High-yield dividend stocks, whose underlying companies have large buyback programs, tend to do quite well over time. The rationale behind this is that the buybacks allow the dividends paid out to increase rapidly over time.

In addition, high-yield dividend stocks with high buybacks tend to have higher share prices over time. This is because there are fewer shares covering the same market value.

For example, if a company buys back 15% of its stock over say, seven years, it can afford to raise the dividend per share at a fast clip. The dividend per share would automatically rise by the same 15% even if the company didn’t spend any more than usual on dividends. That works out to a compound annual growth rate of slightly more than 2% per year.

There are other benefits to shareholders. Buybacks raise every remaining shareholder’s stake in the company. So, if the company ever pays out a stock dividend or spins out a company, the shareholders get a bigger stake than otherwise.

More importantly, the tax advantages of buybacks are clear. If the company paid the amount spent on buybacks in dividends, shareholders would pay more taxes. Remember, both dividends per share and the stock price automatically rise with buybacks.

How Are Buybacks Advantageous?

Here is a simplified and extreme example. Let’s assume there is a public company with 100 million shares outstanding. In addition, let’s assume it spends $100 million in FCF on dividends and buybacks, half each.

If the $50 million in buybacks are completed at say $10 per share, there would now be 5 million fewer shares, or 95 million shares outstanding. To repeat, that is $50 million divided by the $10 per share buyback price, or 5 million shares repurchased.

In addition, the public company stock price will also rise by 5%, since there are 5% fewer shares outstanding. Here is why. The same market value divided by 5% fewer shares will mathematically mean a 5% higher stock price. This is a tax-efficient increase in value to shareholders.

In addition, shareholders get a dividend of 52.6 cents ($50 million divided by 95 million shares).

So the total return to the shareholders is 50 cents (in unrealized gains) plus 52.6 cents, or $1.03 on the $10 stock investment. This is a net gain of 2.6% (only half of which is taxable income).

Alternative Without Buybacks

Let’s consider the alternative. If all the $100 million at the company was spent on dividends, the dividend per share would be $1.00 per share ($100 million divided by 100 million shares). However, after taxes, say at a 20% rate, the investor only keeps 80 cents per share.

So the after-tax return is only 80 cents per share or a gain of 0.8% on the $10 original investment.

In addition, there would be no price appreciation. The stock price will stay flat since there are the same amount of shares outstanding, 100 million.

Therefore, with the buybacks, the investor is better off by 1.8% in the first year alone (2.6% minus 0.8%). Now, over the next five years, the difference will begin to dramatically compound in favor of the buyback example.

In addition, the buyback example will have a large component of unrealized (and untaxed) gains in the stock price, since there are fewer and fewer shares outstanding. The 100% dividend example will have higher taxes paid out.

High-Yield Dividend Stocks With Large Buyback Programs

Here are some high-yield dividend stocks with large buyback programs. The buyback yield is calculated as follows: I take the annual buybacks by the company and divide them by the market value of the stock.

In addition, the “total yield” of a stock is calculated as the combined value of the dividend yield plus the buyback yield. This represents how much cash flows are returned to shareholders through buybacks and dividends.

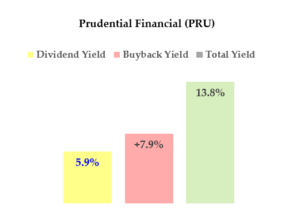

Prudential Financial (PRU)

Dividend Yield: 5.9%

As the chart on the right shows, Prudential Financial (NYSE:PRU) has a 5.9% dividend yield, and a 7.9% buyback yield. This means that the total yield to investors is 13.8%.

PRU stock is very cheap. It trades at about 60% of its tangible book value. Financial stocks have been hit by the latest impact of the coronavirus from China on the U.S. economy.

I recently wrote an article for Seeking Alpha that discusses most of the reasons why Prudential Financial stock is worth looking at. It argues that the fears that PRU will have an interest rate and reinvestment risk, should interest rates keep falling, is overdone.

I show in the article how PRU stock is worth 60% more at $120.13 per share.

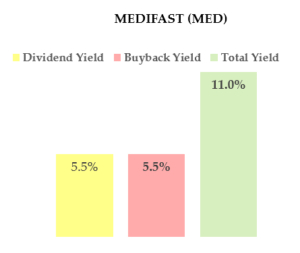

Medifast (MED)

Dividend Yield: 5.5%

Medifast (NYSE:MED) stock is very cheap. The chart at the right shows that this weight loss and nutritional products company stock has very good yield traits.

For example, the dividend yield is 5.5% and the buyback yield is 5.5%. Therefore, the combined total yield is 11%.

In fact, the buybacks are so powerful, the dividends per share have increased by over 52% annually over the past three years.

I recently wrote an article for Seeking Alpha which describes the company’s buyback program. I estimate MED stock is worth over $163 per share.

This represents a gain of almost 100% on today’s price.

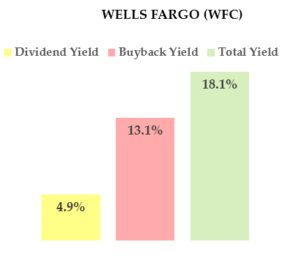

Wells Fargo (WFC)

Dividend Yield: 5%

Wells Fargo (NYSE:WFC) stock is also extremely undervalued. It has a high dividend and buyback yield. You can see this in the chart at the right.

The dividend yield right now is 5% and the buyback yield is 13.1%. So, therefore, the combined total yield is 18.1%. This is a very high total yield.

For example, WFC bought back $24.5 billion worth of its stock during 2019. Its market value today is $161 billion. I estimate that in 2020 WFC will continue to buy back $22.5 billion of its stock, or roughly 14%.

I recently wrote an article for Seeking Alpha which describes the huge buybacks. Over the past five years alone, Wells Fargo has reduced its shares by an astounding 20%.

I point out in the article that as a result, the dividend per share has risen 45% over the past five years. By contrast, the dividend cost rose only 20%. This is a direct result of the massive buybacks.

I estimate in the article that WFC stock is worth $60.54 per share. This is almost 48% higher than the present price.

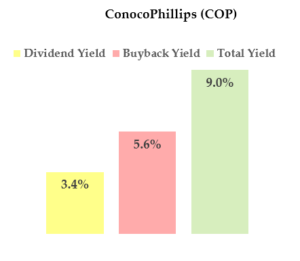

ConocoPhillips (COP)

Dividend Yield: 3.4%

ConocoPhillips (NYSE:COP) stock is also very cheap. As the chart at the right shows, COP stock sports a 3.4% dividend yield, plus a 5.6% buyback yield.

This adds up to a total yield for shareholders of 9% annually. In fact, the company has recently raised its buyback program to $25 billion. This is open-ended, with no date when it will be completed.

Nevertheless, it represents an astounding 48% of its present $52 billion market value. As you might suspect, I recently wrote an article for Seeking Alpha about COP stock.

I estimate that the company, which makes plenty of FCF to support its dividend and buyback programs, will spend at least $3 billion on share repurchases.

I also estimate in the article, that COP stock is worth at least $83.46 per share. This represents an upside of approximately 60% over the present COP stock price.

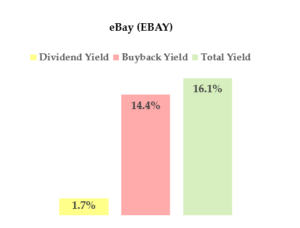

eBAY (EBAY)

Dividend Yield: 1.7%

eBAY (NASDAQ:EBAY) stock is amazingly cheap. The chart at the right shows that the dividend yield is 1.7%, but the buyback yield is an astounding 14.4%.

As a result, the total yield to shareholders is 16.1%. In fact, in the past two years, eBay has repurchased $1 billion worth of stock a quarter. EBAY has a market value of just $30.3 billion.

As a result, its shares outstanding have fallen one-third in three years.

You can read more about this amazing buyback program in my latest article for Seeking Alpha. I estimate in the article that EBAY stock has a true value worth $56.00 per share.

This represents a potential gain of 69%. The large buyback program will help push up the stock to its inherent true value.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks. Subscribers get a two-week free trial.