Rocket Lab (NASDAQ:RKLB) is a small business in the space services business. But RKLB stock makes it seem like a big company.

Rocket Lab said it had $5.3 million in revenue during the third quarter. Its backlog stood at $183 million at the end of September, and the company expects revenue of $23 million to $25 million for the current quarter.

But Rocket Lab’s market cap as of Nov. 17 was nearly $7 billion. It’s taking advantage of that valuation to acquire other space companies. The most recent was Planetary Systems, a spacecraft separation systems company based in Rockville, Maryland.

Previously it bought Advanced Solutions, which has space simulator software, and Sinclair Interplanetary, a satellite hardware maker.

The Joy of SPACs

All this is possible because Rocket Lab went public through a special purpose acquisition company (SPAC) in August. Vector Acquisition, its merger partner, valued the company at $4.8 billion and brought $777 million in cash to the party.

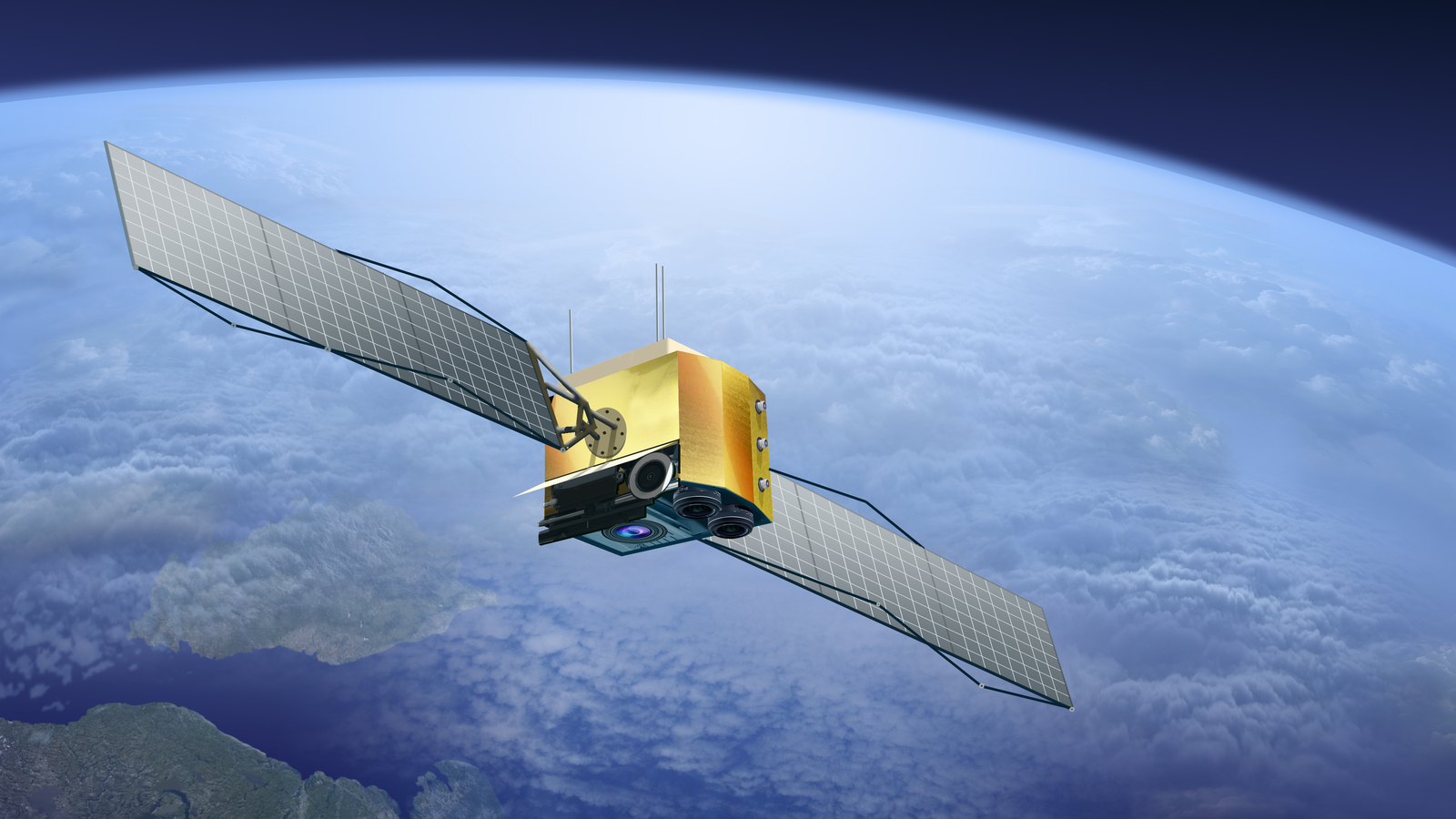

The heart of Rocket Lab is its small reusable rocket, Electron. It’s already the second-most-frequently launched U.S. rocket, having flown 22 times as of today.

The company is developing a larger rocket called Neutron for 2024. Neutron will take payloads of 8,000 kilograms to low Earth orbit and 1,500 kilograms to neighboring planets Mars and Venus.

The SPAC deal — and investor excitement over the company’s prospects — could result in Rocket Lab becoming much more. Shares are up about 50% in just a few months.

RKLB Stock Has Credibility

Rocket Lab’s primary launch site is at the south end of New Zealand’s North Island, 30 miles from the nearest town.

But Rocket Lab is bidding to be much more than a small rocket launcher. The Electron’s success rate adds to the credibility its stock is already generating.

Its most recent launch was for Black Sky (NYSE:BKSY), a geospatial satellite company that is also a newcomer to the stock market. The launch had been scheduled for Nov. 11, but was pushed back to Nov. 18.

The space business is all about potential and credibility. Rocket Lab’s credibility gives its stock potential. This lets it buy other companies that serve government agencies and firms like SpaceX. It becomes a virtuous circle.

Analysts like the story of RKLB stock. There are four following Rocket Lab at TipRanks and three say buy it, despite a valuation that has nothing to do with fundamentals. The average one-year price target is 43% ahead of its current price.

Big Risks Lie Ahead for RKLB Stock

Space is a risky business, and Rocket Lab faces all the same risks. Should future launches fail or the Neutron rocket be delayed, watch the stock fall.

Maintaining relations with the U.S. government is also important. Rocket Lab recently hired Andrew Bunker, a former Republican operative who previously worked with Boeing (NYSE:BA) and Lockheed Martin (NYSE:LMT). Bunker formerly led government operations at United Launch Alliance and will be running interference in Washington for the company.

Our David Moadel has followed the rise and fall of RKLB stock. He says you should expect a bumpy ride. However, Moadel expects the stock could pay off in the end.

Each successful launch of the Electron sends Rocket Lab stock higher. But it’s Rocket Lab’s ability to acquire other component companies that can earn it a place in your portfolio.

This will remain a very speculative trade for several years. Bigger companies will grab the headlines. But it’s companies like Rocket Lab, and the smaller operations it’s able to buy, that will create an industry.

If you believe in that industry, RKLB stock is an affordable way to play it. Start with a small position, and don’t invest any money you can’t afford to lose.

On the date of publication, Dana Blankenhorn held no positions in any companies mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Dana Blankenhorn has been a financial journalist since 1978. His latest book is Technology’s Big Bang: Yesterday, Today and Tomorrow with Moore’s Law, essays on technology available at the Amazon Kindle store. Follow him on Twitter at @danablankenhorn.