When the novel coronavirus began rapidly spreading worldwide, companies scurried to set up remote work arrangements with their staff.

This dramatic shift from the office to home may last longer than thought. The U.S. failed to flatten the curve. And with the spread of coronavirus on the rise, remote work is going to be a big part of the new normal.

That means companies will have to increase their spend on remote work solutions. But they’re also going to have to spend big on protecting their networks and employees from cyber attacks.

Investors have a slew of cybersecurity stocks to choose from. In this article, we pick seven cybersecurity companies needed more than ever. They are:

- CrowdStrike Holdings (NASDAQ:CRWD)

- Microsoft (NASDAQ:MSFT)

- NortonLifeLock Inc. (NASDAQ:NLOK)

- Fortinet (NASDAQ:FTNT)

- CyberArk Software (NASDAQ:CYBR)

- Palo Alto Networks (NYSE:PANW)

- Datadog (NASDAQ:DDOG)

Already software firms specializing in endpoint and cloud protection are reporting higher demand. VMware (NYSE:VMW) recently released its cybersecurity threat survey. The survey of 250 CIOs, CTOs, and CISOs revealed that attack volume increased 92% over the last 12 months.

CrowdStrike Holdings (CRWD)

CrowdStrike broke out during the V-shaped stock market recovery in March 2020 and again after posting quarterly earnings on June 2, 2020. The company is taking market share from Symantec and next-generation operators. It has $686 million in annual recurring revenue, up 88% year-on-year. Subscription revenue grew 91% on 6,261 subscription customers.

CrowdStrike enjoys a steady stream of recurring revenue because their solutions are superior to the competition. For example, other security products require on-premise inflexibility and are needlessly complex. They also miss attacks, offering workers a false sense of security. As a cloud-native platform, the company can effectively distribute its solution to neutralize threats. And by detecting anomalies, CrowdStrike may deal with the threat and prevent attacks.

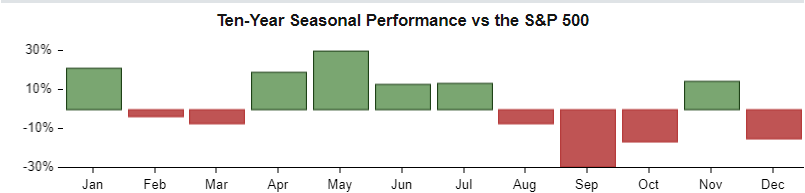

Below, CrowdStrike stock is approaching seasonal weakness between August and October 2020. If shares drop, investors could buy them at better prices:

CEO George Kurtz said on the conference call that even if people return to the workplace, a hybrid model can sustain the company’s growth. Krutz said, “I think ultimately a more into the work from anywhere and there will be a hybrid model of people going back to work, but I think we all know that we are not going to continue in the same way that we had pre-COVID.”

Microsoft (MSFT)

Microsoft doubled down on its Office solution by offering Office 365. By charging a license and hosting Office on the cloud, end-users are protected from viruses or malware. But Microsoft’s Operating systems for the desktop and server also offers core protection to customers. By constantly issuing patches, the company stays ahead of hackers trying to find holes in the operating system.

Microsoft also distributes an antivirus and malware protection program with Windows 10. When customers buy a PC running the OS, they automatically have this software running in the background. On the conference call, Microsoft highlighted Bridgewater Associates as a customer using its security services built into Microsoft 365. CEO Satya Nadella said, “The world’s largest hedge fund, Bridgewater Associates, is using security services built into Microsoft 365 to protect employees and core services in a zero-trust environment.”

Azure complements the security around work from home. CEO Nadella said, “Usage of Windows Virtual Desktop tripled this quarter as organizations deploy virtual desktops and apps on Azure to enable secure remote work.”

NortonLifeLock Inc. (NLOK)

NortonLifeLock earned 26 cents a share (non-GAAP) in the fourth quarter of fiscal year 2019. Revenue topped $614 million as billings grew 3% Y/Y. It earned $9.07 in revenue per user, up 3% from last year. The solid top and bottom-line beat are due to the business offering around prevention, detection and restoration of systems and data when a hacker breaks in.

CEO Vincent Pilette describes the company as “Managing and handling crisis is part of our DNA and then entire NortonLifeLock team is rising to the occasion, adapting ourselves and our processes to help customers in need as well as communities by donating time and resources.”

NLOK stock has a quality score of 96/100. The company’s operating margin could expand as its customer base grows and its efficiency increases.

| NLOK | Industry | S&P 500 | |

| Quality Score | 96 | 53 | 79 |

| Gross Margin | 81.50% | 69.00% | 29.00% |

| Operating Margin | 20.90% | 26.30% | 13.00% |

NortonLifeLock doesn’t charge much for protecting its members. Its average revenue per user is only $9 a month. That makes this an inexpensive cost for companies as staff work home and online almost all the time.

The firm also offers SurfEasy, which provides VPN protection for devices. It launched Norton 365 with LifeLock in April 2020. These product launches should give revenue a lift in the quarters ahead.

Fortinet (FTNT)

Fortinet shares spent May to June 2020 in a tight trading range between $130 and $150. Though the stock presently trades at unfavorable price-to-earnings multiples, the cybersecurity firm enjoys strong revenue and profit growth.

In the first quarter, Fortinet reported earnings of 60 cents non-GAAP. Revenue grew 22.1% Y/Y to $576.9 million. Since 2018, the company has posted a steady increase in service, product and billings revenue. But the work from home trend will drive even greater shipments of FortiGate.

In Q1, shipments increased 30%, due to strong demand for home secure VPN and secure SD-WAN. These products are built from Fortinet’s ASIC-powered appliance. Ken Xie, the company’s CEO, also said that the company benefited from strong demand for FortiClient, FortiAuthenticator and FortiToken.

In the last quarter, business with small and medium-size customers grew by around 2%. As SMB takes off, revenue from this segment should continue to grow.

CyberArk Software (CYBR)

CyberArk posted strong first-quarter results, but it also withdrew its full-year guidance. The company reported revenue growing 11% to $106.8 million. It ended the quarter with $1.2 billion in cash and cash equivalents.

In the second quarter, CyberArk forecast revenue in the range of $95 to $105 million. It expects to earn up to 35 cents a share. The company is ramping up a virtual sales approach to adjust to the new work conditions amid the pandemic. Together with its acquisition of Idaptive, the company plans to offer better secure solutions, called privileged access. It believes its approach in managing identities with privileged access management will reduce security risks.

CyberArk’s CEO, Udi Mokady, said that:

“Our customers have immediate needs as they transition and secure business operations and remote employees. Customers added laptops at unprecedented pace and employees are accessing corporate resources from any and everywhere. “

In the financial statement summary below, steady revenue growth and an increase in net income support the valuations in CYBR stock:

Data courtesy of Stock Rover

Palo Alto Networks (PANW)

Palo Alto Networks accelerated its customer growth by offering over 1,500 customers a free trial of its remote secure access solution. In the second quarter, demand for connectivity and security solutions grew in segments that include the mobile market.

At a consumer technology conference, CEO Nikesh Arora explained the company’s lightweight approach to security control in the cloud. It supports SD-WAN and also offers cloud management capability with CloudGenix. Because its firewall works seamlessly with SD-WAN, customers may choose from two different capabilities.

Palo Alto has three core products. Cortex offers advanced threat detection using artificial intelligence and analytics. Strata offers its customers mobile and branch security, as well as data center protection. And Prisma protects the network through compute security and cloud identity.

Datadog (DDOG)

Datadog traded as low as $27.55 in the past year, but recently peaked at $98.99. The company posted revenue growing an astounding 87% Y/Y to $131 million in the first quarter. It now has 960 customers with an ARR of over $100,000. This is up from 508 customers last year.

Datadog launched security monitoring, illustrating its rapid pace of innovation. The company won deals in which it sold multiple products. The revenue expanded because Datadog upsold its Security Monitoring solution.

CEO Olivier Pomel said “we had a sizable upsell to a mid-market on-demand logistics company which now spends more than $1 million a year with us. This company has been a customer since 2018, started with infrastructure monitoring, and then adopted both APM and log management in 2019.”

The company’s research and development efforts in security solutions will drive revenues higher. Existing customers will prefer to buy this and its other products. This will increase the ARR per customer.

According to Tipranks, an analyst at FBN Securities set a $115 price target on DDOG stock. The average price target, based on 14 analysts is $75.00.

Disclosure: As of this writing, the author did not hold a position in any of the aforementioned securities.