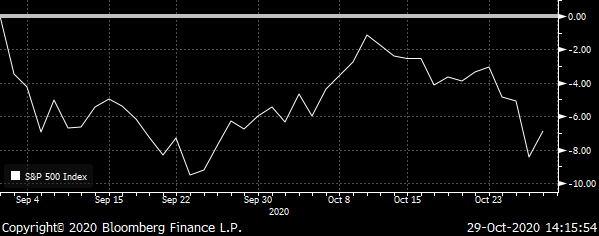

The U.S. stock market is not off to a good fall season. The S&P 500 Index is currently down by 7.6% since Sept. 2 to date, and that includes the bit of recovery in the earlier days of October.

In the October issue of Profitable Investing, I made the case that the selloff was not like the one in the Fall of 2018. Back then, the initial benefits to bottom line earnings from the Tax Cuts & Jobs Act of 2017 (TCJA) was wearing off. And there was the continued belief that the companies inside the S&P weren’t expecting to gain as much in sales and earnings in the coming quarterly reports. That belief was turned on its ear on Christmas Eve.

In the November issue, I provide more data that sales and earnings for the members of the S&P are expected to rise into and through the quarters of 2021. So, the core of the stock market should be discounting expected improved results.

Challenges for the S&P 500

But there are a few challenges. First is the election. This was supposed to be more contested and fraught with challenged results. That challenge is subsiding. Second, the technology-heavier weighted S&P has become highly valued based on price to earnings (P/E) and other metrics. That is true, but the stock market is not about current earnings, sales and business valuations but rather future developments. Third is Covid-19, as virus case counts around the US and Europe.

Europe is in more trouble. Lockdowns are back, either partially or fully. This is having a genuine impact on prospective business revenues for its stock market indexes — many are dominated not by technology, but financials which is not any sort of haven.

The U.S. has several localized hotspots — but for now it is less likely to see draconian lockdowns. But all of the challenges are coming at the same time, dampening even some of the very good bits of news.

Current earnings reports are good. Positive surprises for sales and earnings are quite strong at 2.99% for sales and 14.95% for earnings of all reported members so far. And some of the sectors of the S&P members are much better with 271 of the 505 reported.

And we got the GDP report for the third quarter with a gain of 7.4%, which annualizes at 33.10% — well above expectations. And with expectations for the fourth quarter gaining 4%, the full-year GDP for the U.S. will likely show a decline of 4%, which is remarkable given the severity of virus and the lockdowns. And this is much better than for most of the major economies of the globe.

Even weekly jobless claims dropped to 751,000 from 791,000 along with continuing claims down to 7.8 million from 8.5 million. And the Bloomberg Consumer Comfy Index came in at a good 46.30 level.

I am looking for more rational investing in the coming weeks on the improved economic data including for consumers and businesses. But what should growth and income investors do both before the recent sell-off as well as through any further negative reactions to challenges?

Essential Security

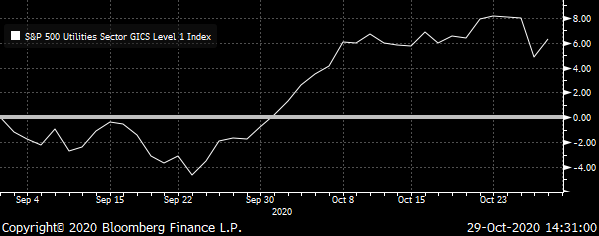

Essential services companies are what has been working and what will keep working for dependable growth and income. Otherwise known as utilities, they may be considered by some to be boring — but they are only boring in dependable performance.

From Sept. 2 to date, the S&P Utilities Index has returned a positive 6.38%. And this continues the positive return for the trailing year of 4.16% and a return of 74.31% for the trailing five years equating to an annual average return of 11.74%. And that terrible fourth quarter for the S&P 500 Index in 2018 — the utilities tracked by S&P were positive in return.

The entryway to great utilities is the Vanguard Utilities ETF (NYSEARCA:VPU) which is the synthetic means of owning the broad U.S. utilities market complete with its 2.58% yield. And this is a good start. But I can do better.

I have an impressive selection of top performing utilities inside the model portfolio of Profitable Investing. They are part of a broad collection of great growth and income stocks from a variety of industries, sectors and markets.

Let me start with a favorite for some time, NextEra Energy (NYSE:NEE). This is a Florida-based power utility that continues to expand in its non-regulated power generation around North America. And it does this by ESG-focused (Environmental, Social & Governance) wind and solar to become one of the largest by capacity in the world for green energy.

The stock has been soaring for years as it has returned 670.70% since being added to the model portfolio. And year to date its returned 25.82% — multiples of the S&P 500.

It just split its stock 4 for 1 to make it more accessible and makes for a great buy right now in a tax-free account including its 1.87% yield which keeps climbing in distribution by an average of 12.42% over the past five years.

Xcel Energy (NASDAQ:XEL) is another power utility with core regulated business in the northern central part of the U.S. But it has the NextEra playbook and its running it with surging wind and solar both for regulated and non-regulated markets. Yielding 2.46%, it has returned 14.73% year to date and has lots more to go and is another essential buy in a tax-free account.

There is more to stock investing than just betting on the S&P 500. And getting to know more of the underlying stocks and sectors makes for better and safer returns — especially during broad sell offs.

All My Best,

Neil George

Editor, Income Investor’s Digest & Profitable Investing

Author, Income for Life

On the date of publication, Neil George did not hold (either directly or indirectly) any positions in the securities mentioned in this article.

As the editor of Profitable Investing, Neil George helps longer-term investors achieve their growth & income goals with less risk. With 30+ years of experience in the financial markets, Neil recommends undiscovered and underappreciated companies that offer subscribers double-digit yields now and triple-digit returns over time.