Editor’s note: This column is part of InvestorPlace.com’s Best Stocks for 2020 contest. Jason Moser’s pick for the contest is Wayfair (NYSE:W).

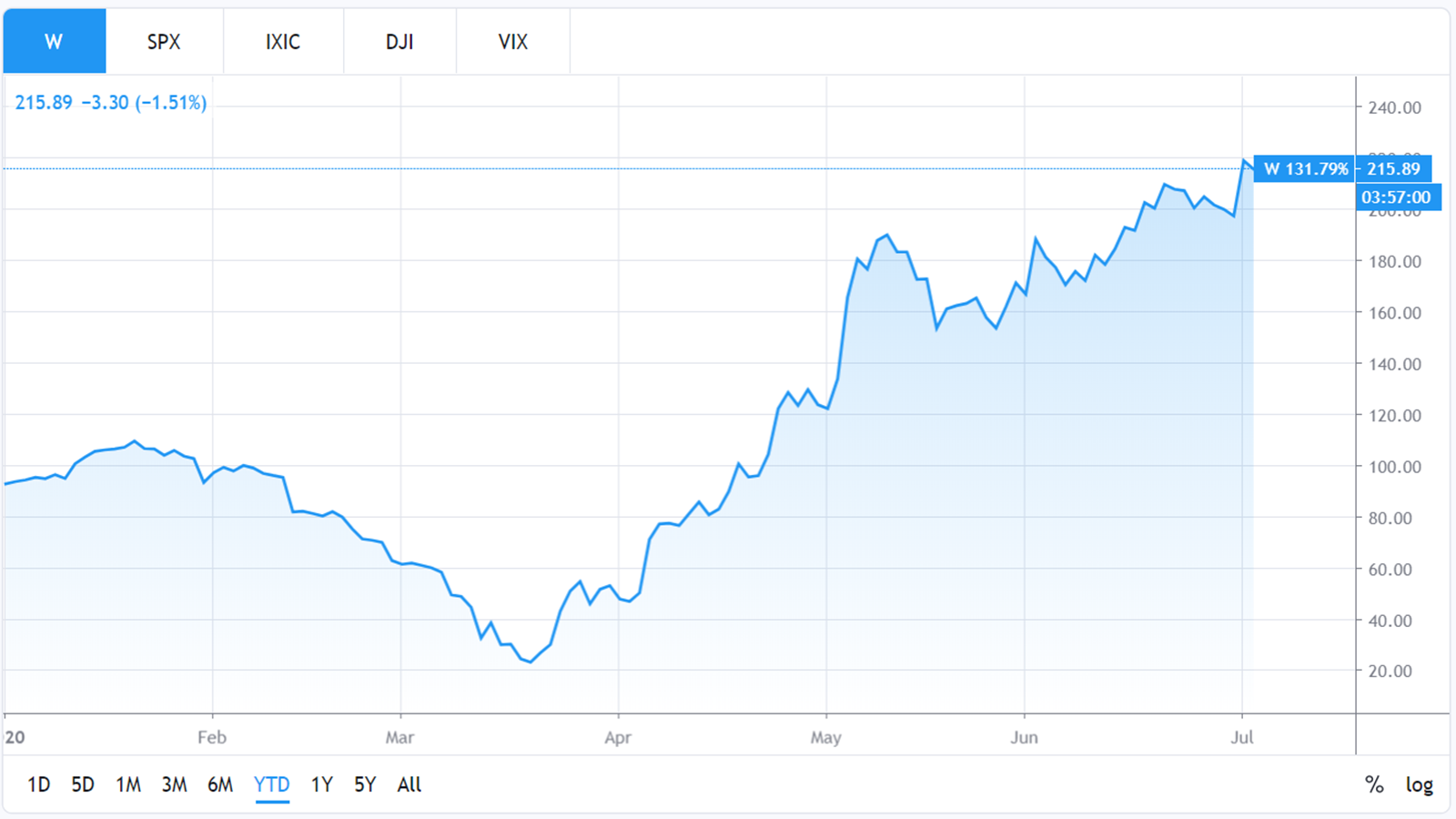

To say that 2020 has been a crazy year for the stock market would be putting it mildly. And what about for my InvestorPlace.com Best Stocks pick? To say that 2020 has been a crazy year for shareholders of Wayfair (NYSE:W) would be putting it, well I don’t exactly know what word works best here but as you can see from the chart below, maybe roller coaster works?

China trade concerns at the beginning of the year quickly took a back seat to the novel coronavirus. And at its low, Wayfair stock touched $21.70. With shares today trading at just over $200, the stock’s recovery has been nothing short of breathtaking.

Plus, the company’s first-quarter results were very encouraging:

- Revenue of $2.3 billion was up 19.8% from a year ago.

- Gross margin of 24.9% was up 70 basis points from a year ago.

- Active customers of 21.1 million up 28.6% from a year ago.

- Orders delivered of 9.9 million up 21% from a year ago.

- Percentage of orders from repeat customers of 69.8%, up from 66% a year ago.

Management noted on the earnings call that “Starting in mid-March, we saw a pickup in both traffic and conversion, with increasingly strong repeat behavior coupled with an acceleration in new customer orders.” No doubt the market is also enthusiastic about the company’s progress toward profitability.

Plus, management expects to achieve “positive consolidated adjusted EBITDA margin” in Q2. A recent private placement raised additional capital. Now the company’s balance sheet now has about $900 million in cash and equivalents giving it firm footing in an uncertain time.

The Bottom Line on W Stock

The bottom line is that Wayfair’s business is performing very well these days and all signs point toward that performance continuing into the back half of the year. While Covid-19 remains a risk on all fronts, Wayfair remains in a good position to continue picking up share in a massive market opportunity.

As of this writing, Jason Moser, a senior analyst with The Motley Fool, held shares of W stock.