A less-than-stellar jobs reports caused stocks to take a breather on Friday. Let’s take a look at a few top stock trades for next week:

Top Stock Trades for Tomorrow #1: Disney (DIS)

While the broader market continues to churn its way to new highs, Disney (NYSE:DIS) stock is not whistling the same tune. To be fair, the stock is still up big, but after peaking in late-November, it’s been unable to garner much upside action.

It sits on key support, as investors wonder whether this will give DIS a much-needed boost or if it will fail and trigger more declines.

The stock was trading in a descending triangle pattern, as downtrend resistance (blue line) squeezed shares lower against a static level of support (black line). However, rather than break down — which DIS almost did — shares broke out over downtrend resistance.

Almost right away though, shares were back under pressure, selling back down to $144.50. Now sitting near short-term support, the backside of prior downtrend support and the 50-day moving average, this is make-or-break territory in the short term.

On a bounce, see if DIS can take out its recent high at $148. If support fails, a test of the 200-day may be in order.

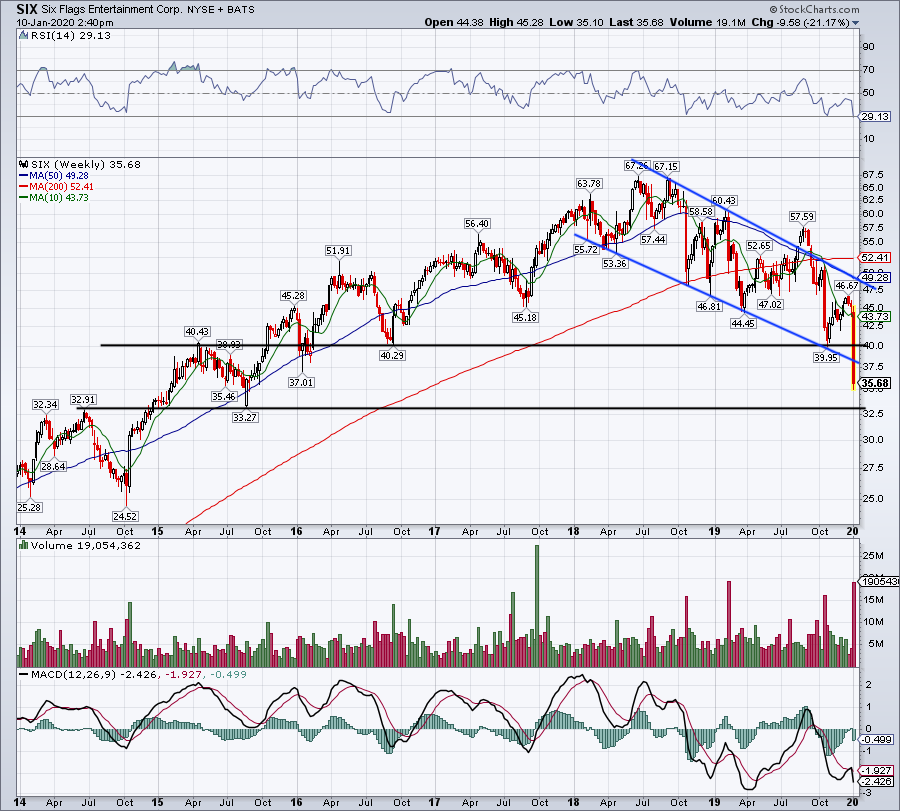

Six Flags (SIX)

Six Flags (NYSE:SIX) was decimated on Friday after warning on revenue. Shares blew through downtrend support (blue line) and right through the $40 mark, which has been a notable level over the past five years.

Now just under $36, SIX is definitely in no man’s land.

If it continues lower, look to see if the $32.50 to $33 area buoys the name. If it begins to rally, see if the stock can reclaim prior downtrend support, then $40.

Citigroup (C)

Citigroup (NYSE:C) was the “pick of the decade” by Bank of America analysts the other day, but shares are looking tired ahead of its earnings report on Tuesday.

In the event that we see more selling next week, either ahead of or after earnings, this one may be a solid buy-the-dip candidate. Specifically, I’m looking for a pullback to the $76 area, which was a big multi-year breakout level.

Even though that would put it below uptrend support (blue line) and the 10-week moving average, that level would represent a good spot to nibble a long position — provided its earnings results are not dramatically worse than expected.

Below that, and the $70 to $72 area may be a good spot to buy as well. Over last week’s high of $81.26 and C can keep on running.

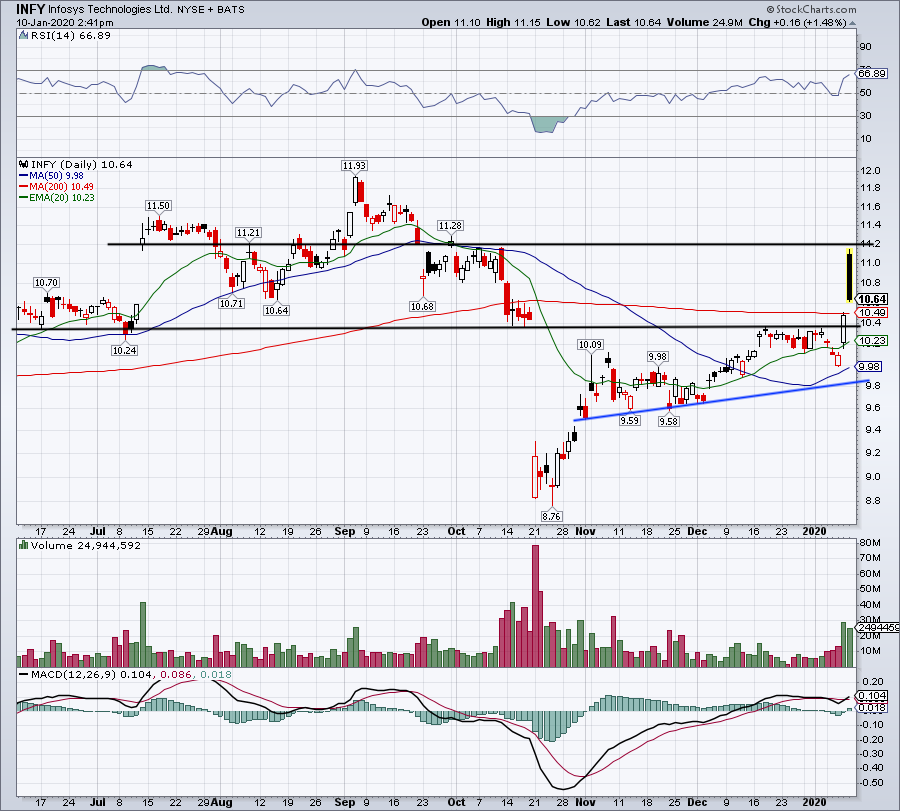

Infosys (INFY)

For a $45 billion company, Infosys (NYSE:INFY) really does fly under the radar. The company rallied hard on Friday after reporting earnings, but has since given up most of those gains.

It could not penetrate the $11.20 level and is being sold into the close. From here, bulls will want to see the $10.40 to $10.50 level hold as support. The former has been significant over the past year, while the latter marks the 200-day moving average.

On a rebound, see if INFY can take out $11.20.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell is long DIS.