This article discusses five high-yield dividend stocks that have grown their dividends in the past five years and also have low price-to-earnings ratios.

In addition, the dividends are well covered by their earnings. This means that each company can afford the high-yield dividends it pays out.

Each of these high-yield dividend stocks has a dividend yield exceeding 6.5%. That’s is a very high dividend yield few stocks have. In addition, the dividend per share has been growing at a positive rate in the past five years.

Moreover, the price-to-earnings ratio on a forward basis is 13 times or less. That means they’re priced to buy.

Finally, each of these high-yield dividend stocks has forward earnings per share that are at least 100% of the dividend per share set for 2020.

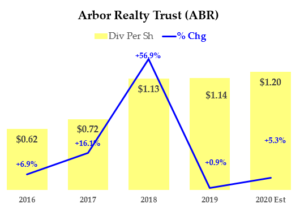

Growing High-Yield Dividend Stocks: Arbor Realty Trust (ABR)

Dividend Yield: 8.1%

Price-To-Earnings Ratio: 11.8x

Average Annual DPS Growth: 15.7%

Arbor Realty Trust (NYSE:ABR) stock is a Real Estate Investment Trust (REIT) that invests in mortgages and bridge loans related to real estate purchases. ABR stock has a $1.9 billion market value and pays a $1.20 dividend per share that yields 8.1%.

ABR stock’s dividend per share is more than covered by its prospective 2020 Funds from Operations (FFO) of $1.25 per share. Moreover, its dividend has grown at a compound average annual rate of 15.7% per year.

ABR just announced earnings showing that its latest quarterly FFO rose 17% to 34 cents per share over last year’s rate of 29 cents per share. Moreover, its core net interest income was up 11.1% over the prior year.

Therefore, the company is continuing on its growth path. This bodes well for continued dividend increases.

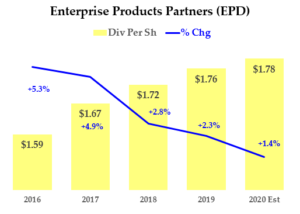

Enterprise Products Partners LP (EPD)

Dividend Yield: 6.8%

Price-To-Earnings Ratio: 12.1x

Average Annual DPS Growth: 3.3%

Enterprise Products Partners (NYSE:EPD) is an oil and natural gas midstream service provider based in Houston. It makes fees from natural gas liquids (“NGL”) processing, marketing, and docking services. EPD has 19,200 miles in NGL pipelines and related storage tanks. It also operates approximately 5,300 miles of crude oil pipelines; and crude oil storage and marine terminals located in Oklahoma and Texas, as well as a fleet of 360 tractor-trailer tank trucks, used to transport crude oil. EPD has a $58 billion market value. Bottom line: this is a huge company.

EPD pays an annualized dividend of $1.78, which it recently raised. This provides EPD stock a dividend yield of 6.8%, which is very high. But its expected earnings this year of $2.18 per share more than cover this dividend. EPD has had a stable history of earnings since 85% of its income comes from fees rather than oil and gas production.

For example, in the past five years, its earnings have risen 42% from $1.47 per share to $2.09 in 2019. This works out to average annual growth of 7.3%. Moreover, its dividend per share has risen on average 3.3% per year over the same period.

Moreover, EPD stock trades for just 12 times this year’s expected earnings. So it is very cheap. With its high yield, growing dividends and earnings coverage, EPD stock looks like a good bargain for long-term investors.

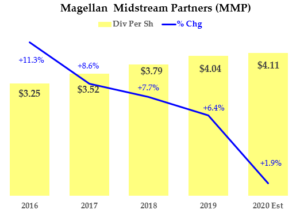

Magellan Midstream Partners LP (MMP)

Dividend Yield: 6.8%

Price-To-Earnings Ratio: 13.1x

Average Annual DPS Growth: 7.1%

Magellan Midstream Partners (NYSE:MMP) transport, stores and distributes refined petroleum and crude oil in the U.S. MDP stock has a large $13.6 billion market value. MMP stock is cheap at 13 times price-to-earnings.

Moreover, MMP is also a high-yield dividend stock. It recently raised the dividend to an annual rate of $4.11 per share. This gives the $60 stock price a dividend yield of 6.8%. Moreover, the dividend is well covered by its expected earnings this year. Analysts expect MDP to earn $4.57 per share in 2020.

This past quarter MDP grew its cash by over 18.3% from the prior year. The underlying cash flow the company has been growing consistently over the past five years. This has supported its annualized growth in dividends of 7.1% over the same period.

In short, this is another solid cash-flow producing company that has had a stable and growing dividend. At its present dividend yield and P/E ratio, MMP stock is very cheap.

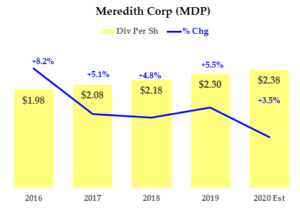

Meredith Corp (MDP)

Dividend Yield: 7.3%

Price-To-Earnings Ratio: 5.2x

Average Annual DPS Growth: 5.4%

Meredith Corporation (NYSE:MDP) is the number-one magazine operator in the U.S. It publishes People, In-Style, Better Homes and Gardens and Martha Stewart Living. It also owns 17 TV stations.

Meredith is very cheap, selling at around five times its expected non-GAAP June 2020 earnings, based on MDP’s guidance. Based on its last 12 months of FCF, where it made $213 million, MDP stock has a 21.9% FCF yield based on its $1.43 billion market value.

Moreover, MDP just raised its dividend sometime on February 1, 2020. This marks the 27th year the company has raised its annual dividend and 73rd year of making dividend payments. Moreover, the company has plenty of FCF to pay for its huge dividend.

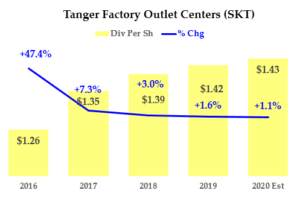

Tanger Factory Outlet Centers (SKT)

Dividend Yield: 10.99%

Price-To-Earnings Ratio: 6.5x

Average Annual DPS Growth: 10.8%

Tanger Factory Outlet Centers (NYSE:SKT) is a REIT that owns or has a stake in 39 upscale outlet shopping centers in 20 states and Canada. SKT stock is cheap at 6.5 times earnings and with a 10.99% dividend yield.

In fact, SKT recently increased its quarterly dividend to $1.43 on an annualized basis. This is more than covered by its expected FFO rate to $2.02 per share.

Moreover, over the past five years, its dividend has grown 10.8% on an annualized basis. Obviously this doesn’t guarantee that the dividend will continue to grow at this rate. But it shows that the company has the earnings power to continually increase the dividend.

In summary, this is a cheap stock with a high-yield dividend and growing earnings that covers the dividend.

Summary and Conclusion

Overall, this set of dividend stocks has cheap valuations and growing high-yield dividends. That’s a good bargain. In fact, as a group, they offer an average dividend yield of over 8% and on average trade at less than 10 times earnings.

Moreover, the dividends in this group of high-yield dividend stocks have grown on average 8.5% per year over the past five years.

In conclusion, this looks to be a good bargain for value-based investors. For example, it is ideal for those who are looking for a group of high-yield stocks that have growing dividends well covered by earnings.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks. Subscribers receive a two-week free trial.