There’s a lot of concern out there about where stocks are going over the next few months, with some pundits calling for a deeper market crash. But we’re not one of those pundits. Stocks are not only surviving — they’re thriving, despite the economic and geopolitical turmoil this past year.

As of this writing, the Russo-Ukrainian invasion effort is ongoing, inflation is running at decade highs, the Federal Reserve is winking at rates hikes, and the yield curve is flashing a recession warning signal. But look closely at the data (which is readily available), and you’ll see hypergrowth stocks can thrive through all that.

What’s more, Bank of America’s contrarian “BUY” indicator was just triggered last week, indicating that stocks are due for a sharp near-term rally. In other words, BofA’s “buy” indicator signal says it’s a great time to buy stocks!

As opposed to running away from stocks, we’re embracing this weakness and finding some truly exceptional buying opportunities. As a result, our Innovation Investor stocks have been thriving, with our most recent “Buy Alert” up nearly 20% in just two weeks. The two most recent alerts before that are up 25% on average — in just three weeks!

There’s money to be made in the markets these days. We’re finding the opportunities. We strongly suggest you join us and do the same.

Stocks Beat War, Inflation, the Fed, & the Yield Curve

Are you worried about the war in Europe? Fair. But did you know that stocks actually perform very well during wartime periods?

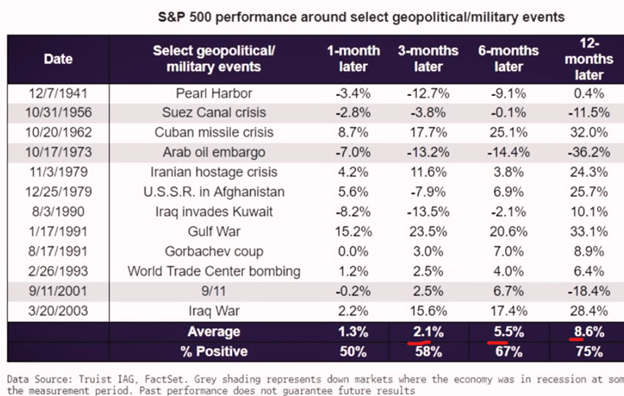

Since the 1940s, the S&P 500 has averaged a near 9% gain in the year following the outbreak of a new war, partly because wars tend to energize domestic production and manufacturing. The same should be true this time around. Not to mention, this war is being fought 5,000 miles from America and without any American troops. The direct impact here is very small.

So, history says the war in Europe shouldn’t derail stocks.

What about that sky-high inflation? Again, stocks historically perform pretty well during inflationary periods. During times of high inflation (in the ~6% range, which is where we are today), stocks have historically averaged 9% annual gains.

And how about the hawkish Fed? Well, during the last 11 rate hike cycles since 1946, the S&P 500 has averaged an 11% gain through all of them. In the most recent rate hike cycle of 2015 to 2018, the S&P rose more than 20%.

Oh, and as for the yield curve, the last three times it has inverted, stocks proceeded to rally about 30% on average over the next 20 months.

Do you see now why we’re so bullish?

Forget the talking heads on CNBC. People lie to spin narratives and get clicks, likes, and views. The numbers, however, don’t lie. And those numbers are painting a crystal-clear picture that the recent sell-off is a golden buying opportunity.

BofA’s Big “Buy” Signal Was Just Triggered

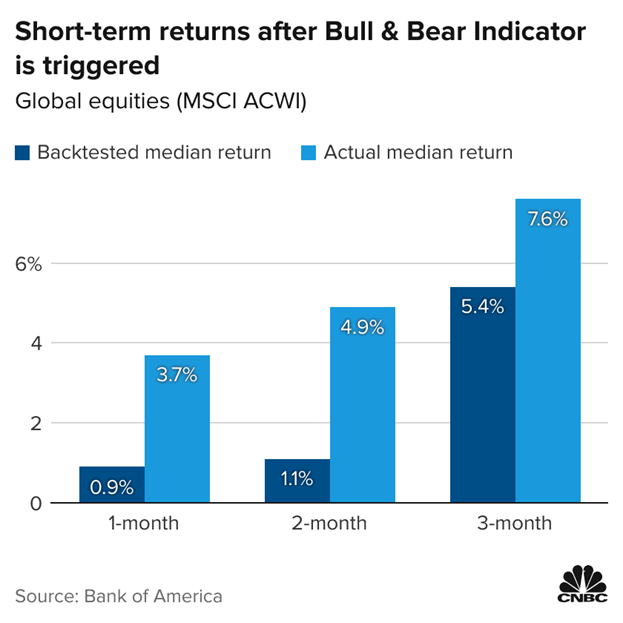

Bank of America has this powerful contrarian buy signal called its Bull & Bear Indicator. It measures the inflows and outflows of equity markets to determine whether investors are getting too bullish or bearish on stocks.

That indicator just flashed rare “Buy Signal” last week.

That’s a big deal. The Bull & Bear Indicator has flashed a “Buy Signal” just eight times since 2013. The last one? The depths of the Covid-19 pandemic in March 2020. The average returns after it does flash a buy signal? A very impressive 8% gain in just 3 months.

In other words, Bank of America is saying that investors got too bearish, and now stocks are due for a sharp rebound rally over the next several months.

We’ve reached a similar conclusion; and as such we’ve called all hands on deck in our flagship investment Innovation Investor advisory to position subscribers for a big few months ahead.

The Best Stocks to Buy

When stocks are falling, it’s easy to run away, hide, and seek cover in a savings account.

But no one ever got rich by taking the easy route.

As I like to say as someone who has successfully pinpointed over twenty 10X investment opportunities before I even turned 26, the path of least resistance in markets is often the path of lowest returns.

The corollary, of course, is that the path of most resistance — the path that few are bold enough to embark on — is the path on which you could make a lot of money in the markets.

Remember: Crises create opportunities. In the markets, this has been the case forever. This time is not different.

And, in the current crisis, the opportunity is particularly large in tech stocks. We’re on the other side of the stock market crash, and certain beaten-up tech stocks will roar back to life in a big way. We’re talking 100%, 200%, and even 300%-plus gains in matter of 12 months or less.

We’ve been adding those stocks to our Focused Portfolio. And our three most recent recommendations are all up ~20%-plus in less than a month.

And we’re just getting started.

If you’re ready to get started too, there’s no better place to find beaten-up tech stocks with up to 300% upside potential than here.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.