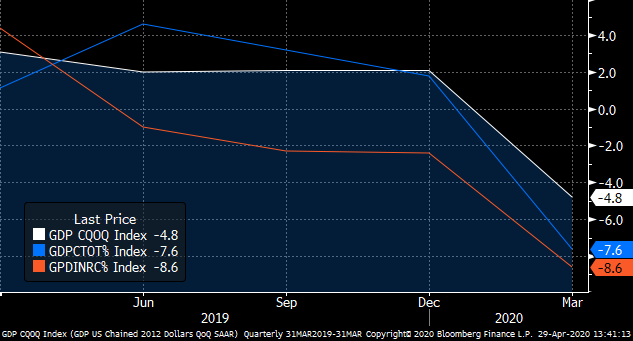

The lockdowns in the U.S. has resulted in the economy being shoved into reverse, giving investors plenty of options for stocks to buy. The Bureau of Economic Analysis (BEA) announced earlier this week that the first pass at the data for the first quarter of 2020 is very bad. The U.S. gross domestic product (GDP) dropped by 4.8%, which reverses the prior quarter’s gain of 2.10%.

And it will get worse on the data front. The majority of the lockdowns occurred only in the closing weeks of March. This means that for the current second quarter, with the vast majority of the U.S. under full lockdown, the further drop in GDP should be even worse than for the first quarter.

In addition, the BEA also reported that personal consumption — which represents the biggest segment of the economy dropped by 7.6%. And business spending on non-residential investment dropped by 8.6%.

U.S. GDP (White) Personal Consumption (Blue) & Business Investment (Red) Source

All of this means that the U.S. economy is likely headed into technical recession. Now, with the Federal Reserve near frantically buying all sorts of bonds, credit products, loans, ETFs and more — as well as providing lending facilities all with the legally-required credit guarantees from the U.S. Treasury — there is some stability entering the markets and the economy. Also, with President Donald Trump’s administration getting Congress to go along with stimulus programs including the Coronavirus Aid, Relief & Economic Security Act of 2020 (CARES), there is further stabilizing cash being brought into the economy.

Then of course, the gradual unlocking of the economy will bring some return in spending and investment in the economy. But with no real data to base any credible scenarios for recovery timing and amounts, the next return to boom times is a wild card at best.

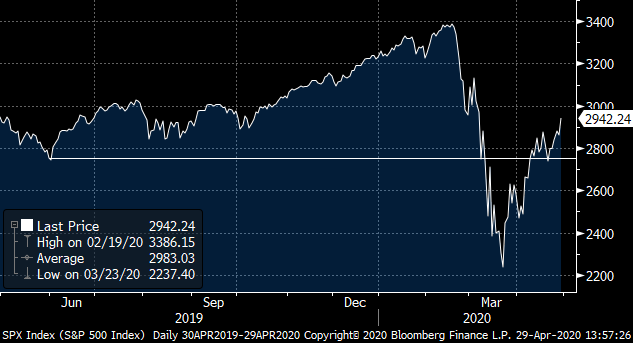

Meanwhile, the general stock market — as measured by the S&P 500 — is up 26.6% since March 23. And since June 3 of last year, it is up more than 3%. This means that there are plenty of folks buying ahead of an eventual anticipated recovery in the economy.

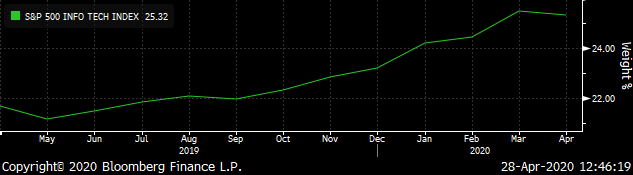

However, it is worth noting that the composition of the S&P 500 Index has been changing. That said, as always, not all stocks and sectors are the same when it comes to the S&P 500 Index. But one of the bigger developments has been that the weightings of sectors in the Index have been shifting over the past year. And the biggest single market sector with accelerating weighting in the Index is the Information Technology sector.

The Information Sector has jumped from 21.14% of the S&P 500 Index in May of last year to a current level of 22.188%. And with many investors and traders seeking out technology stocks as defensive investments during the lockdowns, the buying and resulting price gains of the leaders inside this segment is changing the makeup of the overall Index.

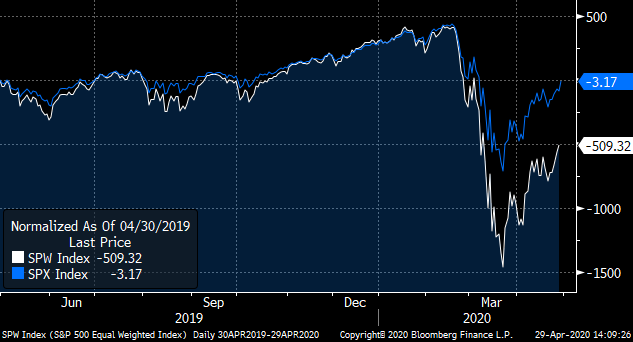

In turn, this provides some arguments against the idea that the stock market is showing that things are set to get better for the broader economy. For example, if we take a look at the unweighted S&P 500 Index against the traditional weighted (and tech-heavier now) S&P 500 Index, we can see that the recovery is not the same for the rest of the broader collection of stocks.

You can see that the unweighted index (SPW) hasn’t been as fully in recovery mode as the tech-heavier weighted index (SPX). This means that there are many companies out of the 505 stocks in the index that are still troubled and challenged in the stock market. And perhaps this better reflects the truer nature of the U.S. economy when it comes to companies and consumers.

For investors, I argue that you should make sure that you have some companies that — by their nature and in their businesses — are set up to profit whether the U.S. economy does move back to boom times; Or if the current economic bust is going to be around for a while to follow.

These companies and their stocks are what I call “heads-I-win-tails-I-win” stocks. No matter which direction the economy goes, they are set to profit. That said, these companies are:

- Easterly Government Properties (NYSE:DEA)

- Life Storage (NYSE:LSI)

- B. Riley Financial (NASDAQ:RILY)

- Ritchie Brothers (NYSE:RBA)

- KAR Auction Services (NYSE:KAR)

So, with that in mind, here’s a look at some stocks to buy right now.

Stocks to Buy: Easterly Government Properties (DEA)

Easterly Government Properties is a real estate investment trust (REIT). Many REITs have significant challenges right now. REITs that own retail properties are in serious trouble, and REITs that own leisure and entertainment properties and resorts are in serious jeopardy. Residential property REITs also have issues with tenants seeking to delay lease payments or full on default.

Moreover, some commercial property REITs are also getting squeezed now by tenants that can’t or won’t pay. And these may well be further squeezed as more companies recognize that remote work is working potentially reducing needed office space.

However, the one entity that has plenty of cash now and in the future is the U.S. government. And this is the primary tenant of Easterly. This is perhaps one of the few companies that have financial reports and data that actually have credibility in that the U.S. government will continue to pay and continue to lease its properties. Revenue has been up by 38.1% over the past year, and it derives a return on funds from operations (FFO) — which is the return on the actual property leases of 9.7%. And it pays a dividend yield of 3.8%.

DEA’s stock has generated a return of more than 60% over the past five years. And yet, the stock is valued at only 1.9 times its intrinsic book value. All in all, these reasons make DEA one of the top stocks to buy.

Life Storage (LSI)

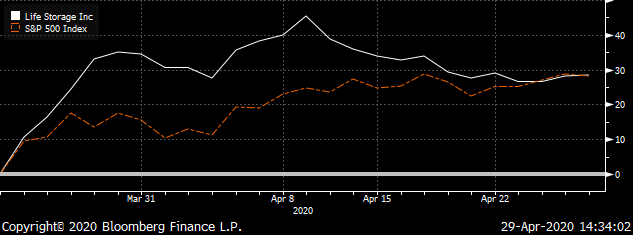

Life Storage (LSI) is a beneficiary of transitions in the economy. Disruptions bring need to store household and business goods as folks will have to move or adjust living spaces. That said, the stock is reflecting the capabilities of the company while it is still down a bit for the year. But since March 23, it has outperformed the S&P 500 by a small margin.

However, what makes Life Storage more attractive now and going forward is one of its developing initiatives that is very focused on the evolution of the U.S. economy and commerce.

Its developing product or service called Warehouse Anywhere is exactly what the current and transitioning retail and business products market needs. Life Storage has set up facilities that are tailorable for businesses to have localized warehouse space in the company’s facilities. And with radio frequency identification devices (RFID), customers can have goods delivered, tracked and deployed to their own customers on a localized basis with Life Storage offering logistics support.

This is exactly what Amazon has been developing for its own platform and for some of its platform vendors. And with that, it makes LSI a good looking member of these stocks to buy.

B. Riley Financial (RILY)

The lockdowns in the U.S. economy has resulted in shuttering of countless retail stores around the nation. And even before the lockdowns, retail was already in trouble with thousands upon thousands of stores slated to be closed either in company consolidations or bankruptcies.

Each and every store that is closed has to be dealt with. Think of all of the inventories, fixtures, real estate and other assets — as well as settling local liabilities. And the company which is the leader and is the best in the business of closing the deal on closings is Great American Group.

Great American Group has reported closing more than 6,800 stores since 2013, amounting to over $13 billion in assets. The company is set to do a fire sale of a business for 2020, as the closing market is showing signs of surging further both during and post lockdowns.

Additionally, Great American Group is part of an even more interesting company called B. Riley Financial. And yes, it’s another member of good stocks to buy.

B. Riley was founded by its CEO Bryant Riley, who is the largest shareholder in the company, and — along with management — owns 27.3% of the shares of the company. That said, Bryant just bought a pile more of the stock last month.

B. Riley is a financial firm that provides a big umbrella and structural underpinnings for six core businesses, which ithas either acquired or merged with over the past several years including Great American Group. B. Riley also acquired FBR – which was a favored investment bank with capital markets expertise in specific industries which I used to have regular dealings with the company in my former banking days.

Then there’s another business which I like quite a bit in B. Riley Principal Investments which is an alt-financial. Principal Investments makes loans and takes equity stakes in a variety of companies as it inches out traditional commercial banks. And it is benefitting from Federal Reserve buying of business loans adding to its liquidity now and opportunities later.

Principal Investments works well with B. Riley Capital Management in loan origination as well as other direct asset acquisitions and management. And in turn, B. Riley Wealth Management utilizes the strengths of FBR and the other business to provide family office and other private client asset management with more than $10 billion reporter in assets under management (AUM)

And then there’s GlassRatner which dove tails nicely with Great American. GlassRatner specializes on workouts of failed or failing companies including restructuring, bankruptcies as well as valuation of assets and legal and accounting counseling.

The company has a tremendous amount of cash and equivalents on hand – but management including Bryant Riley likes leverage to drive returns higher. As such, debts to assets are higher at 73.10%. This gives me some pause if there is a stumble – but provided that the company has divisions which work in expanding and contracting economies and markets – there are internal business hedges which makes it all the more appealing. And the stock pays a ample dividends with plenty of special additional payouts for a current yield of 5.03%. All of these reason combines make RILY a great option for investors looks for stocks to buy.

Ritchie Brothers (RBA) and KAR Auction Services (KAR)

How many films of economic collapses have scenes whereby family farms are being auctioned off with ma and pa tearing up for the camera?

Auctions are one of the more efficient means of disposing of assets quickly and efficiently during times of strife including bankruptcies and whole industry disruptions.

There are two auctioneering companies that I have inside my model portfolios of my Profitable Investing including Ritchie Brothers (RBA) and KAR Auction Services (KAR).

Ritchie Brothers was founded by three brothers that inherited a furniture store business from their father. It also came with lots of debt and they needed cash quickly during a tough time. They came up with an auction and cleared their debt, raised lots of cash and their business was born.

During the good times, it auctions business and industrial equipment that is in demand online and in person providing quick and cheaper access to goods that are needed in place or in the field in quick order.

And during bust times, it liquidates all sorts of stuff on behalf of businesses or their lenders and again collect lots of fee income in doing so.

KAR Auction Services as its name implies provides auctions for cars and other vehicles. During economic boom times, folks are eager to buy and lease new cars. And in turn – this leaves plenty of used cars that have to be liquidated to keep the flow of cars coming through dealerships around the nation. And lease companies need to get rid of off-lease cars and turn to auctions.

Now in bust times – there is an absolute glut of used cars and KAR is stepping up its operations. And in addition, it also has a specialty in damaged or salvage vehicles for parts. Insurance companies don’t want to keep cars that have been totaled. KAR solves their problem and has eager buyers for parts which now are often more valuable due to parts shortages with factories locked down.

Both Ritchie Brothers and KAR Auction Services also pay nice dividends, as RBA yields 1.86% and KAR yields 5.07%. That said, both of these names make up two more great stocks to buy.

Neil George was once an all-star bond trader, but now he works morning and night to steer readers away from traps — and into safe, top-performing income investments. Neil’s new income program is a cash-generating machine … one that can help you collect $208 every day the market’s open. Neil does not have any holdings in the securities mentioned above.