- The market expected a 31 bcf build in inventories

- Natural gas recovers

- Selling should emerge over $2 per MMBtu- Inventories remain high

Over the past week, the price of natural gas futures on NYMEX broke out to the upside. After trading to a low of $1.583 per MMBtu on June 26, the active month September futures contract has made higher lows and higher highs, reaching a peak of $2.198 on August 4. The over 38% rebound came on the heels of news of a $10 billion investment by Warren Buffett in the energy commodity. The Oracle of Omaha purchased the transmission and pipeline assets of Dominion Energy (D), which likely made some market participants think twice about speculative short positions as the 2020/2021 peak season that begins in November approaches.

Meanwhile, another supportive factor over the past weeks has been a steady decline in the level of natural gas injections into storage across the US. The last triple-digit increase in stocks came during the week of June 19. Since then, injection levels have been steadily falling with the Energy Information Administration reporting a 26 billion cubic feet rise in stockpiles for the week ending on July 24.

On Thursday, August 6, the EIA released its inventory data for the final week of July. The United States Natural Gas Fund (UNG) follows the price of natural gas futures on NYMEX higher and lower.

The market expected a 31 bcf build in inventories

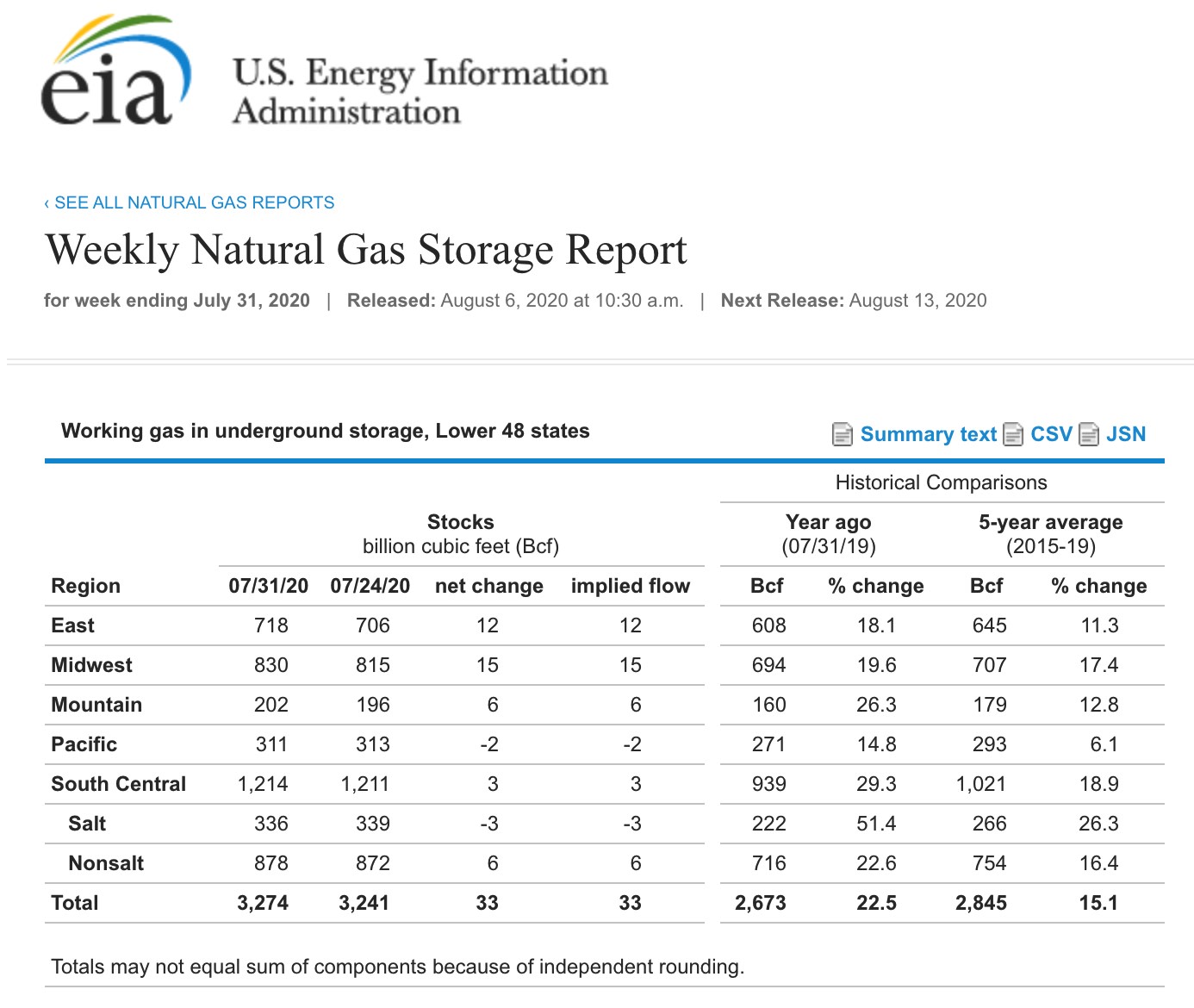

According to Estimize, a crowdsourcing website, the market had expected a 31 billion cubic feet injection of natural gas into storage across the US for the week ending on July 31.

Source: EIA

As the chart shows, the data came in marginally above the projected level at 33 bcf. Stocks rose to 3.274 trillion cubic feet at the end of July, 22.5% above last year’s level, and 15.1% over the five-year average for this time of the year. The report marked the nineteenth consecutive week where stockpiles declined on a percentage basis compared to last year’s level. The natural gas futures market was steady following the EIA report, with the price trading over $2.20 per MMBtu level.

Natural gas recovers

The cure for low prices in commodity markets is low prices. September futures had declined to a low of $1.583 per MMBtu on June 26. After a recovery to just below the $2 level on July 7, the price made a higher low at $1.646 on July 20. On August 3, the price broke above the $2 level and rallied over the past four consecutive sessions.

Source: CQG

The daily chart shows that natural gas rallied to its latest high at $2.284 on August 6 and was trading around the $2.25 level, near the high, in the wake of Thursday’s EIA data. Price momentum and relative strength indicators rose to overbought territory on the short-term chart. Daily historical volatility increased to 87.3% as the daily trading ranges expanded during the price recovery. Open interest at 1.285 million contracts moved marginally lower, which could be a sign of short covering as the price moved higher. Technical resistance stands at the early May peak of $2.499 per MMBtu on the September futures contract. Natural gas moved higher as the price ran out of steam on the downside. Warren Buffett’s $10 billion investment via his purchase of Dominion Energy’s (D) transmission and pipeline assets likely gave the market a psychological boost. After falling to its lowest level since 1995, the market was overdue for a recovery.

Selling should emerge over $2.20 per MMBtu- Inventories remain high

Despite the decline in the percentage over last year’s level since March, natural gas stocks remain historically high. With approximately fifteen weeks to go before the start of the 2020/2021 peak season of demand when stockpiles decline, an average injection of 48.4 billion cubic feet would put the total inventory level above the four trillion cubic feet level for only the third time since the EIA began reporting data.

Injections have been small over the past weeks but are likely to increase as summer cooling demand declines in the fall season. However, the drop in the number of natural gas rigs operating across the US will limit the output of the energy commodity. According to Baker Hughes, only 69 natural gas rigs were in operation as of July 31, 102 fewer than last year at the end of July.

Source: CQG

The weekly chart shows that nearby natural gas futures broke above the first level of technical resistance at the early May $2.162 per MMBtu level. However, the trend over the past years had been bearish. The higher price and level of stockpiles for the 2020/2021 peak season could cause sellers to return to the market sooner rather than later.

I do not expect the price to run away on the upside in August. Speculative shorts have pocketed lots of profits over the past months and years selling the energy commodity on rallies. I expect them to view the recent rally and prices above the $2.20 level as another opportunity to sell and push the price of the energy commodity lower. A higher low above $1.646 per MMBtu on September futures or $1.768 per MMBtu on the October contract would create another buying opportunity on the long side of the market as the peak season that begins in November approaches.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

How to Trade THIS Stock Bubble?

7 “Safe-Haven” Dividend Stocks for Turbulent Times

The United States Natural Gas Fund L.P. (UNG) was trading at $12.64 per share on Thursday afternoon, up $0.05 (+0.40%). Year-to-date, UNG has declined -25.03%, versus a 4.20% rise in the benchmark S&P 500 index during the same period.

UNG currently has an ETF Daily News SMART Grade of D (Sell), and is ranked #72 of 111 ETFs in the Commodity ETFs category.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More…

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More…