Let’s be clear upfront: Amazon (NASDAQ:AMZN) hasn’t had a bad 2019. After all, its stock is up 21.3% so far on the year and nearly 30% over the past 12 months. However, that lags all of its mega-cap tech peers, as well as the SPDR S&P 500 ETF (NYSEARCA:SPY) and the PowerShares QQQ ETF (NASDAQ:QQQ), which are up 33.5% and 43.5% over the past year, respectively. So could Amazon perform any better in 2020?

Compared to names like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL), Facebook (NASDAQ:FB) and Alibaba (NYSE:BABA), Amazon’s underperformance is even more pronounced.

Have a look below:

| Stock | 1Y Return |

| AMZN | 30% |

| GOOGL | 36% |

| MSFT | 60% |

| BABA | 63% |

| FB | 65% |

| AAPL | 89% |

So that begs the question, will Amazon “turn it around” in 2020?

Valuing Amazon

Amazon has built itself into a conglomerate. Its Amazon Web Services business isn’t just a player in the cloud business — it’s a dominant industry leader. It’s built a sticky ecosystem of Prime members, while focusing more on its own shipping efforts. In fact, so much so that Amazon is now delivering billions of packages — handling more of its own packages than United Postal Service (NYSE:UPS) or USPS do.

All of this does add up, though.

A recent Piper Jaffray survey found that a move to one-day shipping could have a significant increase on customers’ use of Amazon Prime. While a good long-term catalyst, the analyst acknowledges that this many continues to weigh on earnings for the next quarter, and possibly longer.

Wall Street analysts have seemingly underestimated how long and how much this effort would cost Amazon, although management has been relatively on point with it.

43 of the 47 calls on the Street are some form of a buy rating, with the lowest price target ringing in at $1,850. With shares at $1,793, that really says something about how sluggish the stock has been this year.

That’s surprising for a stock that has revenue growth estimates of ~20% this year and 18.5% in 2020. However, earnings could be the real catalyst. Estimates call for earnings growth of just 2.6% this year, but escalate to 30.7% growth in 2020.

While that leaves Amazon trading at 66 times next year’s earnings estimates, I wouldn’t get too hung up on the valuation. It hasn’t been an issue for the stock over the past decade, so I doubt it will start playing a role now.

Instead, a return to strong earnings growth could help fuel Amazon out of its funk and launch it over $2,000.

Trading Amazon

If the company can deliver on earnings growth, the fundamentals will start to realign for Amazon. But to get the explosive moves necessary for big gains, the technicals have to line up as well.

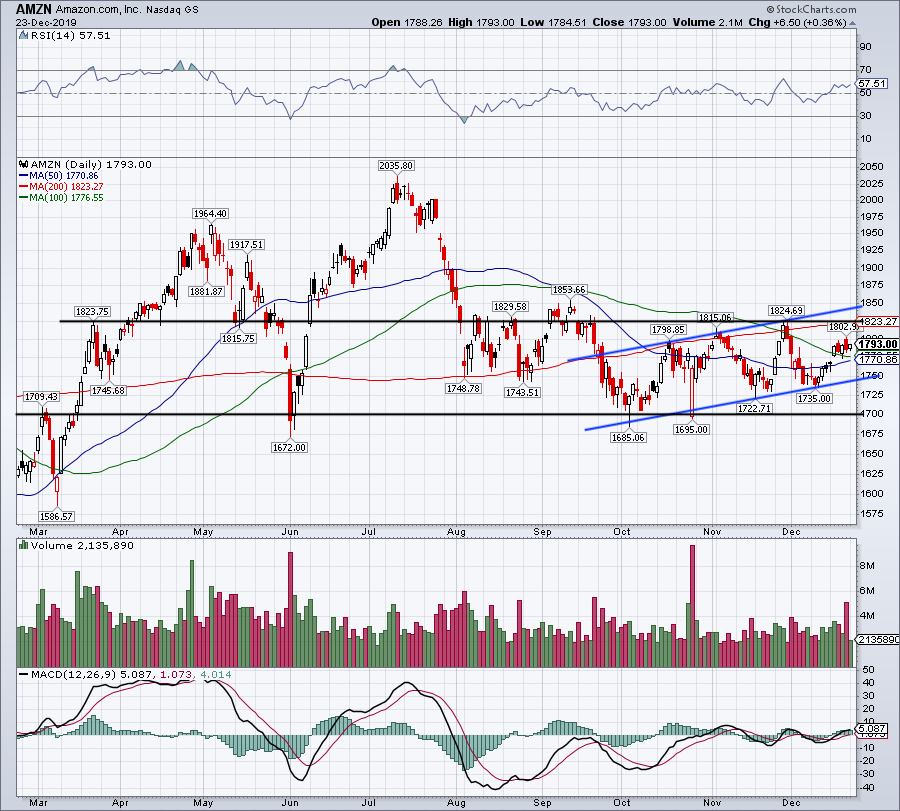

Shares ripped higher near the end of November as all of the Black Friday and Cyber Monday data was rolling in. However, $1,825 resistance, channel resistance and the 200-day moving average put a halt to that rally and sent shares back below the 50-day moving average.

However, bulls stepped in at channel support, as Amazon stock is now above its 20-day, 50-day and 100-day moving averages and is coiling in a sideways pattern. For traders, the setup leans bullish, although it’s clear there’s still risk.

Mainly as the stock has not been on the “buy list” like many of its mega-cap tech peers and as overhead resistance still looms large.

I like Amazon as a catch-up trade in 2020. Enough so that I just reinitiated a long position in the name. I will risk roughly 5% on the trade, allowing only for a decline down to range support near $1,700. Below this level and I will stop out of the trade. On a close over $1,825 resistance and the 200-day moving average, and I will look to add to the position.

A move over channel resistance and bulls may look to fill the gap up to $1,975. Over that and $2,000-plus is on the table.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell is long Amazon, Apple and Alphabet.