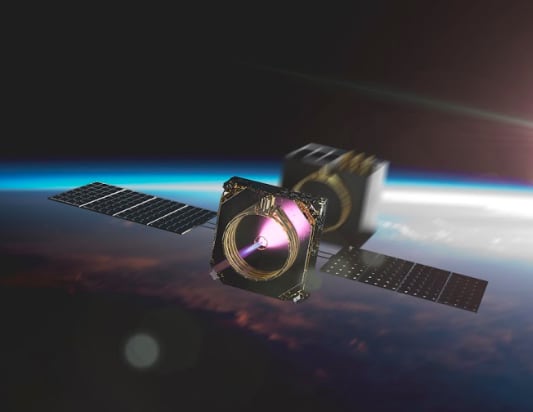

An artist’s depiction of Momentus’ Vigoride spacecraft deploying satellites.

Momentus

Stable Road Capital will take space transportation specialist Momentus public through a SPAC deal that values the company at $1.2 billion, the firm announced on Wednesday.

The acquisition is expected to close early next year, with Momentus to be listed on the Nasdaq under the ticker symbol “MNTS.” Stable Road Capital is using its special purpose acquisition company, which is listed under the ticker symbol “SRAC,” to take Momentus public.

SPAC’s, known colloquially as blank check companies, have become an increasingly popular way method of going public. Rather than go through the traditional IPO market, an investor or firm uses a SPAC to raise funds to finance an acquisition within a certain time frame – and the company that is acquired is effectively taken public. It’s the same manner in which fellow space company Virgin Galactic was taken public through Chamath Palihapitiya’s SPAC last year.

Prime Movers Lab, Momentus’ largest investor, includes several high profile limited partners according to CNBC’s Scott Wapner – including Pershing Square Capital CEO Bill Ackman, Palantir co-founder Joe Lonsdale and business strategist Tony Robbins.

“We believe [Momentus] is primed to be a leader in the rapidly growing new space economy. As the only public, pure-play commercial space company capable of revolutionizing space infrastructure, Momentus is poised to capitalize on its market-defining position,” Stable Road chairman and CEO Brian Kabot said in a statement.

Momentus pitches itself as a ”last mile delivery” service for spacecraft, especially targeting the growing market for small satellites. Based in Santa Clara, California, the company’s business centers around its Vigoride transfer vehicle, which helps deliver satellites from a rocket to a specific orbit. Vigoride consists of a frame, an engine, solar panels, avionics and a set of satellite deployers and is especially designed for satellites that hitch a ride on large rockets, an increasingly popular industry practice called ridesharing.

The company launched a first demonstration mission last year, to show that the key part of its transfer vehicle — the water plasma engines — worked. The first Vigoride mission is lined up this year, currently slated for launch on a SpaceX Falcon 9 rocket in December.

Additionally, Momentus plans to continue to expand its fleet of transfer vehicles to offer even more powerful and capable ways to deliver satellites to orbit. Although its water plasma engines are critical to the business, Momentus CEO Mikhail Kokorich in July emphasized that his operation is “not a propulsion company.”

“In the big picture, we would like to build the infrastructure for industrialization beyond Earth in space,” Kokorich told CNBC at the time. “The first step is developing a last mile delivery in space transportation.”

A line-up of Momentus’ planned transfer vehicles.

Momentus

The company pitches Vigoride as being able to reduce the cost of of reaching orbit from about $50,000 per kilogram to about $15,000 per kilogram. Additionally, Vigoride’s application extends to being a satellite as a service, with Momentus advertising its cost of operating as a satellite platform at less than $1 million per year, below the $10 million per year the company says it costs to use traditional satellite platforms.

Stable Road Capital’s acquisition will raise $310 million in cash for Momentus to further expand its business. In the past year, Momentus has hired former Space Development Agency director and Astra VP Fred Kennedy as president and former Boeing VP Dawn Harms as its chief revenue officer.

Momentus has also signed a number of deals for upcoming missions, with contracts that “represent approximately $90 million in potential revenue over the next several years,” the company said in a press release. Additionally, Momentus said that it is in contention for another $1.1 billion in contracts through either U.S. government awards or further customer contracts.

Momentus aims to be cash flow positive by 2023, when it forecasts annual revenue will exceed $500 million.

An artist’s rendering of a Momentus Vigoride transfer vehicle deploying satellites in orbit.

Momentus

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.