When Rivian (NASDAQ:RIVN) posted only $1 million in revenue recently, it showed quarterly results that potentially hurt Ford (NYSE:F). Unable to sell RIVN at its $179 high, Ford will lose some of the windfalls. Basically, the near-term downtrend in Rivian is also bad news for F stock. But the drag is due to more than just disappearing cash.

At the height of the recent electric vehicle (EV) bubble, Ford shares traded in the $20 range. Investors had divided their holdings between speculative EV stocks and internal combustion engine (ICE) suppliers. However, rival General Motors (NYSE:GM) recently lost steam on Dec. 16, for example, when the company said CEO Dan Ammann would leave Cruise, an autonomous driving (AD) segment that GM owns. That departure is a blow to GM — and a reminder to investors that EV and AD valuations can and will fluctuate.

Ford risks the same sudden shift in negative sentiment. When a stock stalls for too long, failing to follow through with a breakout, bearishness can mount. Investors may grow tired of waiting. F stock rose because it benefited from 12% ownership in Rivian after its initial public offering (IPO). After posting negligible revenue, though, shareholders are fretting over the EV company’s future sales prospects. Its valuation depends almost entirely on its 71,000 R1 net preorders as of Dec. 15.

As such, after the 180-day lockup expiry, Ford needs to sell RIVN stock before it falls further. The legacy automaker canceled its plans to jointly develop EVs with the company. Now, Ford is no longer obligated to keep its investment.

F Stock: How Ford Should Invest Cash From a RIVN Sale

Ford has many options available to increase F stock shareholder returns from an RIVN sale. For example, the company could pay a special dividend. But that’s not the best idea. Rather, Ford needs to re-invest the excess cash to pivot away from ICE vehicles.

Ford has already budgeted billions to develop its Ford F-150 Lightning EV. It could invest more in research and development, although the current EV designs are already quite attractive. On top of the new truck, Ford has another slick design in the sports-utility space with its Mustang Mach-E.

Designs aside, Ford also has a new joint venture in the battery space with SK Innovation. It announced the partnership back in May. If it sells RIVN stock, the company could invest in the partnership even further to accelerate battery development, differentiating its EVs by offering bigger batteries, higher capacity and an industry-leading driving range. That would put the F-150 Lightning over competing trucks offered by Rivian.

Currently, Ford has 13,500 public charging stations as well. The company could also use any cash from a potential stock sale to build more stations and improve its network overall.

Bright Prospects and a Price Target Warning

When it comes to Wall Street, analysts have a divided view on Ford’s fair value. Some analysts rate F stock as a hold or a sell, according to Tipranks. The average price target is $19.50.

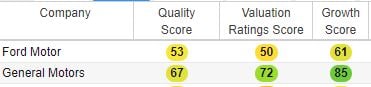

Ford also has a poor stock score after the year-long rally. F stock’s quality score is only 53/100. Numerous recalls add to the company’s operating costs. Profits will continue to lag as the chip shortage constrains output. Those factors are hurting both the quality of the stock and Ford’s growth prospects. In the table courtesy of Stock Rover, GM has a better value and growth score.

<a href=”http://www.stockrover.com/plans/free/?sa_author=diy_value_investing” target=”_blank” rel=”noopener”>Chart courtesy of Stock Rover</a>.

Rivian’s volatility may spread to F stock as well. However, long-term investors may want to ignore the noise. In fact, they may consider adding to their position if the stock dips. In 2022, Ford’s EV unit sales should steadily climb.

Make no mistake — Ford is not a pure-play EV stock. It still depends heavily on the traditional ICE market. Therefore, it needs to deliver on higher product quality and increased reliability. Ford may apply the quality assurance model to its EV lineup. The fewer recalls it has, the more investors will believe in the company’s newfound profitability potential.

The Takeaway on F Stock

All told, automotive investors should consider F stock as well as the above-mentioned firms. GM trades at attractive levels after falling in the last month. Meanwhile, Rivian is still a potential speculative short-term trade. The stock could climb from muted selling volume after the lock-up expiry.

In the next few years, though, Ford has better prospects than Rivian. It already has an established charging infrastructure. It has invested in battery development. And finally, it has the potential to significantly expand its EV lineup. That will boost its future growth rates.

On the date of publication, Chris Lau did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Chris Lau is a contributing author for InvestorPlace.com and numerous other financial sites. Chris has over 20 years of investing experience in the stock market and runs the Do-It-Yourself Value Investing Marketplace on Seeking Alpha. He shares his stock picks so readers get original insight that helps improve investment returns.