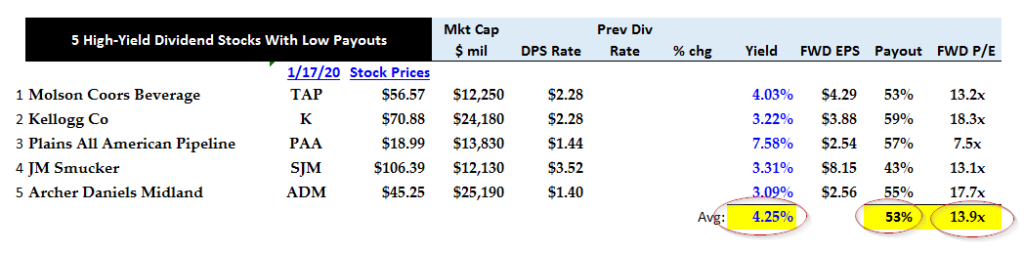

I wanted to find five overlooked dividend stocks that have plenty of room in their finances to pay out high dividend yields. If the dividends are less than 50%-60% of a company’s earnings, there is still room to hike the payout.

Also, that range gives companies room to buy back stock, which would help stock prices rise. Or companies could pay down debt, making their businesses safer. All of these are benefits of having a low payout ratio.

Moreover, these dividend stocks on my list have higher-than-normal dividend yields. That makes them bargains. But they also have low price-to-earnings ratios. These dividend stocks should be great long-term value investments.

So I found five dividend-paying stocks with the following traits. Their payouts represent less than 60% of earnings in dividends. The dividend yields are also higher than 3% annually. In addition, the stocks have price-to-earnings ratios below the market average (less than 18x).

Check out these five worthwhile — and cheap — dividend stocks.

Dividend Stocks to Buy: Molson Coors (TAP)

Dividend Yield: 4%

Payout Ratio: 53.2%

Price-to-Earnings Ratio: 13.2

Molson Coors (NYSE:TAP) stock is very undervalued. It has a higher-than-average dividend yield of 4%, but the dividend does not take up a large portion of earnings.

For example, earnings are expected to be $4.30 in 2019 and $3.98 in 2020. But the dividend costs only $2.28 per share. This means the dividend payout ratio is only 53% for 2019 alone.

Molson Coors is more than just a beer company with the famous Coors and Miller brands. It has a host of other premium brands as well.

Moreover, CEO Gavin Hattersley’s new revitalization plan is to take the company beyond beer. He wants to make it an overall “beverage” company. Molson is investing in seltzer brands, including “Henry’s Hard Sparkling Water.”

Lastly, the company has been growing the dividend in the past two quarters. Hattersley has stated several times that the company aims to pay out 20%-25% of its trailing 12-month EBITDA in dividends.

In the fiscal year ending in September 2019, TAP paid out $389 million in dividends out of $1.2 billion in free cash flow. That is about one-third of its FCF.

This gives Molson Coors plenty of room to do other things to help the company. It can increase acquisitions, buy back stock, hike the dividend or reduce debt. All of these will benefit TAP stock.

Kellogg (K)

Dividend Yield: 3.2%

Payout Ratio: 58.8%

Price-to-Earnings Ratio: 18.3

Kellogg (NYSE:K) stock is also very undervalued. And the company is turning into more than just a cereal brand. It is experiencing significant growth in Europe and Asia by selling organic products and food items that are more popular than its traditional cereal.

Moreover, the company pays out less than 60% of its earnings in dividends. But it still has a 3.2% dividend yield. Its P/E ratio of 18.3 times is on par, if not slightly lower than the market average.

Its free cash flow is very strong. In the 12-month period ending in September 2019, Kellogg had $910 million in FCF on its balance sheet. It used $769 million of that to pay dividends. But it also bought back $420 million in shares.

I have written many articles for Seeking Alpha showing that companies that buy back stock often have fast dividend-per-share growth. Kellogg is similar to those companies. It uses its free cash flow to buy back shares and pay out dividends.

Kellogg is an overlooked value stock that has a low payout ratio and a high dividend yield.

Plains All American Pipeline (PAA)

Dividend Yield: 7.6%

Payout Ratio: 57.8%

Price-to-Earnings Ratio: 7.6

Plains All American Pipeline (NYSE:PAA) is yet another undervalued stock on this list. It has a very high 7.6% dividend yield but only pays out 57% of its earnings. Moreover, its P/E ratio is below 8 times.

The company transports and stores oil and natural gas in the U.S. and Canada. It uses pipelines, barges and other gathering systems to transport these commodities.

Plains All American recently posted a 15% increase in its EBITDA for the third quarter. The company earns fees from transportation, so it is not directly exposed to oil and gas price volatility.

On the other hand, oil and gas production activity will pick up if prices rise. Look for good things to happen to this stock if activity in the oil and gas sector heats up.

J. M. Smucker (SJM)

Dividend Yield: 3.3%

Payout Ratio: 43.2%

Price-to-Earnings Ratio: 13.1

J. M. Smucker (NYSE:SJM) stock has a 3.3% dividend yield and a low 43% payout ratio. That is good because it allows the company to pay down its debt.

For example, in the 12-month period that ended in September 2019, SJM generated $824 million in free cash flow. But it used only $390 million of that cash to pays its dividends over the period in question.

That left the company the ability to pay down $500 million of its debt principal. Now J. M. Smucker will be able to cut its debt significantly over the next several years. And SJM stock still has a nice dividend yield.

J. M. Smucker stock is a cheap dividend stock trading at a price-to-earnings ratio just over 13 times. This is because of recent negative sales and earnings growth. But SJM has been paying down debt and lowering its interest payments. FCF has risen as a result.

At some point, SJM will turn things around. So far, investors are getting paid to wait with a cheap stock price.

Archer-Daniels-Midland (ADM)

Dividend Yield: 3.1%

Payout Ratio: 54.3%

Price-to-Earnings Ratio: 17.6

Archer-Daniels-Midland (NYSE:ADM) stock is another undervalued food stock on my list. It is one of the world’s leading food and beverage ingredient producers. It also plays a key role in storing and transporting those ingredients. Commodities like corn, wheat, oats and rice are its main items.

Dividends represent just 54% of its earnings. Yet the dividend yield is 3.1%, so ADM stock is still cheap. Moreover, the stock was flat during 2019 mainly because of the trade war with China. In addition, swine fever in China lowered the demand for food stock commodities.

These will likely turn out to be temporary issues. Now that China has signed a phase-one trade agreement with the U.S. the pressures may begin to ease. China is supposed to begin purchasing $77 billion in U.S. goods and services in 2020 and $123 billion in 2021.

Specifically, the agreement says China will buy $12.5 billion in agricultural products in 2020 and $19.5 billion in 2021. ADM should be a significant beneficiary of this as it is directly involved in the trade with China for agricultural products.

Look for ADM stock to rise during 2020 as the benefits of this deal start to flow through. It is a key player in this group of high-yielding dividend stocks.

A good number of companies on this list turn out to be food and beverage companies. They are all very cheap, as you can see in the summary table below.

In fact, as a group, their average dividend yield is 4.25% and their average payout ratio is 53%. Moreover, the average P/E ratio is almost 14 times.

Buying these stocks as a group will probably turn out to be a good cheap purchase indeed.As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks. Subscribers receive a two-week free trial.