over 85% of the S&P’s daily trading buying volume on two of three consecutive trading days happens within 30 days of the index’s 52-week low, you always get a rally in stocks over the next year. And indeed, over the past three trading days, two had buying volume account for more than 85% of total trading volume.

- The bond market is also flashing its own bear-market bottom buying signal with a perfect record of predicting positive gains. In bonds, high-yield spreads have collapsed over the past three weeks. They’re down about 85 basis points. Such rapid collapses in high-yield bond spreads are rare. They’re also bullish. Since 2010, high-yield bond spreads have compressed nearly this quickly on nine separate occasions. Each time, the market rose over the next six and 12 months. And the average gain over the subsequent 12 months was more than 20%.

The Final Word on Tech’s New Bull Market

Tech stocks have been on a tear this past month.

Some are calling the resurgence a head fake.

It’s not.

Depressed valuations suggest that’s just not the case. And so do strong earnings, heavy insider buying, cooling inflation and heavy volume on the rallies.

Indeed, there’s a mountain of evidence to suggest that this resurgence is not a head fake.

It’s the real deal.

And if it is, that means it’s time to prepare your portfolio for a massive turnaround.

We believe tech stocks will lead a massive market rebound in the second half of 2022 into 2023. And starting today and lasting for a decade-plus, they’ll lead a new bull market.

One such stock is a tiny $3 biotech company with tons of promise.

This is a stock that’s rewriting the rules of biology. It has so much upside potential that its recent rallies will just be a blip in five years, when this stock is up around $100.

Clearly, this is a stock that you need hear about today.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.