When rock star stocks fall, they tend to fall hard. Such is the case with DraftKings (NASDAQ:DKNG). In the last 30 days, DKNG stock corrected around 30%. Under normal circumstances, this would be a complete disaster but in this case it is but a small setback.

Even after this drubbing, it is still up over 260% on the year, which is ten times better than the Nasdaq. It is hard to feel sad about this situation given the rally it had in 2020. Besides the initial stages of the correction was market-wide but then its momentum took over.

Just a few months ago, DraftKings was under $13 per share and here we are mourning it falling to $40. This, as crazy as it sounds, is part of normal price action. Stocks rally and then they rest, during which they establish a better base of owners. Only then can they continue the upside momentum to set new highs. In this case, it seems extreme because the speed with which it climbed was extraordinary.

The New Normal Suits It

The strength this stock enjoyed happened because of the pandemic lockout. The investment theme that came out of it is that all internet stocks like this deserve sky-high valuations. Not so much for what they bring in now but rather for the future that awaits them. Not all of them will be winners, but DKNG stock is likely to be one to deliver on its promises.

The concept is simple and the customers are there just waiting to contribute. There will be many years of revenue ramp, and all it needs is for some normalcy to resume. There have been recent setbacks, mostly tied to the resurgence of the virus. This should die down to a manageable level soon. The scientists assure us that they are close to a vaccine. Moreover the therapeutics have improved tremendously, with Gilead’s (NASDAQ:GILD) remdesivir — branded as Veklury — being approved for use in treating Covid-19. So catching Covid-19 is no longer as daunting as it was in the beginning.

The Bulls Are Still in Control of DKNG Stock

Anytime there are lofty expectations, there’s always the risk of disappointments. This company is so new that the sky is the limit for now. But at the hint of a setback, the investors will throw a giant tantrum like this.

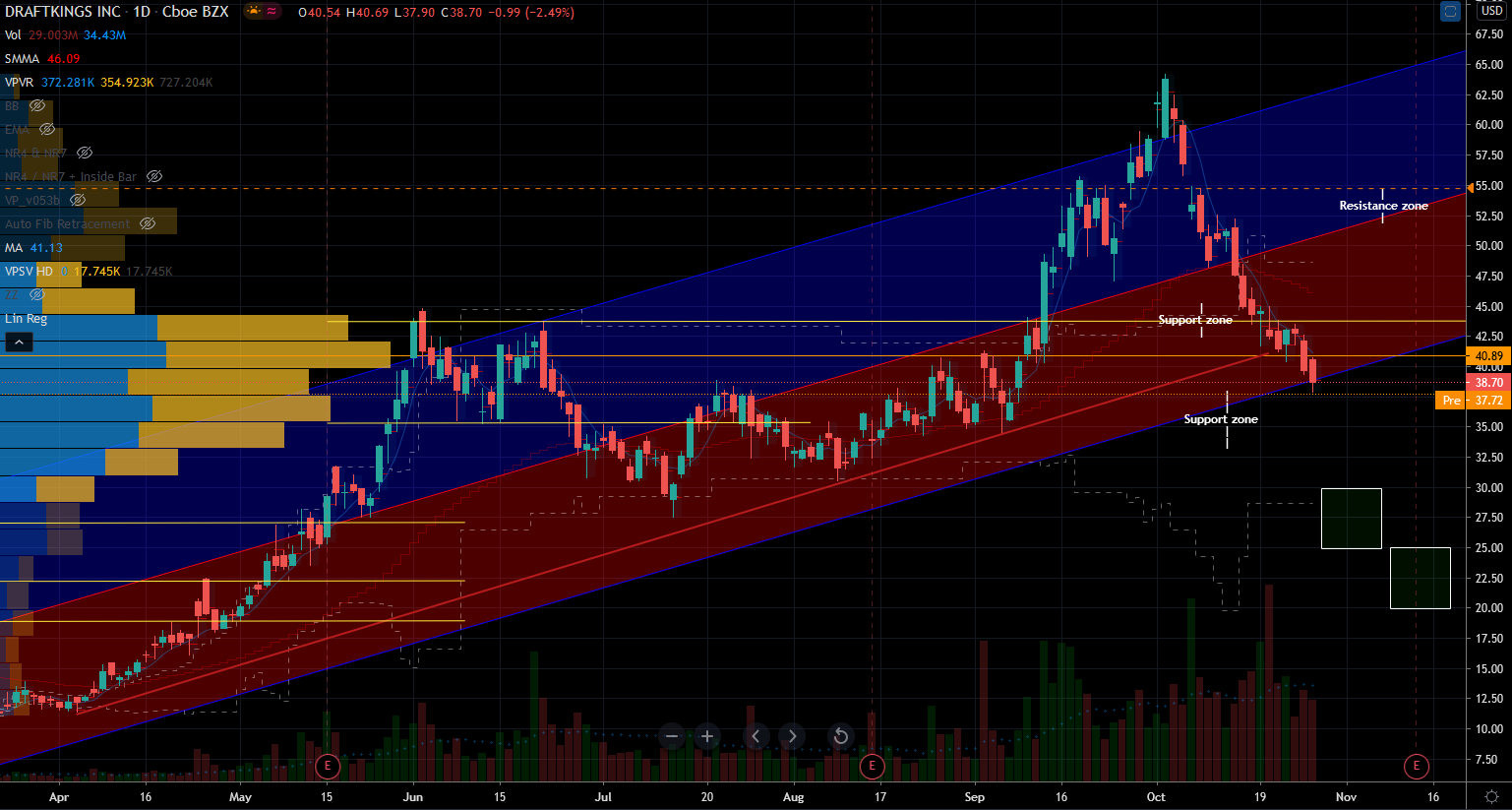

For as long as he bulls are in charge, the dips remain buying opportunities. I wrote about the support it had during the September correction, which delivered a 30% rally. This is no different.

The good news is that DraftKings stock has fallen into a support zone. There will be buyers below here, especially between $30 and $35 per share. There are risks on the chart, mainly from losing the ascending trend line that started in April. This could have a target near $30 per share. Countering that is the consolidation zone that happened between June and September. The range is wide there and has enough volume to act as support. It won’t be a hard line in the sand but more like a rubber band.

Anyway you slice it, this is a speculative stock. But if people loved it when it was rallying into $65, they should be catching now almost 50% lower. This correction gave back the entire September rally. Moreover, this is exactly the 50% Fibonacci retracement level of the rally that started in April. If at any point when DraftKings stock was rallying in the last six months an investor wished they had owned it, they should buy it here. This is the second chance to buy a hot stock after it showed us what it can do on good days.

There Are Outside Factors

What’s making matters worse for this high-flyer is that we have so many extrinsic risks also weighing it down. Wall Street is nervous about the upcoming elections and the complications from them. The earnings season has begun and so far it hasn’t been that great for a few high-profile stocks. Covid-19 is making a comeback in the headlines. And politicians have so far failed us without a stimulus package. Considering all these factors, I’d say this stock is holding up pretty well — again, it’s up 300% year-to-date.

This story is not over and it’s worth another look from the bullish side.

On the date of publication, Nicolas Chahine did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Nicolas Chahine is the managing director of SellSpreads.com.