With the price of oil rebounding, I wanted to find five cheap energy stocks that have solid dividend yields. In other words, the dividends are more than covered by the company’s free cash flow. In addition, the dividend yield is greater than 5% or 6% annually.

It took a little searching. For example, a number of solid energy stocks have recently cut their dividends. I wrote about this in my recent article on BP (NYSE:BP). That company is in danger of cutting its dividend.

Recently, other major energy companies like Royal Dutch Shell (NYSE:RDS.A, RDS.B) and Equinor (NYSE:EQNR) have cut their dividends to persevere cash flow. I wrote about one oil company, Marathon Oil (NYSE:MRO), that appears to have enough cash flow for its dividend. Yet it still cut the dividend in order to preserve its balance sheet and keep its credit rating.

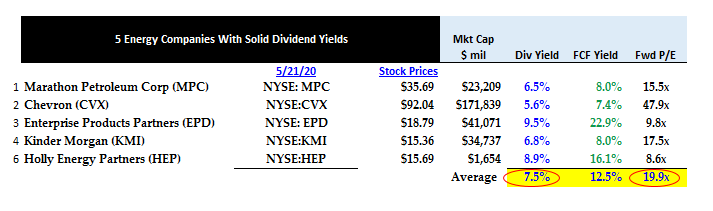

The following five companies have produced enough cash flow to cover their dividend yields. They also seem motivated to continue to pay those dividends. At a minimum, management has not come out and said they are reviewing whether they will pay the dividend, so I consider them solid dividend payers.

Here are the five cheap, high-yield energy stocks to consider:

- Marathon Petroleum Corp (NYSE:MPC)

- Chevron (NYSE:CVX)

- Enterprise Products Partners (NYSE:EPD)

- Kinder Morgan (NYSE:KMI)

- Holly Energy Partners (NYSE:HEP)

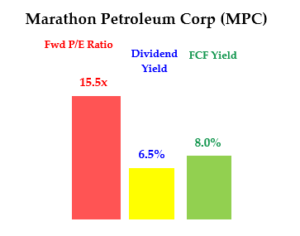

Marathon Petroleum Corp (MPC)

Dividend Yield: 6.3%

Marathon Petroleum is an upstream oil company as well as a gasoline retailer under the Speedway, Marathon, and ARCO brand names. It is a massive company with a $24 billion market value. The company has 17,200 miles of pipelines, operates out of 3,900 convenience stores, and 6,900 retail outlets in 35 states in the U.S. and Mexico.

Marathon produced over $1.85 billion in free cash flow (FCF) in the last 12 months (LTM) ending March. Therefore, its LTM FCF yield was 8%.

This is greater than its dividend yield of 6.5% (as of May 21), making the dividend definitely affordable on a historical basis. In fact, Marathon just declared its latest quarterly dividend of 58 cents per share on April 29.

The CFO said in its quarterly presentation transcript that its cash flow from operations before working capital changes was $1.3 billion. The corresponding cash dividend costs were for the quarter just $377 million. This is also from slide five of its quarterly presentation and shows that the dividend is clearly covered by cash flow.

During the most recent quarterly conference call the CEO, Mike Hennigan, made it clear that he believes that the company runs a “return of capital” business. They decided not to make any change in their dividend policy as a result of that focus.

As a result I believe the company will continue to pay the dividend. Shareholders in energy stocks like MPC stock can expect to enjoy a solid dividend going forward. They are rewarded with a good 6.3% dividend yield at present.

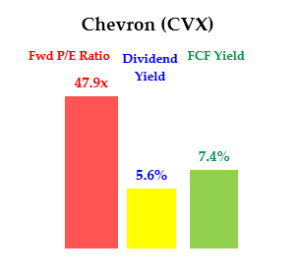

Chevron (CVX)

Dividend Yield: 5.6%

I recently wrote an article on CVX stock and why it is such a great buy. I talked about Chevron’s strong cash flow as well as its priority on paying its dividend. You should read the article to get a sense of the company’s commitment.

For example, Chevron had just announced that its focus was on protecting the dividend, wisely spending its capex, and not over-leveraging the balance sheet.

In fact, Chevron recently raised its quarterly dividend to a rate of $1.29, up from $1.19 in January. On April 29, the company reaffirmed that increase by making another quarterly dividend announcement at the same level.

I suspect you can count on the company continuing to make the annual $5.16 dividend per share payment. That gives CVX stock a very healthy dividend yield of 5.6%.

Meanwhile, Chevron produced $12.7 billion of free cash flow in the past year, despite the falling price of oil and gas.

That works out to an FCF yield of 7.4%. This is more than the dividend yield. It also provides a margin of safety to ensure that there is likely going to be enough FCF to cover the dividend over the next year. It looks like CVX is a solid dividend yield play in the energy sector.

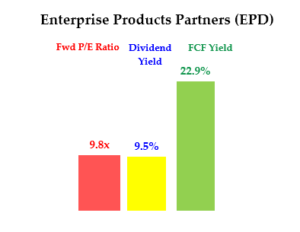

Enterprise Products Partners (EPD)

Dividend Yield: 9.2%

Enterprise Products Partners is a midstream natural gas liquids (NGL), crude oil, and natural gas pipeline and gas storage company. It has over 19,000 miles of NGL pipelines and is based in Houston.

Right now EPD stock yields 9.2% and has an even higher FCF yield. For example, in the last 12 months Enterprise Products generated over $9.4 billion in FCF. The market value of its stock is $41 billion.

Recently, the Barron’s 2020 Energy Roundtable of energy experts mentioned the stock. Robert Thummel of Tortoise closed-end funds company has followed energy stocks like EPD and its management for many years. He believes the stock has “adequate” dividend coverage, despite its high dividend yield.

In the company’s most recent conference call management made it clear that they would pay the ongoing “distribution.” In the past, the company had committed to consistently increase its distribution. But given the current environment they decided to keep it level.

Nevertheless, this still shows that the company has every intention to continue to pay the high yield to investors. That is good enough for me.

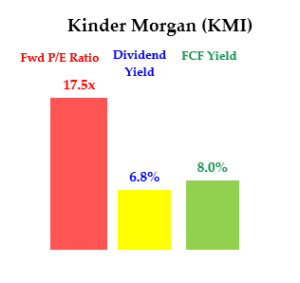

Kinder Morgan Inc (KMI)

Dividend Yield: 6.8%

Like Enterprise Products Partners, Kinder Morgan is a massive midstream oil and gas company. Its market value is about $35 billion. The company operates 83,000 miles of natural gas pipelines and 147 terminals.

KMI stock yields 6.8% with its annual dividend per share set at $1.05 per share. However, in the company’s most recent conference call on its Q1 2020 earnings, a possible increase was discussed. The bottom line is that management expects to increase the dividend per share rate to $1.25 in January 2021.

If that occurs, the dividend yield, at the price at the time of this writing (May 21) of $15.36 will be 8.1% annually, unless the stock rises before then. Another way to look at this is how much the stock would rise to stay at the same dividend yield.

For example, if KMI stock stays at today’s 6.8% dividend yield by the time the dividend per share is set at $1.25 in early 2021, the price will be $18.38 per share. That represents an increase of 19% over today’s price.

Moreover, KMI has plenty of FCF to cover the dividend. Its LTM FCF yield as of Q1 2020 was 8%. This is higher than the 6.8% dividend yield and so the dividend is well covered. So this looks like a solid high dividend yield stock.

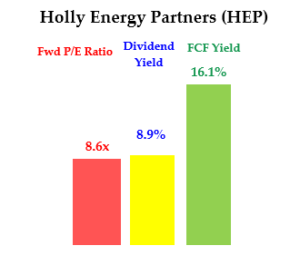

Holly Energy Partners (HEP)

Dividend Yield: 8.9%

Holly Energy, based in Dallas, is a midwestern pipeline company. It operates 26 main pipelines, 10 refined product terminals, one crude terminal, and 31,800 track feet of rail storage, along with other related assets.

HEP stock has a market value of $1.6 billion. The company generated $266 million in FCF last year, which represents an FCF yield of 16.1%. Meanwhile the dividend yield at its current $1.40 per share rate is 8.9%.

Recently the Holly Energy Partners cut the dividend by 48% to 35 cents per share per quarter. This was announced on April 23.

The dividend at this rate is well covered by the cash flow, since it will cost just $147 million. That is well below the amount of cash flow generated in the past year. The company said it will save $130 million per year.

Management said in its Q1 conference call this was a “disciplined and prudent measure intended to fund all capital projects and growth within cash flow, while reducing leverage and will provide HEP with a stronger coverage ratio going forward.”

Sometimes it is better to invest in a stock after a dividend cut. This allows the stock to later move up since the dividend is now more secure. I think that is the situation with Holly Energy Partners stock.

Summary and Conclusion

These five energy stocks have solid dividend yields they can afford. There is plenty of FCF coverage for the dividends. In fact, on average, the dividend yield of the group is just 7.5%, and the LTM FCF yield of the group is 12.5%.

Moreover, the stocks as a group are not expensive. For example, the table above shows that the average price-to-earnings ratio is just 20 times.

These energy stocks look to be good bargains and should pay solid dividends in the future.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here.