Shareholders in Opendoor Technologies (NASDAQ:OPEN) do not have much to write home about so far in 2022. OPEN stock has slipped more than 31% year-to-date (YTD). By comparison, the Invesco NASDAQ Next Gen 100 ETF (NASDAQ:QQQJ) and the Nasdaq 100 index are down 11% and 7% respectively.

Opendoor Technologies is regarded as a pioneer in the iBuying business. An iBuyer, short for instant buyer, is a company that works directly with consumers providing an instant cash offer to purchase a home outright.

Put another way, iBuyers purchase the home without requesting repairs, upgrades, warranties, closing costs or real estate agent commissions. iBuying allows homeowners to sell their home without a broker or real estate agent, saving them money and time compared to traditional real estate transactions.

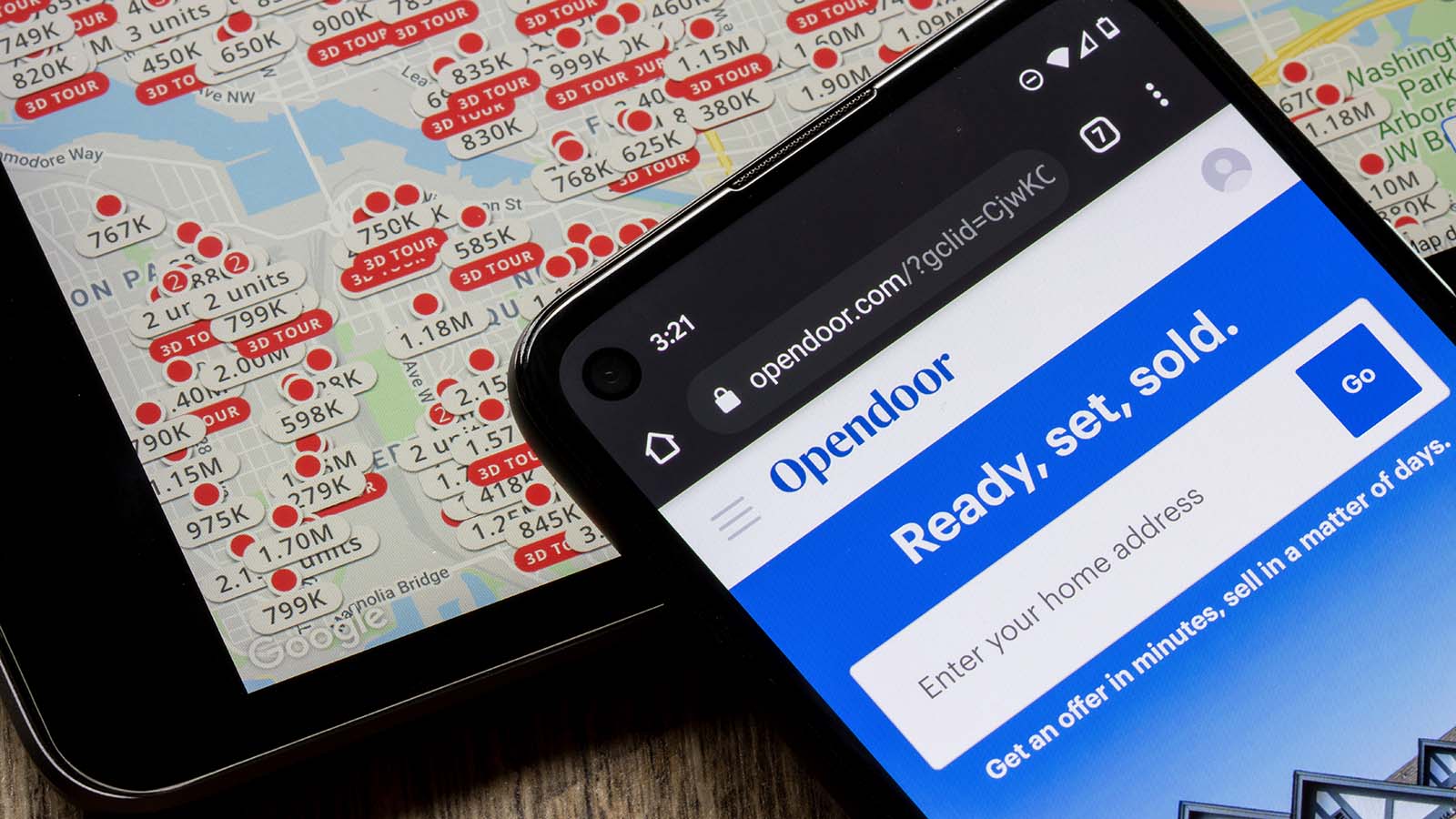

Wall Street concurs that the company is transforming home buying into an e-commerce transaction, purchasing homes from consumers with cash offers via its mobile app or website. After Zillow’s (NASDAQ:Z, NASDAQ:ZG) exit from iBuying, Opendoor’s platform commands a majority of the iBuying market share.

In 2021, total iBuyer transactions surpassed 70,000, revealing that a new generation of young consumers is increasingly willing to sell or buy their homes online. Yet investors have increasingly turned bearish on the entire iBuying space.

Opendoor is not yet a profitable company. Instead, it aims to disrupt an established real estate industry, which is open to macroeconomic risks such as rate hikes or a potential decline in home prices. Yet as the top player in an industry with enormous growth opportunities, its business is gaining traction and offers significant upside potential. Let’s see why.

The iBuying Opportunity

Opendoor Technologies is positioning itself as a transaction platform. An iBuyer needs to find that delicate balance between acquiring homes at a price that the owner would be willing to sell and having enough room to resell with a small profit. The company charges a 5% fee when a homeowner sells its real estate, cutting out the real estate agent and offering a streamlined selling experience.

In 2021, Opendoor made significant progress toward becoming a national brand. The company has expanded its operations from 21 markets to 44 markets. As a result, offer requests from home sellers increased almost seven-fold year-over-year (YOY), while purchase offers grew five times during the same period.

Over the past year, the company launched Opendoor Complete, which combines the entire selling and buying processes into a single transaction. Analysts suggest that the new platform may be a game-changer.

It offers an automated dashboard to ensure that consumers can line up their closing dates so they don’t get stuck paying two mortgages or move twice. The company also launched Opendoor-Backed Offers, which provides buyers with the benefits of an all-cash offer.

OPEN Stock and Its Q4 Results

On Feb. 24, Opendoor issued Q4 results. Revenue surged to $3.82 billion, representing a whopping 1,435% increase YOY. Opendoor acquired 9,639 homes during the quarter.

On the other hand, the company sold more homes than it purchased, ending 2021 with $6.1 billion in inventory. Total homes sold in 2021 soared 119% to 21,725, helping to fuel revenue growth of over 200% to $8 billion.

However, net loss widened to $191 million, or 31 cents per share, compared with $54 million in the prior-year quarter. The higher-than-expected loss was primarily due higher selling costs and higher stock-based compensation.

The contribution margin represents a rough measure of the profitability of the core housing business, which has remained positive for the past 20 quarters. However, the company saw its Q4 margin decline to 4%, down from 12.6% in the prior-year quarter.

“It is our fundamental belief that in a matter of years, millions of homebuyers and home sellers will pick a simple, certain, and fast experience and transact themselves, completely online. More importantly, we know Opendoor’s digital, seamless experience is and will continue to be what consumers choose now and for decades to come,” remarked CEO Eric Wu on the results.

The Bottom Line on Opendoor Technologies

Q4 financials seem to prove that the iBuying model can work. Opendoor has secured the lion’s share of the iBuying space following Zillow’s exit.

Management forecasts revenue of between $4.1 billion and $4.3 billion in the first quarter, aiming for another year of triple-digit growth. While investors may be worried about Opendoor’s $6 billion housing inventory, its $2.6 billion cash position gives the group enough room for maneuver.

Analysts point out that the housing supply stateside remains at multi-decade lows. As a result, home prices should remain strong throughout 2022. Moreover, Opendoor boasts a total buying capacity of $30 billion in cash and credit facilities combined.

Thus, management has plenty of firepower to expand into new markets. The company has recently announced its launch in the San Francisco Bay area, which implies further robust growth opportunities.

OPEN stock looks priced to reflect all possible adverse outcomes and not much of its potential. As a result, the current depressed valuation leaves plenty of room for significant upside and provides a buying opportunity for long-term investors.

On the date of publication, Tezcan Gecgil did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.