The U.S. election date came and went and we still don’t have certainty there. Meanwhile, Wall Street took the overnight volatility in stride. There was a negative reaction, but only when President Trump raised the possibility of contesting the results. This suggests that investors don’t really care about which candidate wins. They just want the event to pass so they can go back to the business of investing. Today we will find smart stocks to buy regardless of the outcome.

While we don’t have an official announcement, it appears is that candidate Biden will have enough vote to win. President Trump still has a path to victory with a bit of luck. Our picks here should do well in either scenario. The only worry is about the peaceful conclusion and transition or retention of power.

The presidential agenda matters to some stocks more than others. Earlier I said that markets don’t care about the outcome. However, some sectors may have to adjust to the new regime. Solar and cannabis stocks rallied hugely when Biden polled well. Banks on the other hand suffered. They are susceptible to more scrutiny under a democratic president. In all honesty it won’t matter much because in the end companies will adjust and figure out a way to live with the changes.

The three stocks to consider today are:

Stocks to Buy After the Election: Skyworks (SWKS)

Skyworks just reported earnings this week, and investors reacted negatively to them. There was nothing inherently wrong with the results, so it was a matter of having unrealistic expectations. 2020 has been pretty confusing, especially on the technology and 5G fronts. The mad rush into the digital revolution created a feeding frenzy for tech stocks. The confusion was even worse for 5G stocks because investors came into the year all fired up about it.

The theme is getting tired as the transition has been slower than expected. Apple (NASDAQ:AAPL) is probably a little to blame because they seem to be late to the party. Providers are going forward with the advertising of 5G networks, but it’s not ready yet. Clearly the concept is still in its formative stage, but therein lies the opportunity. In the next few months it will all come together because one thing is for sure: Everyone on the planet wants 5G.

There won’t be any political pressures with this theme, just pure competition. This is also on the international level because countries are competing, not just companies. The resources to put deploy these networks are going to be huge. Skyworks will benefit from this next year, making SWKS stock a solid bet.

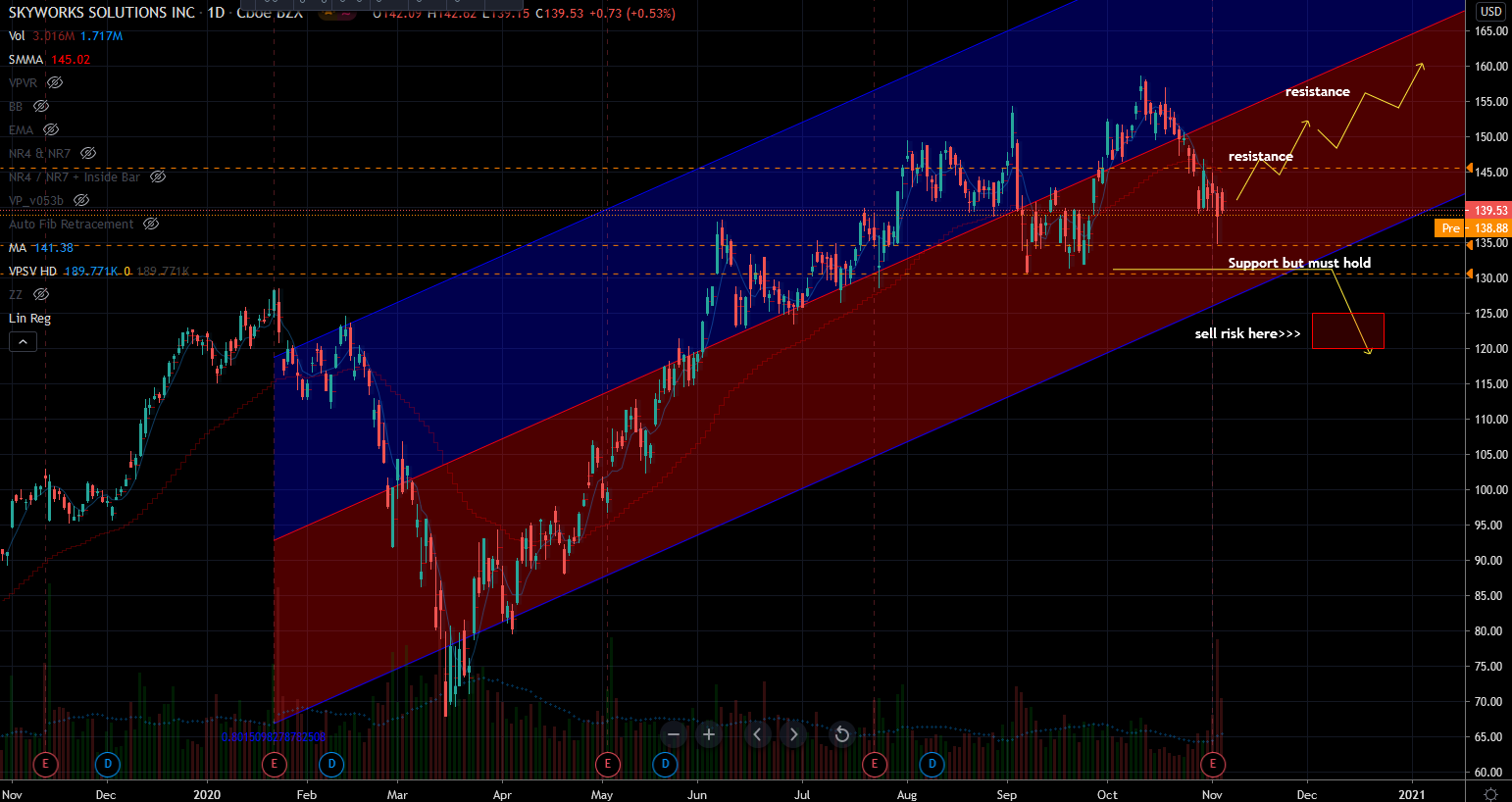

SWKS stock fell into support so the downside from here is limited. For the next few weeks the bulls can consolidate and build a good base for the next leg higher. Eventually it will recover $155 per share maybe by the middle of next year. Alternatively, investors can employ a stock replacement strategy using options. They can sell puts near $125 and buy at-the-money leap calls. This would help absorb any headlines skirmishes stemming from Covid-19 or the U.S. elections.

Boeing (BA)

This year BA stock is more sensitive to what happens to airlines. Consequently, BA stock should have fallen because Biden sounded like he is more apt to shut us down than Trump. The negative reaction in the stock this week was mild and fits within the scope of normal price action. In fact, it rallied 4% in 4 days? Giving back half is normal.

Long term, I expect Boeing to soar again. BA stock is doing well despite all the headwinds against it. First, its clients are on the brink of corporate death. TSA screenings suggest that airlines are still suffering, with traffic down 70% compared to last year. As a result, they have taken on tremendous debt so they can survive the crisis. We still don’t have an end in sight and the vaccine promises from the medical community have abated. We really have no clue when and how to expect one. Secondly, Boeing still can’t sell the 737 Max model, so the income statement is suffering.

But therein lies the point. Things are so bad for BA stock, it’s down 60% in two years. Any change in the headlines on these fronts would bring huge relief rallies. Over 5 years, the stock is still slightly positive, so the appetite is there. I know it can do it because I’ve written about the upside opportunity on late May. It rallied 75% after that.

In the end, I expect that the Max will fly again maybe in December. This will tremendously improve the BA sales forecast. Airline industry experts are optimistic on that front. Consider, for example, the comments from Ryanair’s (NASDAQ:RYAAY) CEO during his appearance on CNBC. He suggested that they look forward to flying the Max model maybe even this year. The pain will pass for Boeing — it’s a stock I’d hold for the long term.

Chevron (CVX)

The oil sector and its companies suffered extreme losses this year. The movement to abolish the use of fossil fuels has been ongoing for decades. Last year the ESG theme caught fire when major firms on Wall Street firmly committed to it. Oil stocks like Chevron and Exxon (NYSE:XOM) are suffering almost like tobacco stocks did a while back. Only this is different because we still need oil. The transition off it will take decades. Meanwhile, there are ways for them to exist in portfolios.

The byproduct of falling prices is ballooning dividend yields. Investors seeking fixed income can find a treasure trove in CVX stock. It yields 7.2%, which is a little bit less than XOM stock, but it has a better chart. Chevron is 40% above its March lows; whereas, Exxon is struggling to hold it.

CVX stock carries short-term downside risk, but the dividend reward largely offsets that. There’s hardly any interest to harvest for fixed income investors, so it stands out and it’s worth an allocation. This week the stock withstood yet another test. Candidate Biden is looking good for winning and that should have cratered oil stocks. But they barely budged, so maybe they have run out of incremental sellers. Those left holding CVX stock are investors who have conviction and they won’t be weak hands.

The idea is simple, every portfolio needs a fixed income component. CVX stock suffered the worst kind of test you can imagine this year. The whole world stopped moving and demand on its only product collapsed. Yet management is navigating the waters well. They are also committed to maintaining their dividends by cutting spending. The worst is behind it and there is only upside from here. This doesn’t mean the stock will soar … that’s not the point. Earning a 7% yield from a strong asset is hard to beat.

There are also extrinsic risks. First, there is another wave of Covid-19 infections brewing. Second, the U.S. elections are still not done. If there is civil unrest for whatever reason, then there will be another can of worms to open. Maybe 2020 is not yet done torturing us, but I am optimistic that the worst is done.

On the date of publication, Nicolas Chahine did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Nicolas Chahine is the managing director of SellSpreads.com.