General Electric (NYSE:GE) is a name embedded within the American consciousness. But these days, GE stock is a cautionary tale, an example of how things can turn so pear-shaped despite such a strong institutional history.

As I have written in the past, the industrial conglomerate’s issues are not new. However, the novel coronavirus pandemic has merely expedited the issues, and it also led to the company selling off some excellent assets, providing short-term relief in terms of cash. Still, it’s not the right move in the long run.

But shares have treaded northwards in the last few weeks. A few developments will help the Aviation side of things that could prompt you to open a position in the stock.

I am here to tell you that I don’t get lulled into a false sense of security. GE stock remains a risky proposition, and the company requires a lot of changes before it regains fundamental strength.

All in all, it’s not a great time to be a GE stockholder.

Slow Recovery for GE Stock

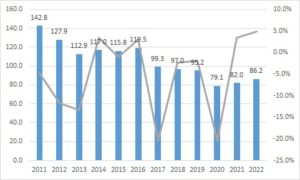

The latest quarterly results reinforced the fact that it will be a slow recovery for GE Electric. GE’s industrial operations reported $15.9 billion in revenue, a 25% year-on-year drop. Other areas like Power, Renewable Energy, Aviation, and Healthcare also suffered notable declines in the latest quarter.

I’ve already spoken at length about how the sale of GE’s BioPharma business will negatively impact its future. That was a very lucrative segment, but what’s done is done. The remaining segments are struggling and will continue to do so for the foreseeable future.

Industrial reported a segment loss of $365 million, down from a segment profit of $2.3 billion a year ago. Meanwhile, Aviation and Energy are facing their own headwinds. Commercial air travel is down, and, by all accounts, it will take a while for it to return to pre-pandemic levels.

However, there is a recent bright spot I want to mention here. European Union (EU) Aviation Safety Agency Executive Director Patrick Ky has said that the safety upgrades Boeing (NYSE:BA) made to its 737 MAX could signal a return to European skies by the end of 2020. Naturally, this is great news for GE as well, because it manufactures MAX engines. Aviation suffered a 44% top-line hit in the quarter, so any good news regarding this segment is always welcome.

Growing Pains

Alternate energy is all the rage these days. People are growing to like the clean and clear skies they see out of their windows. That’s why a lot of headline space and column inches are reserved for renewables these days. General Electric understands this. That’s why it has decided to go ahead and “exit the new-build coal power market” in favor of renewable energy. The exit is a costly one.

In 2014, General Electric paid €12.35 billion to purchase Alstom‘s power and grid businesses. And several other costly acquisitions have been undertaken to build up its prowess in the coal market.

General Electric’s website states it has 100 years of “coal-fired power service expertise” spread across more than 90 original equipment manufacturer brands. The company has decided to move away and concentrate on wind turbines signals a necessary but costly shift.

Will GE Drown in Debt?

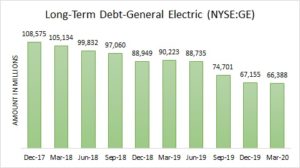

Debt is a topic that often comes up whenever you are discussing GE stock. But I have to give credit where it’s due; GE is aware of the need to pare down debt.

That’s why it has been working to bring down debt in the last few years. However, Covid-19 has put a spanner in the works.

Like several other conglomerates, GE is trying to make sure it has enough funds to survive this crisis and beyond. That’s why GE’s industrial operations had cash and securities of $31.4 billion by the end of Q2, an uptick from $27.6 billion at year-end 2019.

While that’s all fine and dandy, the situation restricts GE from paring down debt further, at least for a few more years. This isn’t great news for GE’s fundamentals.

Summing Up

General Electric has been in trouble for a while. Certain segments will improve when the Covid-19 crisis subsides. However, the larger issues the conglomerate is facing will not change in the foreseeable future. Pivoting from fossil fuels to renewables and paring down debt will take time.

Healthcare, GE’s most profitable segment till a while ago, is severely depleted after the BioPharma business sale. I believe that many of the company’s products will have to be reconfigured before it can become profitable again. Until that happens, I don’t think that GE stock is worth your time.

GE stock is a sell for me.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. He has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. He has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. He has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio.