U.S. equities are rebounding after an overnight bloodbath in the Chinese markets as fears of the spreading coronavirus remain largely relegated to China. As of right now, the spread into Western countries seems largely contained. And the latest reports are that Gilead (NASDAQ:GILD) is preparing to conduct human vaccine trials, raising hopes of a quick and permanent resolution.

Yet despite this apparent good news, a number of technology, media and telecom stocks are rolling over badly and look like sells. Here are four to avoid.

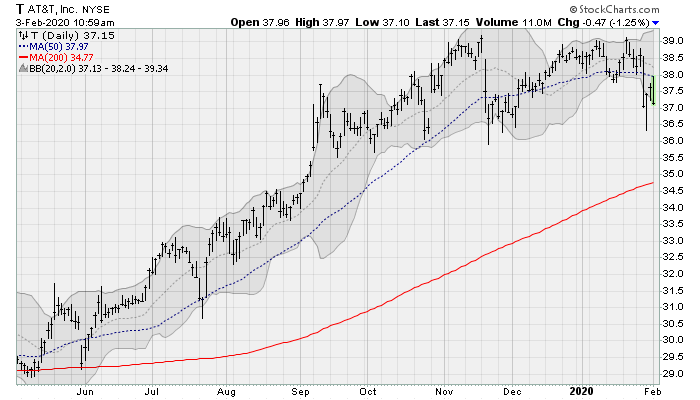

Stocks to Sell: AT&T (T)

AT&T (NYSE:T) shares are breaking down out of a six-month consolidation range with a failed attempt at the 50-day moving average Monday morning. This comes after an impressive 50% rally off of the late 2018 lows. But now, with the streaming video wars red hot and the company continuing to bleed DirecTV subscribers, it’s hard to see a bullish story here.

Shares were recently downgraded to “neutral” by analysts at UBS. Deutsche Bank analysts are still constructive as they look ahead to some movement on cost control and expense management. They are also attracted to the stock’s 5.6% dividend yield.

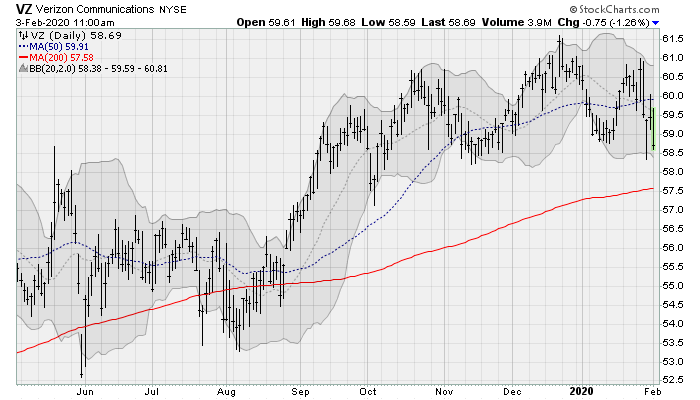

Verizon (VZ)

Verizon (NYSE:VZ) shares are also looking ready to drop down and out of a multi-month trading range. That range caps an even longer uptrend pattern going back to the summer of 2017 that also traced out a 50% price gain. Headwinds are certainly building. Credit Suisse analyst Douglas Mitchelson downgraded shares recently on a lack of positive catalysts and a trying valuation. He’s hopeful around 5G enterprises services, but those will take time to develop.

When the company last reported results on Jan. 30, earnings missed by 2 cents at $1.13 a share on just a 1.4% rise in revenue. Capital expenditures remain intense at Verizon. Management is looking to spend upwards of $18 billion this year on the expansion of 5G, the densification of 4G and the ongoing build out of its fiber optic network.

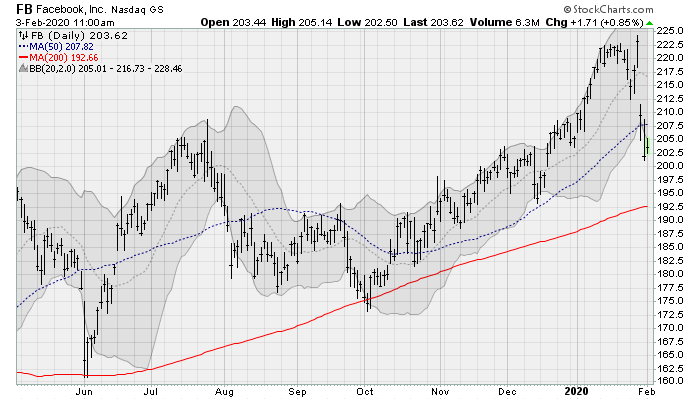

Facebook (FB)

Despite a heart-warming Super Bowl commercial featuring Sylvester Stallone as Rocky Balboa touting Facebook’s Groups feature, shares remain under their 50-day moving average. And that’s after setting a new record high near $225 last week. Resistance from the prior high in the summer of 2018 is kicking in, resulting in some profit taking and a likely retest of the summertime lows near $175. Such a drop would be worth a loss of roughly 15% from here.

As teens and young adults continue to ditch the company’s main social network for its Instagram offering, Needham’s Laura Martin notes that Snap (NYSE:SNAP) continues to take ad spending market share. That’s a clear sign it’s losing some momentum. This is thanks in part to Snap’s innovative direct-response advertising that better tracks return on spending. The company also reported disappointing results in January, resulting in an analyst downgrade from Pivotal Research Group.

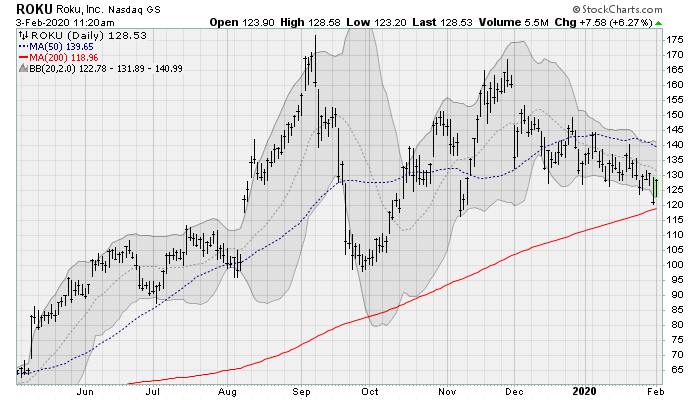

Roku (ROKU)

Streaming competitor Roku (NASDAQ:ROKU) is looking vulnerable as its shares flirt with a breakdown below its 200-day moving average. The rollover breaks the two-year uptrend pattern that started in December 2018 and will likely result in a test of the September lows near $100. Such a drop would be worth a loss of around 20% from here.

The move comes despite news late Friday that its users would be able to stream the Super Bowl thanks to an agreement with Fox (NASDAQ:FOXA). Dallas Mavericks owner and Shark Tank icon Mark Cuban told CNBC recently that he almost bought the company during its selloff in late 2018. But Cuban held off amid ongoing questions over its position as the dominant TV operating system provider.

As of this writing, William Roth did not hold any of the aforementioned securities.