As geopolitical tensions remain muted, stocks continue to hold up near the highs. Let’s look at a few top stock trades from Tuesday’s session.

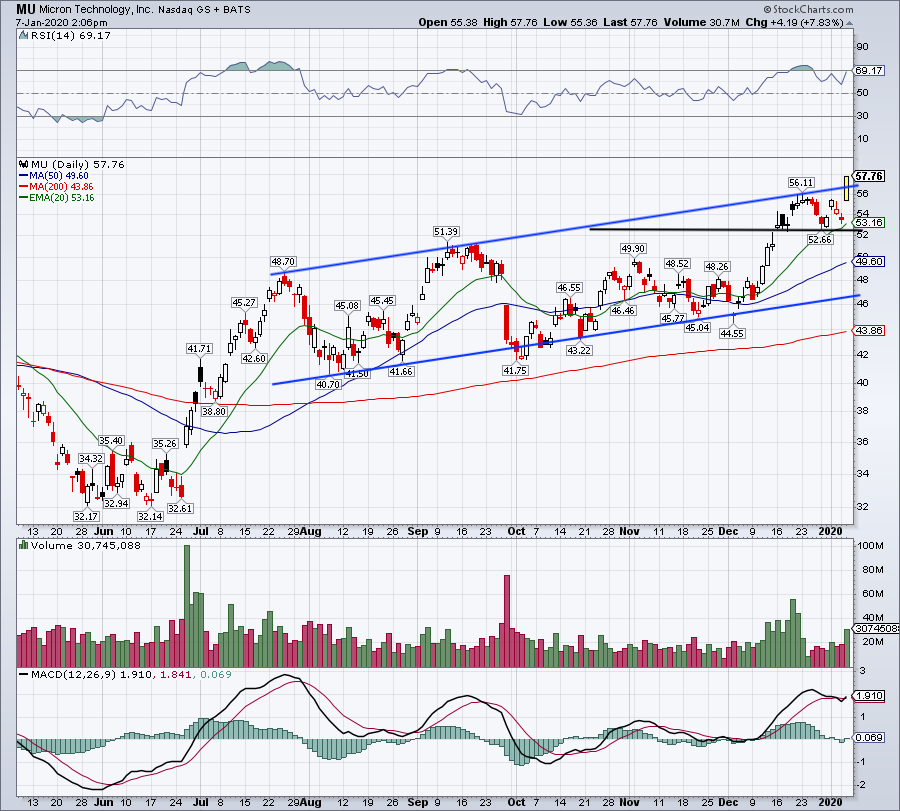

Top Stock Trades for Tomorrow No. 1: Micron (MU)

Micron (NASDAQ:MU) had been trading in a very well-defined channel (blue lines) since summer. After better-than-expected earnings in December, shares eventually topped out at channel resistance.

After pulling back and finding support near $52.50, shares blasted higher on Tuesday and pushed right through resistance.

Now what?

Bulls will want to see channel resistance turn to support now, and will look for shares to continue higher. Provided MU stock can stay north of prior resistance, $60 is on the table. If it falls below $56, the 20-day moving average is possible.

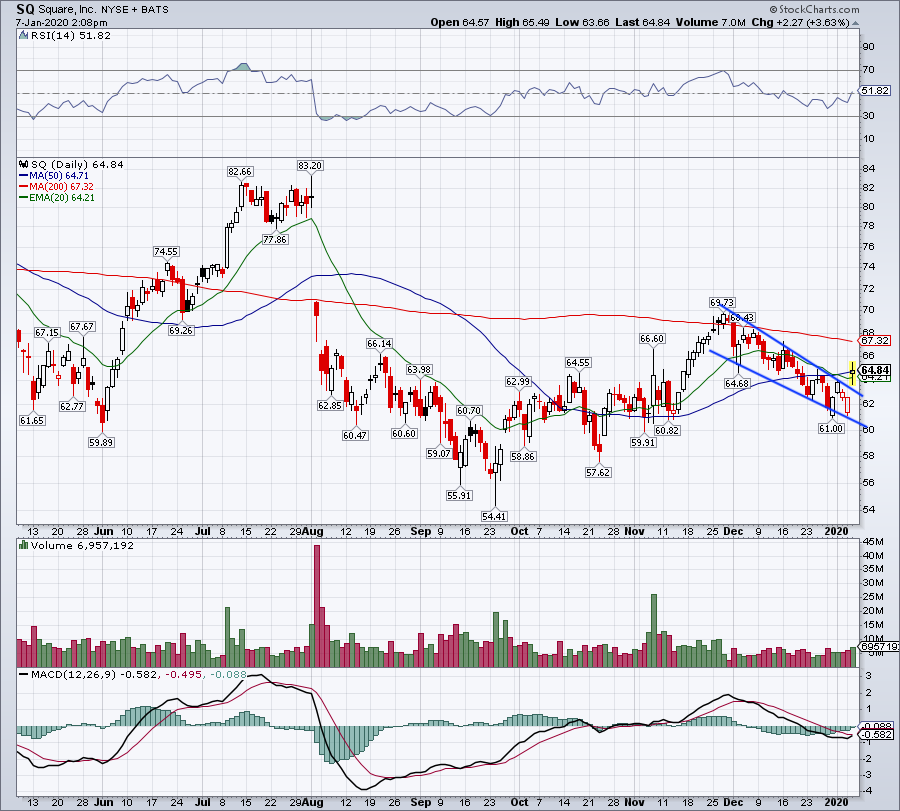

Top Stock Trades for Tomorrow No. 2: Square (SQ)

I have been keeping Square (NYSE:SQ) on my radar lately, and Tuesday’s action has really caught my attention.

Shares are gapping out of a falling wedge, as Square hurdles prior downtrend resistance. However, it’s stumbling at the 50-day moving average. While the 50-day has played a role, it’s been minor compared to the 200-day moving average.

If SQ can clear the 50-day moving average, it’s likely that a test of the 200-day is next. Moving over it puts $70, roughly the high from November, on the table. On a pullback, see that prior downtrend resistance holds as support.

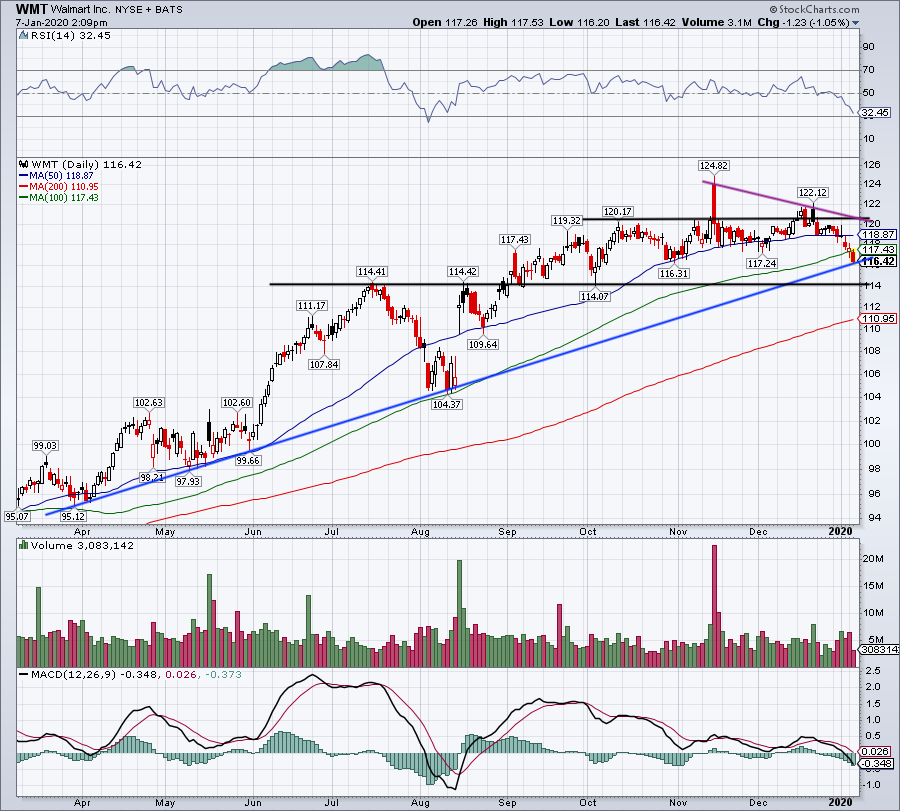

Top Stock Trades for Tomorrow No. 3: Walmart (WMT)

Walmart (NYSE:WMT) jumped higher on earnings in November, and then was immediately flushed lower. Simply put, the stock has struggled north of $120, and has continued to lose momentum.

It’s now losing the 100-day moving average after just losing the 50-day a few sessions ago. Shares are now running right into uptrend support (blue line).

I know WMT is not usually traders’ first pick, but the setup is reasonable. If support holds, look for a rally back to the 50-day, and potentially $120. If it fails, $114 and the 200-day moving average are potential downside targets.

Top Stock Trades for Tomorrow No. 4: Beyond Meat (BYND)

Beyond Meat (NYSE:BYND) jumped higher on Tuesday, launching it over downtrend resistance (blue line) and preventing shares from breaking down below $72.50.

Now above trend, as well as the 20-day and 50-day moving averages, bulls must keep BYND stock elevated. Back below downtrend resistance opens it up to a test of support and if it fails, significant downside could be ahead.

If bulls succeed though, it could put $90 to $100-plus on the table. Over $90 and it could fill the October gap up to triple digits.

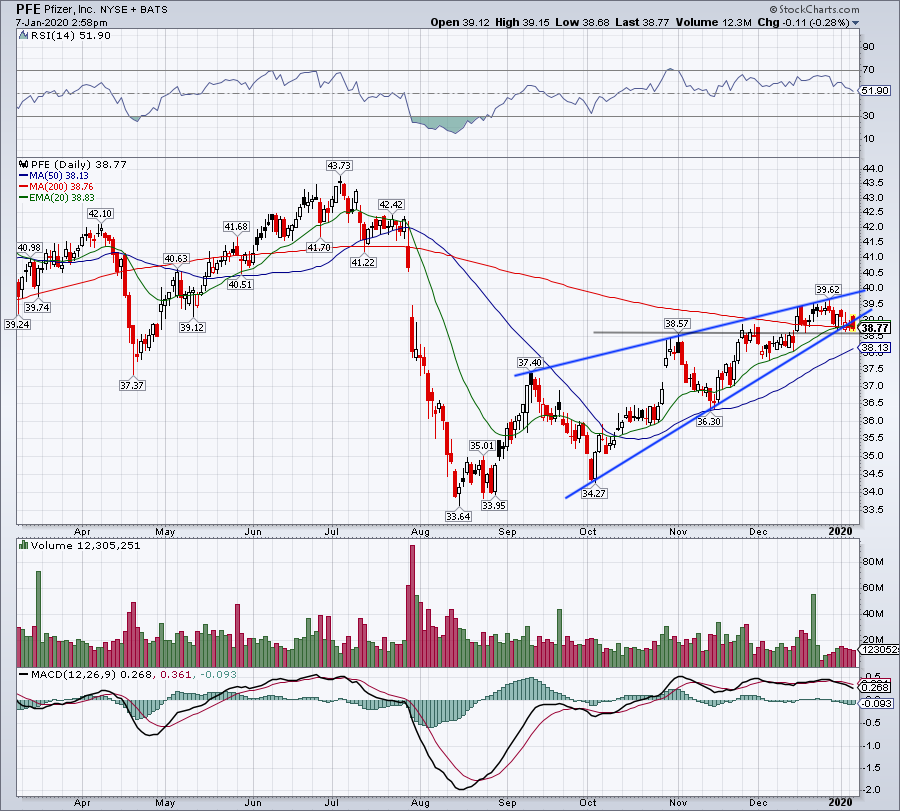

Top Stock Trades for Tomorrow No. 5: Pfizer (PFE)

Pfizer (NYSE:PFE) caught my eye late in Tuesday’s session as it flirts with a breakdown below its 20-day and 200-day moving averages.

Worse, the stock is breaking down below its rising wedge. If this pattern plays out and PFE stock fails to hold $38.50, it won’t be long before the stock tests the 50-day moving average. Below that and a larger decline could take hold.

Pfizer is a good company, but the stock is not cooperating. That changes if it can reclaim the 200-day and wedge support. Below though and PFE is neutral, at best.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforementioned securities.