Editor’s note: This article is part of InvestorPlace.com’s Best Stocks for 2020 contest. Eric Fry’s pick for the contest is Freeport-McMoRan (NYSE:FCX).

When we last discussed Freeport-McMoRan (NYSE:FCX), the novel coronavirus pandemic was in full force, the U.S. stock market was struggling to recover from a wicked 34% drop and copper prices had tumbled to a three-year low.

This toxic cocktail hammered Freeport’s share price from a February high near $13 to a March low below $5. That moment offered plenty of cause for concern … but not for all-out panic.

As I stated at the time:

Yes, the coronavirus epidemic will depress economic activity short term, which will depress copper demand short term…

Despite that frightening prospect, I expect FCX stock to recover and deliver a solid gain for 2020…

Freeport’s decimated share price discounts most of [the risks]. It does not price in any potential upside.

The biggest potential kicker for the stock is probably just one word: normal. If the copper market simply returned to something resembling normal, Freeport’s share price could double fairly quickly from current levels.

Well, that is exactly what happened.

Thanks to a rebounding copper price, FCX stock has more than doubled from its March lows. Now, it’s drawing close to its highs for the year.

At current copper prices around $2.70 a pound, Freeport-McMoRan is on track to generate nearly $6 billion in gross profit (EBITDA) over the next 12 months.

That level of profitability would produce annual earnings of about $1.10 a share, which would mean that the stock is trading for just 10 times earnings. That expectation assumes no additional rise in the prices of copper or gold.

But that’s not my assumption.

I expect copper prices to continue trending higher toward $3 a pound and gold prices to top $2,000 an ounce on their way to $3,000.

At $3 copper and $2,000 gold, Freeport’s annual EBITDA could approach $7.5 billion.

But that’s not all…

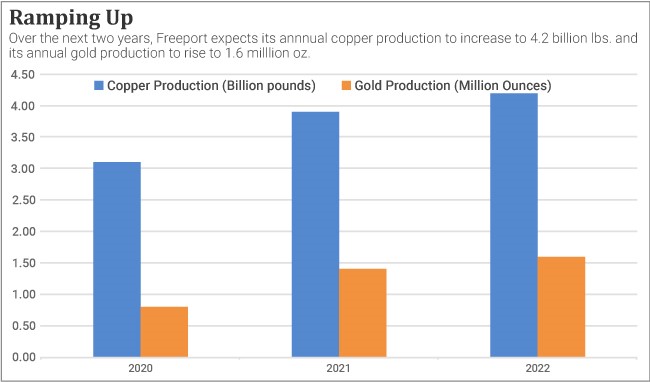

The company’s massive investments to increase production at its Grasberg mine in Indonesia are just starting to bear fruit. As a result, company-wide annual copper production should jump about 40% over the next two years to 4.2 billion pounds. At the same time, gold production should double to 1.8 million ounces.

Those hefty production numbers could produce EBITDA well over $10 billion and earnings per share (EPS) in the range of $2.

Risks remain, of course. The recovering global economy could sputter once again, especially if the second wave of the Covid-19 epidemic in the United States continues to gain traction.

But as I pointed out in my previous update, powerful long-term demand trends are likely to push the copper price much higher than it is today.

Rising Demand to the Rescue

Demand from the electric vehicle (EV) and battery industries, for example, could ramp up total global demand for the metal by 900% over the next eight years, according to Robert Friedland, founder and CEO of Ivanhoe Mines (OTCMKTS:IVPAF), which owns the world’s largest undeveloped copper mine.

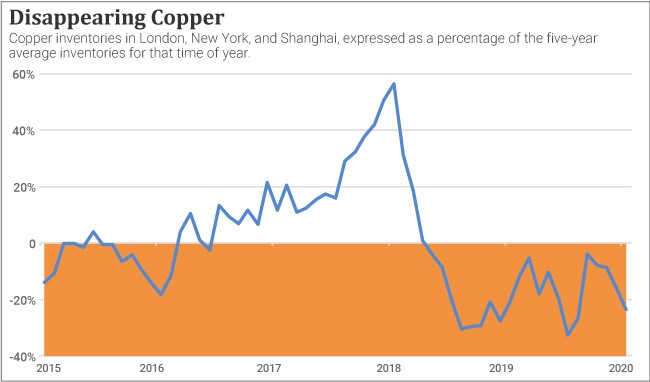

Global copper demand is ramping up already, especially from China, the world’s largest consumer of the red metal.

As a result, global copper inventories have been dropping sharply and are now far below the five-year average levels for this time of year.

Meanwhile, on the supply side of the ledger, Covid-19 continues to toss boulders in the path of progress.

Around the world, the pandemic has disrupted production at more than 50 copper mines. And BMO Capital Markets analyst Colin Hamilton believes that as much as 6.6% of the global copper supply is at risk of disruption throughout the rest of this year.

His forecast drops to 5% in 2021. But that is still a significant number in a market that was in a supply deficit as recently as a few months ago.

In Chile, the source of more than one-quarter of the world’s copper production, the coronavirus is forcing mining companies to run skeleton crews and adopt other measures to operate as safely as possible.

While necessary, these measures will almost certainly take a bite out of production. Furthermore, because these mines are also deferring maintenance, they may have to shut down for longer-than-usual periods later this year and early next.

“The disruptions to copper concentrate mining due to Covid-19 will be felt by Chinese smelters until at least the third quarter,” predicts Zhu Yi, an analyst at Bloomberg Intelligence.

Best Stocks: Don’t Count FCX Stock Out Yet

The coronavirus-constrained supply of copper, coupled with strong resurgent demand, should continue putting upward pressure on the copper price.

Bottom line: Freeport-McMoRan’s robust snap-back from its March lows is a good start. But there is plenty more where that came from. I’m expecting rising copper and gold prices to propel the stock to $15 and beyond by year-end.

Don’t count this stock out yet.

Eric Fry is an award-winning stock picker with numerous “10-bagger” calls — in good markets AND bad. How? By finding potent global megatrends… before they take off. And when it comes to bear markets, you’ll want to have his “blueprint” in hand before stocks go south. Eric does not own the aforementioned securities.