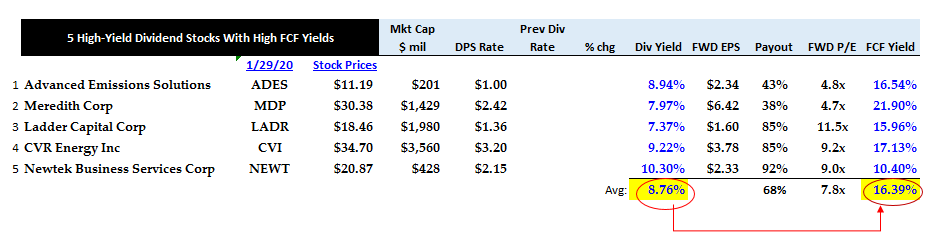

I wanted to find five high-yield stocks that generate enough free cash flow (FCF) to cover their dividends. It’s all about the cash flow. In effect, these are cash cows that have high dividend yields.

Free cash flow is a lot different from net income. FCF covers all outgoing cash expenses, costs, spending and outflows from a company, except for just a few items. These items, like dividends or share repurchases, are not necessary to run the company. So cash flow is considered “free” of any obligations that the company has to make to keep it running.

For example, FCF already includes capital expenditures (capex) and changes in working capital. These two items are often huge uses of cash. But net income, EBITDA, and other measures of a company’s profitability do not include these cash outlays. Only FCF already includes these uses of cash by a company.

So if a company has enough free cash flow left over to pay huge dividends to shareholders, it makes the stock very attractive. In other words, an FCF-heavy company does not have to borrow money or sell assets to pay dividends.

I wanted to find five stocks with dividend yields greater than 7% but whose dividends are financed solely from the company’s own free cash flow. These stocks do not have to rely on other sources of cash to pay those high yields.

How do I measure the FCF yield of a stock? Very simply. I take the free cash generated by the company in its last 12 months of operations. Then I divide that amount by the market value of the stock. That is the FCF yield.

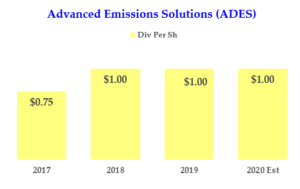

Advanced Emissions Solutions (ADES)

Dividend Yield: 9.28%

FCF Yield: 16.5%

Advanced Emissions Solutions (NASDAQ:ADES) is a small-cap stock ($201 million market cap) that has a very high dividend yield (9.28%) and an even higher FCF yield (16.5%). As the company’s name implies, ADES is involved in pollution control and coal-scrubber technology.

Its technology provides a pre-combustion coal treatment process to enhance combustion. It also reduces emissions of nitrogen oxide and mercury from coal burned in cyclone boilers and industrial boilers. The company serves customers in the coal-fired power generation and industrial boiler processes, as well as potable water and wastewater treatment markets.

ADES bought Carbon Solutions in December 2018 and has been paying down a $70 million loan to fund that acquisition. But its free cash flow is very strong and can also support dividends of $1 per share as well as share repurchases.

For example, in the 12 months ending September 2019, ADES generated $33.2 million in FCF. Since its market value is $201 million, that gives it ADES stock an FCF yield of 16.5%.

ADES paid out $18.7 million in dividends to shareholders. It also bought back $17.5 million worth of its stock. The company said in its Q3 earnings presentation that it is committed to its dividend program and is open to making “opportunistic share repurchases.”

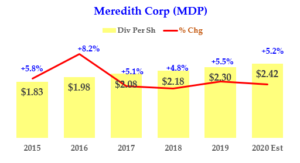

Meredith Corp (MDP)

Dividend Yield: 7.66%

FCF Yield: 21.9%

Meredith Corporation (NYSE:MDP) is the number-one magazine operator in the U.S. It publishes People, In-Style, Better Homes and Gardens and Martha Stewart Living. It also owns 17 TV stations.

Meredith is very cheap, selling at around five times its expected non-GAAP June 2020 earnings, based on MDP’s guidance. Based on its last 12 months of FCF, where it made $213 million, MDP stock has a 21.9% FCF yield based on its $1.43 billion market value.

Moreover, I estimate that the company will raise its quarterly dividend sometime this quarter or when it reports its results for the December-end quarter. Therefore, shareholders earn high yields while they wait for MDP stock to rise. Moreover, the company has plenty of FCF to pay for its huge dividend.

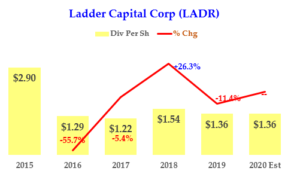

Ladder Capital Corp (LADR)

Dividend Yield: 7.4%

FCF Yield: 16%

Ladder Capital (NASDAQ:LADR) is a mortgage REIT headquartered in New York City. It originates first-mortgage commercial real estate loans and invests in U.S. Agency securities.

As a REIT it distributes 90% of its taxable income to its stockholders. Its annual dividend of $1.36 gives the stock a dividend yield of about 7.4%.

Its cash flow from operations of $316 million compared to its $1.98 billion market value gives it a 16% FCF yield. Ladder Capital does not have capex requirements.

Its annual dividend cost $144.3 million in the year ending September 2019. So its cash flow more than covers the dividend payments it makes.

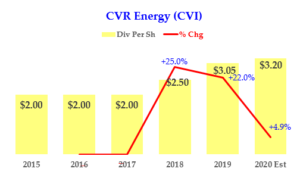

CVR Energy (CVI)

Dividend Yield: 9.29%

FCF Yield: 17.1%

CVR Energy (NYSE:CVI) refines oil and makes gasoline, diesel, and nitrogen/ammonia fertilizer through several Midwest refineries that it owns.

In the 12 months ending September, CVR Energy produced Cash Flow from Operations of $747 million. It had capex spending of $136 million, which means CVR generates $611 million in free cash flow.

Since CVR has a market value of $3.56 billion, CVR stock has an FCF yield of 17.1%. CVR’s dividend cost $301 million in the past year. So CVR stock’s dividend yield at $1.36 per share is well covered by its FCF.

CVR trades at a price-to-earnings of just 9.2 times earnings. This is a well-covered value stock which investors should look carefully at.

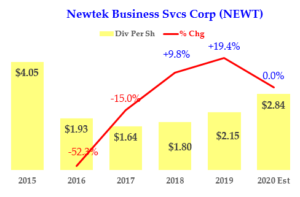

Newtek Business Services Corp (NEWT)

Dividend Yield: 13.5%

Earnings Yield: 10.4%

Newtek Business Services (NASDAQ:NEWT) is a business development company with a high dividend yield. But it acts as a sort of investment bank in that it trades and securitizes the loans it originates.

A very insightful article in Seeking Alpha was recently published by Michael Yu about Newtek. The article describes how Newtek’s business model is very unique as a pseudo-investment bank. In short, Newtek makes money by originating small business loans under the SBA loan guarantee program. It then immediately resells the guaranteed portions of the loans at a profit.

It puts the unguaranteed portions into tranches that are rated. As rated tranches, institutional investors can buy them in bulk. It makes enough money to cover its expenses and then pay dividends from this trading and securitization process.

So, this is not strictly a typical free cash flow play like the companies above. Nevertheless, Newtek is expected to make $2.33 per share this year, putting it giving it an earnings yield of 10.4%.

Summary and Conclusion

As of their numbers on Jan. 29, these five stocks have an average dividend yield of 8.76%. This assumes they are equally weighted if bought in one portfolio.

Their average combined FCF yield (and in one case an earnings yield) is 16.39%. This is significantly higher than the average dividend yield of 8.76%. You can see this in the chart above.

You might find that these stocks will be safe and well-covered, high-yielding investments over the long-term.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks. Subscribers a two-week free trial.