Today I’m looking at stocks to buy on earnings dips. Ideally we would look for strong fundamentals, and technical support to boot. However, there are plenty of outside risks to fret. Mainly the geopolitical hot spot situation in the Ukraine. If it exacerbates, it can foil all equity rallies. So far and after the initial headline shock late February, stocks have stabilized a bit. This week the major indices have come within single digits of their all-time highs. Those are not signs of corrections, so risk appetite is very much alive.

Secondly we have a hostile Federal Reserve. It has committed to focusing primarily on price stability. Therefore, it will do what it can to cool down this economy. These rate hike and balance sheet runoff plans will be headwinds on Wall Street. Finding stocks to buy on earnings dips will be that much trickier.

Wise investors would do well to temper their enthusiasm. Regardless of the confidence levels in the opportunities, they should remain cautious. Leaving room for error is an essential part of trading in this 2022 mess. The global risks are too real to treat them lightly.

The three stocks to buy on earnings dips are:

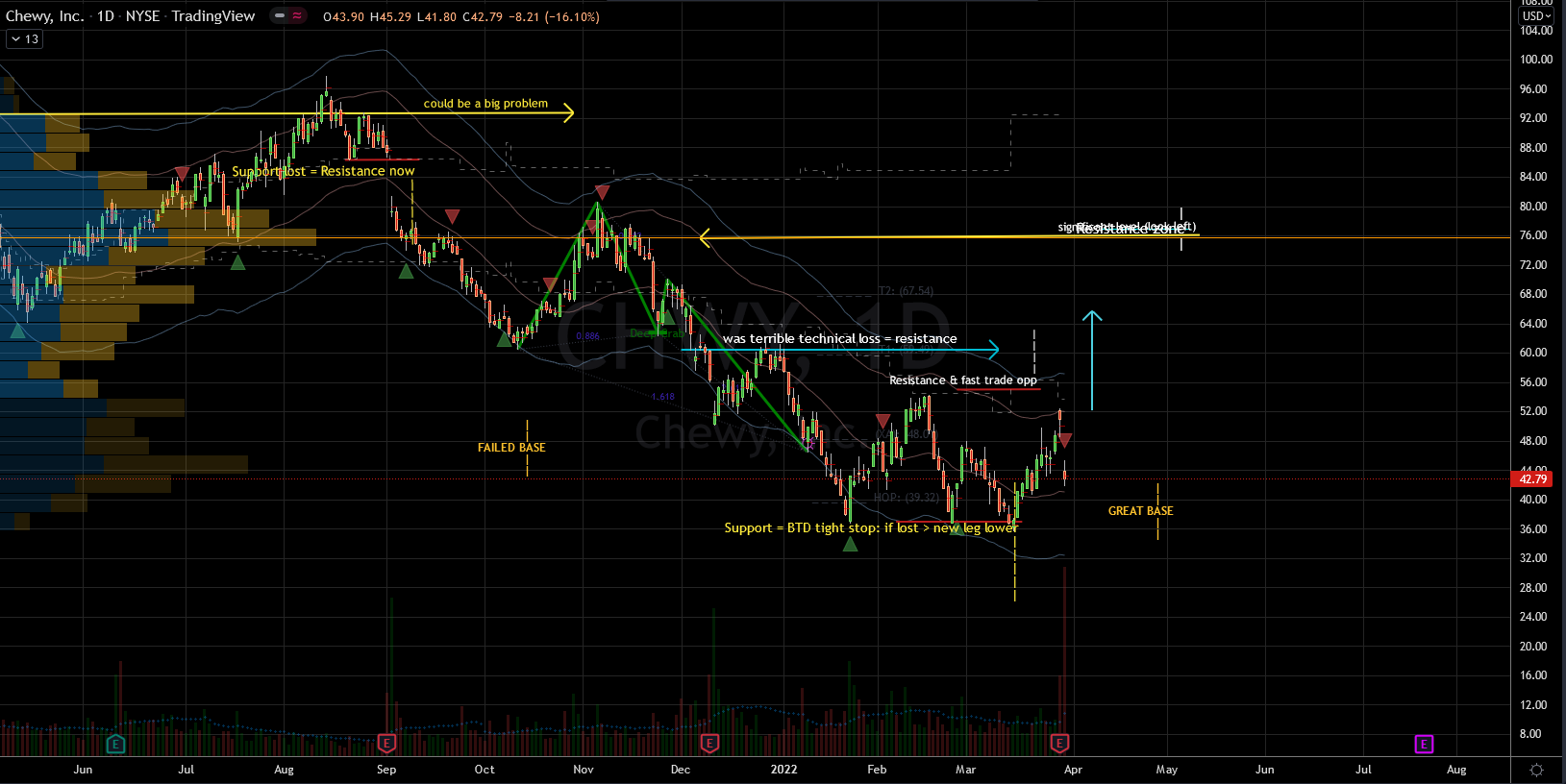

Stocks to Buy on Earnings Dips: Chewy (CHWY)

Chewy reported earnings yesterday and investors reacted negatively to the results. It wasn’t so much that the absolute numbers were bad, but its forward guidance was lackluster. Management still delivered 17% revenue growth but the suffering came from its forward outlook. The stock fell 16% on the headline, but therein lies the opportunity. My instinct is to buy the dip, but I do have reservations about it. The hesitation comes from the recent S&P 500 rally. This surely opens the door for a potential small market-wide dip.

If that happens, it will drag CHWY down a bit further. However, looking left on the chart we see evidence of strong support. The last three times CHWY stock fell below $40 it found strong buyers lurking. Strong rallies between 30% and 45% each quickly followed. On Tuesday, and going into the earnings report, the stock had finished its latest one to $52 per share. So, I anticipate that this dip will bring out more buyers to try it again.

However, I suggest leaving room for error in case there’s a small swoon in the indices. For this I would prefer to use a bull put spread with options. This would allow me to be bullish without actually needing a rally to win. Later this week or next, I can then add a trade to capture more upside potential that can follow. If the bulls can take out $52 per share, they can target another 25% rally from there.

The fundamentals of CHWY stock are solid. There is evidence of strong growth without too much bloat in valuation. I’m not saying that it’s cheap, but there isn’t a flagrant foul on the field with regards to spending. The price-to-sales metric is within reason relative to its competition.

Micron (MU)

The semiconductor industry has been suffering with a supply disruption since the 2020 pandemic. It has been one blow after another, and most recently the aggravation comes from the threat of war. Therefore companies like Micron have been under unusual stress to say the least. Despite of all of this, MU reported earnings last night and they were strong. Wall Street celebrated them at first with a nice rally in after-hour trading. But by the end of the day Wednesday, MU stock was down 3.3%. The results beat expectations and there were no obvious issues with them. Sales and earnings grew 25% and 118%, respectively. And management’s guidance did not disappoint either.

Dips that have no fundamental basis usually present decent buying opportunities. I rarely seek to know why a stock is falling, as long as I am comfortable with its fundamentals. In this case, I am confident that Micron is a leader and will succeed for a long while. Therefore, I can assume that there is nothing wrong intrinsically. Then, my decision would be to try to capitalize on this weakness.

Deciding to do so doesn’t mean you should blindly jump in. Instead, rely heavily on technical analysis for superior short-term results. Step one is to vet the fundamentals like we just did. Next, comes the tricky part, especially after this long rally in the market. Investors would be prudent to leave room for more downside just in case. Sometimes stocks fall because of outside forces. In addition, MU stock is still not close enough to support for comfort. It can fall another 13% before encountering legitimate bounce levels. Moreover, the rally out of September 2020 was too ferocious. This leaves MU stock vulnerable to bigger dips if the indices correct.

Therefore, it would be prudent to only take partial positions at first and without panic. All too often traders feel the FOMO and pounce on the first red tick. There is evidence of short-term support through $75. But it is possible for the selloff to extend another $4 lower. Otherwise, I am confident that without a market correction, MU will hold its recent support. If I’m long already this is not an opportunity to add to my risk. New investors should only deploy a partial position, so they can leave room to add more later. Demand is strong so the macro is not an issue either. These savvy management teams will find a way to get things back on track. They have survived worse tests, so they can emerge healthier out of this one as well.

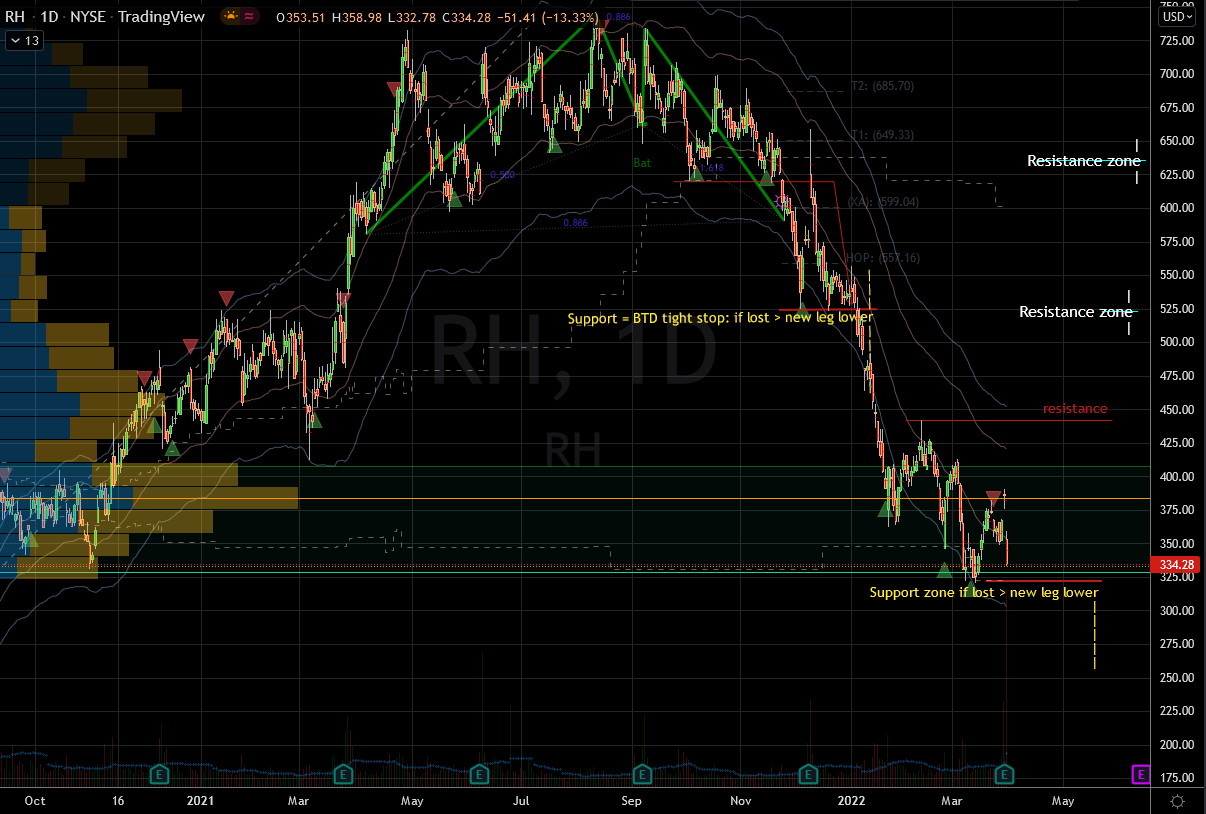

Stocks to Buy on Earnings Dips: Restoration Hardware (RH)

For a long while pre-pandemic RH stock could do no wrong. It came into the February 2020 correction from an all-time high. Into the abyss it fell 72%, but then rebounded and rallied 210%. Sadly, this party ended last summer in a fiery crash. From August highs to this month’s lows, RH lost 56% of its value. The experts no longer fawned over it so they haven’t bought dips in a while. Needless to say that it has had better years.

Yesterday management reported earnings and the stock fell 13% on the headline. This is after it has already under-performed the S&P 500 10-to-1. Year-to-date, RH is now down 38%. Judging by this price action, one would guess that the business is deteriorating. On the contrary, yesterday’s report showed 11% revenue growth and a bit more in earnings upside.

The company may have disappointed some analysts, but the meek single growth they forecast was underwhelming. Moreover, the company announced a 3-for-1 stock split, but it didn’t help the RH stock action. This new breed of investors loves splits, like with Tesla (NASDAQ:TSLA) earlier this week. But not this time; RH sank like a stone.

The good news is that the business is still doing well enough. Moreover, it is falling into recent support and more of it below that as back up. This should give the bulls time to muster the strength to buy the dip eventually. Of the three stocks to buy on earnings dips today, this is my least favorite. If the RH support fails, it could bring another wave of sellers much lower still. The pandemic breakout neckline is almost 30% below yesterday’s close. Ordinally I would opt for CHWY first, then MU and finally RH.

On the date of publication, Nicolas Chahine did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.