U.S. equities are suffering one of the greatest one-day routs in history on Monday, with the Dow Jones Industrial Average touching a loss of more than 2,000 points after circuit breakers tripped in early trading and forced a 15-minute halt to trading. Things are moving extremely fast, with Wall Street reacting to the ongoing spread of COVID-19 and the breakout of an oil price war between Saudi Arabia and Russia over the weekend.

The oil price collapse of roughly a third is a perfect storm: A drop in demand is underway as coronavirus fears and restrictions hit the travel and shipping industries. Meanwhile supply is now being poured on as Russia and Saudi Arabia turn on the taps. U.S. oil companies, which weathered the last price war in 2014 thanks to junk bond financing, are once again stuck in the middle.

The carnage is breathtaking. The Energy Select SPDR ETF (NYSEARCA:XLE) is down nearly 20% as I write this, capping a loss of more than 40% from the high set in early January. The U.S. Oil Fund (NYSEARCA:USO) is down by 25%. And a number of large oil companies are pushing lower like cheap penny stocks.

Here are four to avoid:

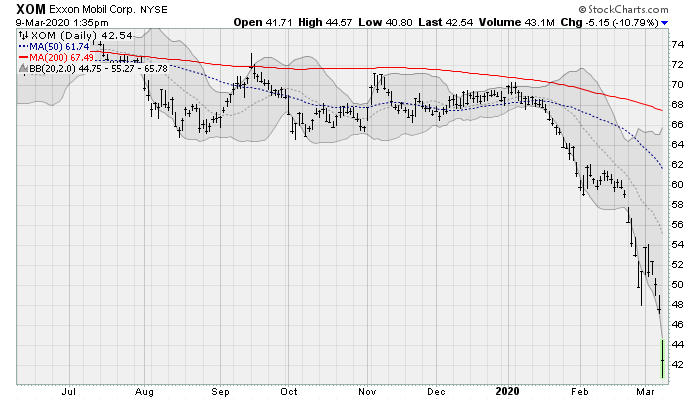

Oil Stocks to Avoid: Exxon Mobil (XOM)

Exxon Mobil (NYSE:XOM) shares are down around 10% as I write this, returning to lows not seen since 2010 as traders realize that energy prices are going to be lower for much longer than they anticipated. With two of the world’s largest oil exporting nations determined to squeeze the U.S. oil patch, revenue growth is going to remain severely constrained. Shares have a long way to fall, especially with the stock’s dividend — which is currently yielding a whopping 8.2% — vulnerable to a cut.

Before the meltdown, Cowen analysts lowered their price target on an expectation that free cash flow would be constrained as the company stuck to its counter-cyclical investment program. That looks to be under threat now, as liquidity management becomes a concern.

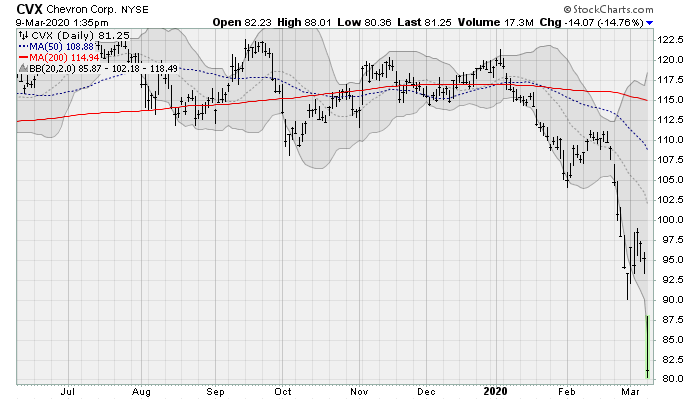

Chevron (CVX)

Chevron (NYSE:CVX) shares are down around 13% as I write this, and down nearly 40% from their recent high to return to lows not seen since early 2016. Not only are the headlines around the new oil price war dampening spirits, but the company reported weaker-than-expected revenues at the end of January as well, revealing that top-line pressure was already building before this week’s events.

To restore sentiment, management raised their dividend 10 cents to $1.29 per share resulting in a current dividend yield of 6.2%. But it’s hard to see how long that can be sustained, with sales sure to come under serious pressure as crude oil falls more than 20% on the day and West Texas Intermediate crude oil threatening to trade with a $20 handle for the first time since 2016.

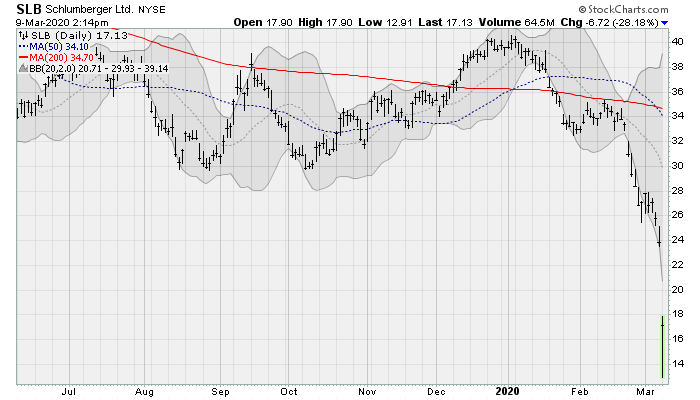

Schlumberger (SLB)

Oilfield services stock Schlumberger (NYSE:SLB) is down nearly 30% today, returning to lows not seen since 2003 — wiping away some 17 years of returns in just two months since peaking in early January. Citigroup analysts downgraded a number of oil stocks this morning from “buy” to “neutral” in response to the over-the-weekend OPEC/Saudi/Russia news. Analysts at Bank of America Merrill Lynch have also downgraded shares.

Oilfield services stocks like SLB could be the worst affected, since cuts to development budgets and the capping of high-cost wells will slam revenues. Analysts at UBS downgraded shares earlier this month, lowering their price target to $30. We have already blasted through that with more downside to come.

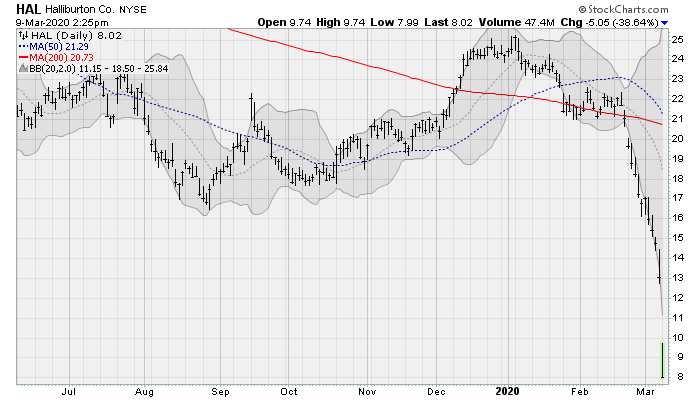

Halliburton (HAL)

Another major oilfield services provider, Halliburton (NYSE:HAL), is suffering nearly a 40% share price decline as I write this marking a decline of nearly 70% from their high to return to levels not seen since 2003. The stock was also included in the group marked down by Citigroup analysts this morning. The action will come as a surprise to the stock bulls that celebrated the reporting of an earnings beat in late January, with earnings of 32 cents per share beating estimates by three cents.

What does the downside look like? Much of the recent focus has been on the company’s international business — which drove 54% of its Q4 revenues. That looks particularly vulnerable to the global oil price war moving forward. Despite the 5.5% dividend yield, investors need to stay away.

As of this writing, William Roth did not hold a position in any of the aforementioned securities.