Investing in stocks should truly be about buying the underlying companies, and not just the stocks of the companies. It might read as trite, but before you click on the buy button in your brokerage account, you need to get to know the company and want to own it. This process helps investors identify the best long-term stocks to buy and hold.

It also means understanding what the company does now — and what’s ahead. Are the products and services in demand, and will that continue? Does the company have costs under control as well as scale when it comes to making more stuff or providing more services.

When l look at a company, I look for not just rising sales, but rising operating profits. Earnings can be managed for any given quarter. But sales are sales, unless there is fraud. Subtracting the cost of goods and services — along with general and administrative costs — gives you the operating profits.

You want to own companies with fat operating profits and rising operating margins. That means that as a company sell more, it earns more on each transaction. This shows that the company isn’t just dumping stuff to gain market share in the short term.

Then you want to ask: What will go wrong, and how will the company deal with it? What will go wrong typically comes down to either a drop in sales or a rise in costs. Go back through the past years and see when sales dropped, or when costs rose, and how it played out for the company.

And if history doesn’t provide enough evidence, it’s not that hard to run some numbers.

Don’t Stop Your Research at Sales and Profits

Most investors stop at looking after sales and profits at their peril.

This means that after the fun of the income statement, you need to turn to the balance sheet. I’m a former banker and bond market guy. And if I can’t see myself lending a company money, then I’m not buying it — and I’m not recommending it to subscribers of Profitable Investing.

You can do some basic credit analysis of your own. Look at the current ratio which compares cash and equivalents against liabilities going out to one year. If this ratio is less than 1, then the company has a potential threat. Then look at the debt compared to assets. If a company has debts that are climbing closer to 100% of assets, that’s a big red flag that missteps will bring in discussions of Chapter 11.

And, if a company has a pile of debt that is coming up very soon, then there better be a plan outlined to roll it over. I prefer companies that have debts spread throughout maturity dates. And I like companies with bonds and other publicly traded debt to be well supported in the market. If a company has bonds that are sagging, that’s a red flag that creditors aren’t impressed, and you need to stay away.

Finally, if the balance sheet and the income statement are good, it comes down to the value of the stock.

I first focus on the current price-sales ratio, which takes the market capitalization divided by the trailing annual sales of the company. If a company’s price-sales ratio is 1 times that means that the stock is valued at what the company sold. A ratio of 2 means that the stock is valued at twice what it sold.

But you want to find a good company that hasn’t been fully priced.

For that, look at the price compared to the intrinsic value. This is known as the price-book ratio. Compare it to its peers to see if the stock is cheaper on an intrinsic basis or if it’s expensive.

10 Long-Term Stocks to Buy and Evaluate Each Month

Most think you can just buy and forget about long-term stocks. But you need to do all of the above analysis each and every month. Sum it up by asking yourself: Would I buy this stock all over again, and why? And then ask yourself: At what price?

If you can’t answer the first question — or if the price that you’d be willing to pay is below its current price — it’s time to sell. But if both queries are good, then keep owning the stock and perhaps buy more.

Never hold shares and hope that something will work out. If a stock is down, too many investors trick themselves into holding out for a bounce to sell. That never works, and more pain will likely follow. Or, investors feel they’ve done so well with a stock that they refuse to cash out — again leaving plenty of room for pain.

OK, enough with my words about long-term stocks. You are reading this to get some guidance for stocks that you can do your homework on and perhaps buy. Here are 10 long-term stocks I’m a fan of now:

- FMC Corporation (NYSE:FMC)

- Microsoft (NASDAQ:MSFT)

- Nestle (OTCMKTS:NSRGY)

- Procter & Gamble (NYSE:PG)

- Zoetis (NYSE:ZTS)

- Verizon (NYSE:VZ)

- BlackRock (NYSE:BLK)

- Easterly Government Properties (NYSE:DEA)

- Samsung (OTCMKTS:SSNLF)

- Amazon (NASDAQ:AMZN)

Each of these stocks I’ve followed, and in most cases, have owned for some time. I keep reviewing each of them. Note: These long-term stocks are not in any particular order. I pulled them from the model portfolios of my Profitable Investing, which is celebrating its 31st year of publication.

Long-Term Stocks: FMC Corporation (FMC)

FMC Total Return

The first of my long-term stocks is FMC. This company goes back to 1883 and has worked to help farmers produce more higher-yielding crops. Its herbicides and pesticides are used — and embraced — throughout the world including in tough markets of Europe, China and India.

Sales continue to rise, with the trailing three years showing average annual gains of 26.6%. Operating margins are fat at 17.8%, which then deliver a return on equity of 17.2%. Debts are low at 35% of assets and the current ratio is fine at 1.5 times.

The stock yields 1.9% and is priced attractively at only 2.6 times sales.

FMC has provided a return of 306.8% over the past 10 years for an average annual equivalent of 15.1%.

Microsoft (MSFT)

MSFT Total Return

Microsoft is a transformational technology company that went from unit sales of boxed software to recurring sales of subscription software and services. And gaming continues to be a big seller that only adds to the company’s prospects.

Revenues have climbed by an average of 11.4% per year over the trailing three years alone. The operating margin is fat at 34.1% for a return on equity of 44.2%.

Plus, Microsoft’s cash s ample with a current ratio at 2.5 times. Debts are also low at only 30.2% of the company’s assets.

The yield is low at 1.1% as it retains 64 of earnings. Yes, MSFT stock is pricey as successful tech companies trade at 10.2 times sales, but I see the stock as still a value in its space.

MSFT has returned 766.3% over the past 10 years for an average annual equivalent return of 24.1%.

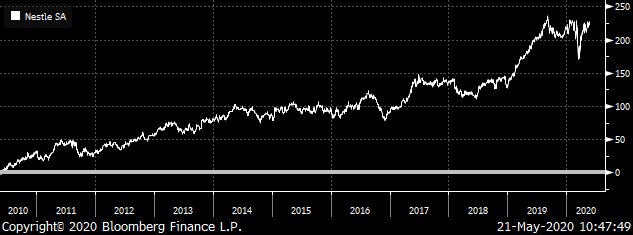

Nestle (NSRGY)

NSRGY Total Return

Nestle is a reformed consumer food and products company, and it sees vast U.S. and global demand for its products. It has also been doing a good job of controlling the cost of its production and shipping. And while revenues are growing more slowly given the softer economies beyond the U.S., they are positive at 1.1% annually over the trailing three years.

Nestle is a cash machine. The operating margin is running at 17.3%, which then works to deliver a return on equity of 23.1%. The company pumps cash into its coffers on a daily basis — so it keeps less on hand. That means the current ratio is only 0.9 which is fine given its business. Debts are really low at only 29% of assets.

And the yield is higher than for the general stock market average of the S&P 500 at 2.6%.

The stock has returned 223.8% over the past 10 years for U.S. investors for an average annual equivalent return of 12.5%.

And the stock is still at value at only 3.3 times trailing and dependable sales.

Procter & Gamble (PG)

PG Total Return

Like Nestle, Procter & Gamble has done a good job of reforming its management and focusing on making its consumer products more desirable in changing market conditions. Procter & Gamble wasn’t always a well-run company. It had gotten complacent about its products and its customers. And the cost of manufacturing and shipping was also a problem. But the company has been proving itself to me over the past two years — addressing challenges and making needed changes.

Revenues are now moving positive and operating margins are fattening up to a current level of 8.1%. And in turn, the return on equity has been improving to a current level of 9.6%.

Cash has always been flowing into the company, so its treasury keeps less on hand. This results in a current ratio of only 0.7. But its debts are very low at a mere 26.1% of assets.

The dividend yield is at 2.8% — again better than for the S&P 500.

As I said above, P&G had been a bit of a disappointment to shareholders until 2018. But since then, the shares have been reflecting the positives of the company and its management. Over the last 10 years the return has been 149.6% for an average annual equivalent of 9.6%.

Long-Term Stocks: Zoetis (ZTS)

ZTS Total Return

In the current world of the novel coronavirus, viruses have become a make-or-break phenomenon for the economy and markets. But Covid-19 isn’t the only virus causing havoc.

African swine fever (ASF) has been decimating pig populations around the globe, severely impacting the pork supply. Zoetis has been fighting it with vaccines and treatments for livestock that it’s had for years.

It is one of the leaders in animal healthcare and vaccines, including for pets such as my beloved miniature dachshund Blue. Revenue continues to be robust — gaining 7.5% over the trailing year alone. Operating margins are very fat at 31.4%, and contribute to a remarkable return on equity of 63.6%.

Lots of cash and equivalents makes the current ratio 2.6. And while debts are higher at 57.6% of assets, it is a good credit with eager lenders and creditors.

The stock has been a good long-term investment with the trailing 10 years seeing a return of 432.4% for an average annual equivalent return running at 25.7%.

The dividend yield is stingy. The company has a high retention rate for further drug and other product development. And the stock is more highly valued given that it is a vital health technology company with a price-sales ratio of 9.9 times.

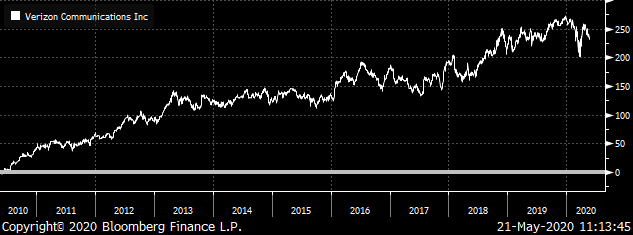

Verizon (VZ)

VZ Total Return

Verizon is a leading provider of data and voice communications, primarily operating in the U.S. The remote-work and stay-at-home trends have only made the market see it as more vital to the economy.

Revenues are largely steady with a minor annual average rise of 1.5% over the past three years alone. But operating margins are good at 23%, which in turn aid return on equity of 31.7%.

There’s a lot of cash flowing with this giant. That means it has less need to keep cash on hand, and its current ratio of 0.8 is acceptable. Debts are also manageable at 45.6% of assets.

Plus, Verizon shines with its dividend yielding 4.5%.

Verizon has been good to investors over the last 10 years, returning 233.1% for an average annual equivalent of 12.8%. And yet, it is a good value at only 1.7 times its trailing sales.

BlackRock (BLK)

BLK Total Return

BlackRock is one of the world’s largest asset management companies that runs trillions for government investment funds. And, it runs the major funds for retirement investing for all U.S. federal employees. It also is a leader in passive investing through its vast offerings in its exchange-traded fund products.

Oh yeah, it is also under contract again by the Federal Reserve to oversee bond buying. It did this after the 2007-08 financial crisis.

This is a top member of my long-term stocks, and a go-to company.

Revenues are steady– if only climbing modestly in certain markets beyond the U.S. But in the U.S. the gains have been running at 8.8% each year on average for the past three years.

BlackRock’s efficiency ratio runs at 59.5%, and although it should be better, is still reasonable given its size. Debts are nearly nonexistent, running at only 3.4% of assets.

Investors have seen a return over the past 10 years of 298% for an average annual equivalent return of 14.8%. This includes the fair dividend, yielding 2.9%. And the stock is a value based on the price-book ratio currently running at 2.4 times.

Easterly Government Properties (DEA)

DEA Total Return

Easterly Government Properties is a real estate investment trust (REIT) that has a particularly stable focus. Its primary tenant is the U.S. government. This means that whether the economy is good or bad — Uncle Sam pays his rent. That’s why it makes this list of long-term stocks.

Revenues continue to gain at a very strong average annual rate of 28.5% for the past three years alone. It runs its property operations efficiently, resulting in a solid return on funds from operations of 9.6%.

The company is newer to the public market, but has returned 106.5% since its 2015 IPO for an average annual return of 14.7%. DEA stock is a value — it runs at 1.7 times its book value.

Oh, and the dividend is nice with a yield of 4.3%.

Samsung Electronics (SSNLF)

SSNLF Total Return

Samsung Electronics is the leader in global technology. Very few tech items work without parts and components that Samsung invented, developed or built. Its own branded products are some of the highest quality in the market.

And Samsung isn’t just about technology demand now. It’s benefiting from the unlocking of China and other Asian markets. Then, it will benefit as U.S. factories and labs reopen, and many already are. Samsung’s operations and revenue should come back, and continue to be ahead of its peers.

Revenues are up over the past three years by an average of 20.1% for China and 3% in North America. Samsung has an average in other markets near 4%.

Margins of 12.1% are good for such a massive and diversified company, and the return on equity is running at a 7.4% rate.

Lots of cash results in a current ratio of 2.8 and it has very little debt, with debt-assets ratio at 5.2%.

The stock has returned 288.4% for U.S. investors over the past 10 years for an average annual equivalent return of 14.5%. And it yields 2.8% which is good for an Asian company. Plus, the shares are cheap. They are valued at a mere 1.2 times book and 1.3 times trailing sales.

One note: Shares can be a little challenging to buy through some brokerages and may need a phone call.

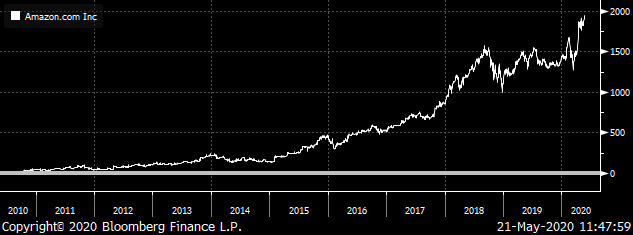

Amazon (AMZN)

AMZN Total Return

Who hasn’t paid for a product or service through Amazon? I am a Prime member, and I have access to its video, audio and book services. And I have many Alexa devices that I use throughout the day. Oh, and then there’s its Amazon Web Services (AWS).

The current mess has made Amazon a further necessity. It continues to deliver essential items like toilet paper and cleaning products. And I also use the platform for additional digital information from the Washington Post. You also can’t forget food. I get household goods from Whole Foods as well as products for my miniature dachshund Blue through Amazon.

I have always liked this company as a consumer, but didn’t completely get it as an investor. But, I have been coming to a different understanding of what Amazon means as an investment. It really is more of an index of what has been working right in the U.S.

The company has sales climbing by 20.5% in the trailing year. Margins are thinner at 5.2%, but the return on equity is good at 18.6%. Its current ratio is fine at 1.1 and debts are low at 34.4% of assets.

Although it doesn’t pay a dividend, the shares still have delivered a return of 1,906% over the past 10 years for an average annual equivalent return of 34.9%. And yet, there is some value here with the shares valued at 4.1 times trailing sales.

I know that my subscribers to Profitable Investing didn’t pay me to tell them about Amazon. But, I have been recommending AMZN stock as the company is really a leading index of the evolving U.S. and many other economies and markets.

Neil George was once an all-star bond trader, but now he works morning and night to steer readers away from traps — and into safe, top-performing income investments. Neil’s new income program is a cash-generating machine … one that can help you collect $208 every day the market’s open. Neil does not have any holdings in the securities mentioned above.