BP (NYSE:BP) stock offers great value for investors. This energy producer’s dividend yield is 6.3% and its forward price-to-earnings ratio is under 12 times.

That is a great bargain. Moreover, the company appears to be able to afford the high dividend payments that it is making.

For example, in the 12-month period leading up to September 2019, BP generated $25 billion in operating cash flow. Now after all of its net capital expenditures were made using that cash flow, BP had free cash flow (FCF) of $7.6 billion remaining.

Thanks to this FCF, the company was able to pay dividends and buy back shares. BP decided to pay $6.6 billion in dividends and bought back $356 million of its shares. So in effect, BP had plenty of money to afford its high-yield dividend.

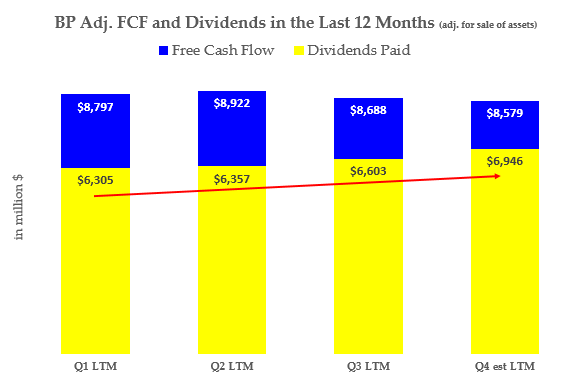

BP Stock’s Dividend in the Last 12 Months

You can see in the chart I prepared below that BP has consistently had plenty of adjusted FCF to pay its dividends. Here I have adjusted FCF figures for the sale of assets, which effectively lowered capex and raised FCF.

This chart shows that for each quarter looking back 12 months, BP has generated more FCF (in blue) than the dividends it paid (in yellow). That should make investors feel very confident that the present high dividend yield is sustainable.

Moreover, this was accomplished in a very difficult environment for oil and gas prices. Energy prices are at the bottom of their long-term ranges.

The red line in the chart shows that dividends have actually been growing as well. But no worries. The FCF (in blue) more than covers the dividend growth.

So for BP to produce such FCF and pay dividends through this period without having to increase debt, sell assets or raise equity is a great accomplishment. It lends stability to the BP stock high-yield story.

Dividend Growth History

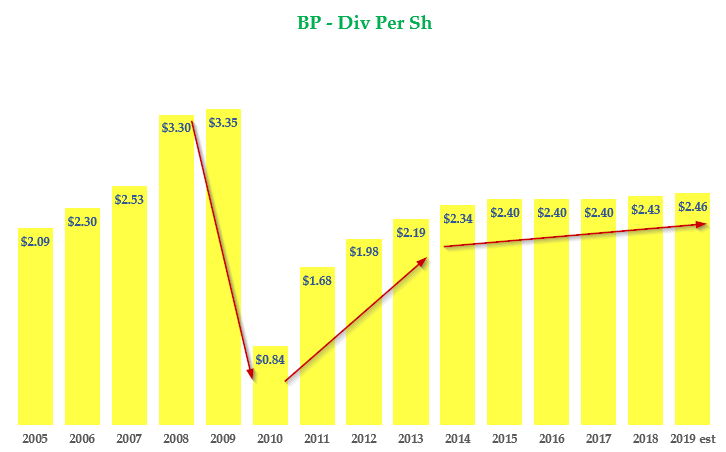

If you look at the past 15 years of dividends at BP you see that there have been three trends. You can see this in the chart below.

First, before 2010, dividends per share were growing very nicely but then the Deepwater Horizon tragedy occurred in the Gulf of Mexico. BP cut its dividend dramatically.

After that, the dividend per share increased once more to higher levels. And it did so fairly quickly. But the dividend only regained about two-thirds of its prior glory.

Then from 2015 on, the dividend per share has increased slowly from $2.40 to $2.46, where it is today. That reflects the time period in which oil has stayed fairly low. Since 2015, the annualized payout has only grown 2.6%.

BP’s Future Value

Let’s assume that the dividend continues to show this kind of slow growth, and the annual payout continues to increase by 2.6% per year. By 2024, the dividend per share will be $2.79.

Now assuming that the dividend yield improves a bit, here is what BP stock could be worth. Let’s say that the dividend yield improves, and reaches 5% from 6.3% by the end of 2024.

That would mean that BP stock would rise to $55.80 by 2024. That is because the dividend estimate of $2.79 in 2024 divided by 5% is equal to $55.80.

That represents a price gain of 44.2%. Now that is not what BP stock is worth today. Let’s say the alternative is a fund that paid at least a 3% dividend or a certificate of deposit with a 3% guaranteed return. That provides us a present value alternative.

The present value factor for a 3% return is 86.3%. So multiplying $55.80 by 86.3% brings a net present value of $48.13. So BP stock is worth $48.13 today, given our assumptions about dividend growth and dividend yield.

This represents a real worth for BP stock at $48.13 that is 24% higher than today’s price near $38.69 per share.

Total Return Given BP’s Safe Dividends

Here is another way to look at how much investors can expect to make with BP stock. Given our calculations above we can estimate the total return annually.

For example, the price at 2024 year-end will be $55.80 per share. That represents a price gain of 44.2%. That is one part of the total return calculation. The other part is the dividends that will be collected during that period.

Based on my calculations, the total amount of dividends over the five years will be $13.26. This represents, as assumed above, a 2.6% average annual increase in dividends paid out per share.

Therefore, the price gains could be $16.11 per share and the dividends collected will be $13.26. This total of $29.37 per share represents a gain of 78.5% over the next five years.

Now the annual average total return is equal to 78.5% calculated on a cumulative basis. That works out to 12.3% annually.

So the average annual total return to investors in BP stock could be 12.3% per year over the next years. This reflects the current 6.3% dividend yield and an average estimated price gain of 6% per year.

To the defensive investor, that looks to be a pretty good and safe return.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks. Subscribers receive a two-week free trial.