Virgin Galactic (NYSE:SPCE) is a pre-revenue business aiming to become the first mover in the space tourism industry. With virtually zero revenue, it boasts a market capitalization of roughly $4 billion. Though it remains a speculative play, it doesn’t quite need to break-even to create shareholder wealth. With ample cash at hand and its innovative asset base, expect SPCE stock to soar in the coming months.

The company had initially planned to commence its first commercial flight in 2020 until the novel coronavirus had its way. Hence its maiden space-tourism voyage is delayed until next year, giving it more time to prepare for launch day.

Two test flights are set for the latter half of the year, which would greenlight further proceedings. The company already has bookings worth over $80 million, filling up its first year’s capacity. If everything goes smoothly, Virgin Galactic will have the first movers’ advantage in the sector.

Solid Potential

Virgin Galactic has talked a big game, but does it have the firepower to back its claims? So far, it is on course to ensure that its first commercial flight next year would be a smashing success.

The first aspect to consider is its technological prowess. It has developed the first passenger-carrying spaceship called the SpaceShipTwo. The SpaceShipTwo and its other ship, WhiteKnightTwo, are built for efficiency and are in line with the company requirements.

Perhaps the unique element in the company’s technological repertoire is its hybrid rocket motor called the RocketMotorTwo. The motor provides unmatched propulsion, which will launch its ships into space. Additionally, the company may also look to sell the motor to derive an additional source of revenue.

Moreover, the company recently raised $460 million of equity through a 23.6 million share offer. Additionally, its cash balance stands at $360 million, which will take its liquidity balance to roughly $800 million. Hence, the company has enough financial resources for smoothly running its operations.

Demand Is Growing

The exorbitant $250,000 ticket price for a trip to space would seem a distant dream for many but not for everyone.

Virgin Galactic is targeting high net-worth individuals, who are defined as those individuals with at least $1 million in liquid assets. However, you would probably argue that even a $250,000 ticket would be too much for even these people.

Fortunately, for Virgin Galactic, a sizeable market exists beyond the high-income individuals as well.

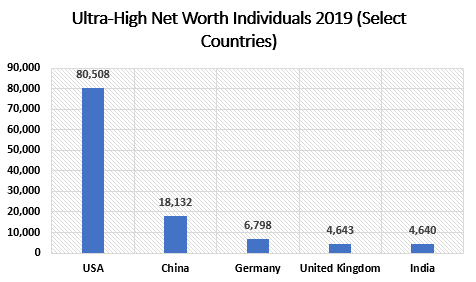

The chart shows the countries with the highest ultra-high net-worth individuals (those having $50 million in wealth). You could scale that figure down to $30 million and thousands more to the list. Nevertheless, the bottom line is that the market is vast enough for Virgin Galactic to realize its potential.

Sir Richard Branson, the company’s founder, will be on board for the first flight, which is likely to be a major PR event. Therefore, I expect the company to gain a lot of traction among its target market.

The company is also working to increase its capacity to cater to the potential demand. It hopes to get five SpaceShipTwo spaceplanes ready by 2023. The goal is to have airline-like operations in the future with a secondary market for its products. It has already started working with Rolls-Royce (OTCMKTS:RLLCF) to work on a new revenue stream for its products.

Final Word on SPCE Stock

Virgin Galactic is on the brink of ushering in a new era of air travel.

The evidence so far suggests that the company will be proving its naysayers wrong next year. It has the technology, the funds and the technical expertise to take its project past the finishing line.

Those who spot this now will reap the benefits later. Therefore, invest in SPCE stock now to get ahead of the curve.

On the date of publication, Muslim Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Muslim Farooque is a keen investor and an optimist at heart. A life-long gamer and tech enthusiast, he has a particular affinity for analyzing technology stocks. Muslim holds a bachelor’s of science degree in applied accounting from Oxford Brookes University.