Abbvie (NYSE:ABBV) is up over 40% since its mid-August 2019 lows, but amazingly Abbvie stock still offers great value to investors.

For example, ABBV has a dividend yield of 4.8% and a prospective price-to-earnings ratio of just 9 times. This is significantly below the averages for the S&P 500.

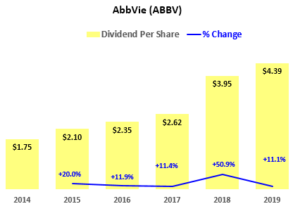

I have pointed out in previous articles that Abbvie has enjoyed consistent and regular dividend growth. For example, the chart below shows that Abbvie has regularly raised its dividend per share in the past five years.

On average, dividends have increased by 21% per year over the past four years. The dividend is expected to rise by 10% this year

Moreover, Abbvie is close to closing on its mid-June 2019 acquisition of Allergan (NYSE:AGN). Allergan is well known for its Botox and other beauty products. Analysts suggest that it will only take a few more months.

This will provide a big boost to the stock price.

For one, the deal is expected to be “accretive” to earnings. That means earnings per share will be immediately higher.

Abbvie is losing its patent protection on Humira. That is a rheumatoid arthritis treatment that accounts for more than half of Abbvie’s revenue.

But Abbvie has indicated that there will be $2 billion in synergies with Allergan. Moreover, the combined earnings will be 10% higher during the first year.

More Acquisitions Possible

Moreover, Allergan’s nearly $16 billion in revenue, on top of Abbvie’s $33.3 billion will give it the flexibility to make further acquisitions. Abbvie says the deal gives it “new growth platforms” and is “transformative.”

The combined company generated $19 billion in operating cash flow in 2018. You can make a lot of new deals with that kind of cash flow.

Of course, Abbvie will have to pay down the $30 billion in debt taken on for this $63 billion transaction. The bottom line is that the deal will boost dividend growth, allow further R&D and cut debt.

Valuing Abbvie Stock

Assuming the deal closes and everything works out, Abbvie should be able to continue to raise its dividend. Let’s assume that the dividend per share (DPS) continues to rise 10% per year for the next three years.

That would increase the $4.72 DPS rate by 33.1%. So the new DPS would be $6.28 per share.

Now let’s also assume that Abbvie’s dividend yield falls a bit to an average of its peers. For example, Eli Lilly (NYSE:LLY) has a 2.10% dividend yield. Merck (NYSE:MRK) has a 2.7% yield, and the Pfizer (NYSE:PFE) yield is 3.8%.

So if Abbvie’s dividend yield improves to say 3.5%, which is still higher than the average, Abbvie will be significantly higher. We can estimate that price by taking DPS and dividing it by the average estimate yield.

For example, the DPS of $6.28 in three years divided by 3.5% results in an expected price of $170.43 per share. That is over twice the present price. Even if we use a 4% dividend yield, the resulting expected price is $157 per share.

Now the present value of $157 using a 5% discount rate for three years means that the stock is now worth $135.62 per share. So that means ABBV stock is worth 54% higher than today’s price.

The Abbvie Stock Takeaway

Abbvie has a great track record raising its dividend. Abbvie sells for less than 9 times forward earnings. I have shown that if the dividend hike trends continue Abbvie is likely worth at least $135.62 per share. This assumes only a slightly better dividend yield of 4% versus its present 4.8% yield.

That sounds like a pretty good deal for investors. The closing of the Allergan deal in the next few months is likely to act as a catalyst for higher earnings and cash flow.

Even though the stock has risen in the past few months, it is probably worth buying now.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks. Subscribers a two-week free trial.