Yes, it is that time of the year again. When the calendar flips, everyone ponders what lies ahead, and resolutions for self-improvement are made; Often, to be broken later. Additionally, it is also a great time to re-examine your portfolio and consider adding in some new, income-oriented names — including dividend stocks.

While stocks overall are blasting to new highs, valuations are looking extended and things look vulnerable to a pullback. The catalyst will likely come when the Federal Reserve returns to a tightening bias, perhaps around March. When that happens, dividend stocks will provide a modicum of protection for equity investors when the volatility returns.

With that in mind, take a look at these seven names to consider as we begin the new decade.

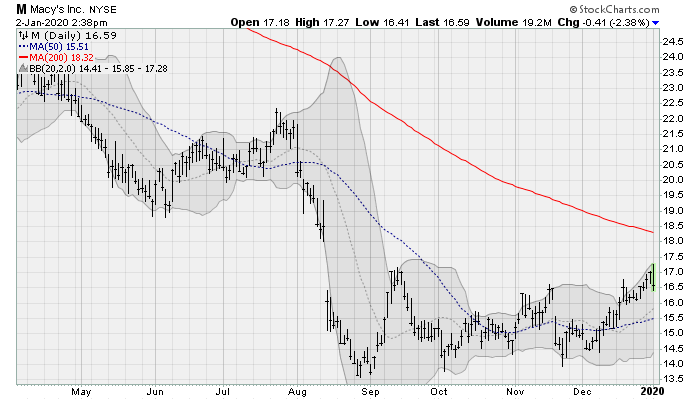

Dividend Stocks to Buy: Macy’s (M)

Dividend Yield: 9.1%

It’s no secret that department stores are facing severe headwinds. However, retailers like Macy’s (NYSE:M) are aggressively looking to revamp their value proposition to customers. This includes a new, second-hand thrift partnership with thredUP that provides lower cost options to bargain hunters searching for a deal.

The company pays a dividend yield of 9.1%, and is enjoying a share price challenge of recent highs near the $17 per share level. The company will next report earnings results on Feb. 25 before the bell, and analysts are looking for earnings of $1.86 per share on revenues of around $8.3 billion.

Duke Energy (DUK)

Dividend Yield: 4.2%

Duke Energy (NYSE:DUK) shares are pushing above their 50-day moving average, continuing a steady rise along its 200-day moving average that’s been in play since the summer of 2018. The stock pays a 4.2% dividend yield, and has enjoyed recent analyst upgrades from Goldman Sachs and Barclays. Watch for a return to the prior high near $96-$97, which would be worth a gain of roughly 7% from here.

The company will next report results on Feb. 13 before the bell, and analysts are looking for earnings of 89 cents per share on revenues of around $6.6 billion.

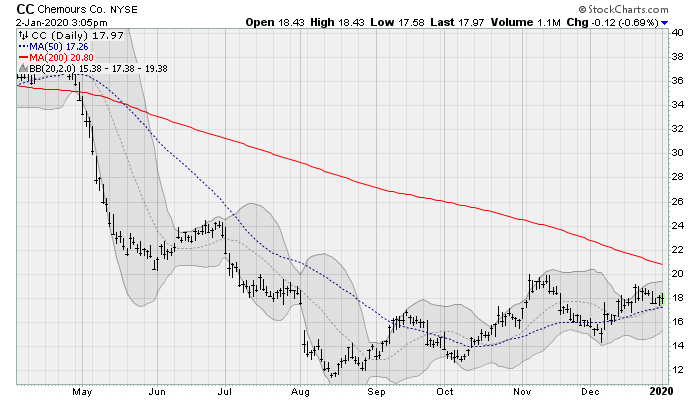

Chemours Company (CC)

Dividend Yield: 5.5%

Shares of the The Chemours Company (NYSE:CC) are rounding higher off of a six-month trading range, and look ready for a push above their 200-day moving average for the first time since last April. The chemical company is behind familiar products like Teflon and Freon, and pays a 5.5% dividend yield.

It will next report results on Feb. 13 after the close, and analysts are looking for earnings of 46 cents per share on revenues of $1.4 billion.

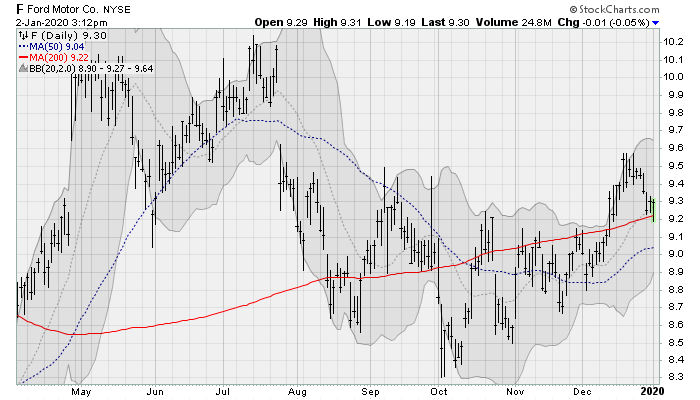

Ford (F)

Dividend Yield: 6.4%

Shares of Ford (NYSE:F) are consolidating above their 200-day moving average as of late. The company looks ready for a rally to prior highs near $10.20, which would be worth a gain of roughly 10% from here. Ford has been in the news recently for its Mustang Mach-E First Edition electric vehicle, with reservations full. This seems like a sign that the company could take some electric vehicle market share away from Tesla.

The company will next report results on Feb. 4 after the close, and analysts are looking for earnings of 17 cents per share on revenues of $36.7 billion. Shares pay a 6.4% dividend yield.

Exxon Mobil (XOM)

Dividend Yield: 4.9%

Exxon Mobil (NYSE:XOM) shares are rising up and out of a six-month consolidation pattern with a run towards its 200-day moving average. Oil prices have been on the move lately, with West Texas Intermediate rising from a low of $51-$52 per share to return to push towards $62 amid the rise of renewed tensions in the Middle East.

The company pays a 4.9% dividend yield and will next report results on Jan. 31 before the bell. Analysts are looking for earnings of 73 cents per share on revenues of $63.6 billion.

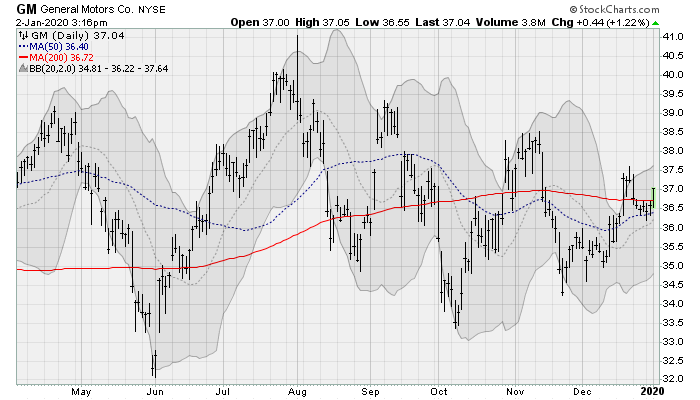

General Motors (GM)

Dividend Yield: 4.1%

Shares of General Motors (NYSE:GM) are rising back up and over their 200-day moving average, and look ready to test the upper end of a three-year trading range. In early December, the company announced plans to mass-produce battery cells for electric vehicles in collaboration with LG Chem. Together, the companies intend to invest a total of $2.3 billion by 2023 to establish a new battery factory in northeast Ohio.

The company will next report results on Feb. 5 before the bell, and analysts are looking for earnings of seven cents per share on revenues of $30.8 billion. The company pays a 4.1% dividend yield.

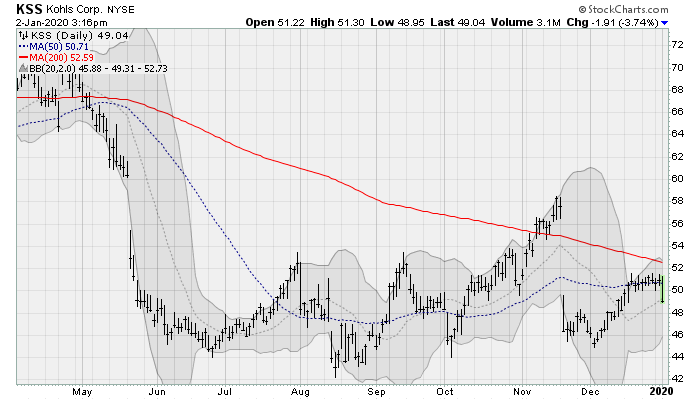

Kohl’s (KSS)

Dividend Yield: 5.5%

Kohl’s (NYSE:KSS) shares are in the midst of a sideways consolidation range going back to May, but look ready for an attempt to push up and over its 200-day moving average. That would open the door to a test of prior highs near $78, which would be worth a gain of roughly 60% from here.

The company pays a 5.5% dividend yield and will next report results on May 3 before the bell. Analysts are looking for earnings of $1.97 per share on revenues of $6.6 billion.

As of this writing, William Roth did not hold a position in any of the aforementioned securities.