U.S. stock futures are headed for a green open to kick off the post-Christmas festivities. Elsewhere, precious metals like gold and silver are beginning to percolate, rising 0.5% and 1.3%, respectively.

On the equity side, futures on the Dow Jones Industrial Average are up 0.11% and S&P 500 futures are higher by 0.16%. Nasdaq Composite futures have added 0.17%.

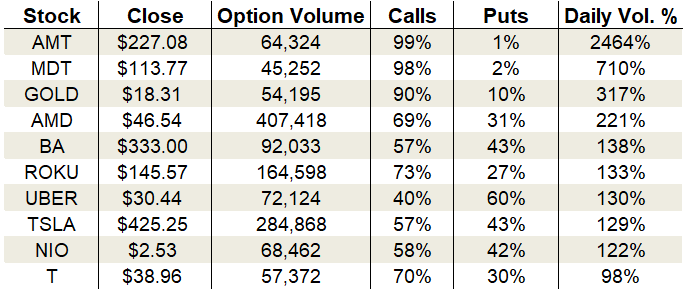

In the options pits, overall volume was as dull as you’d expect for a Christmas Eve session. Calls led the way with about 10.1 million calls trading compared to just 7.5 million puts.

Meanwhile, at the CBOE Volatility Index (VIX), the single-session equity put/call volume ratio slipped to 0.52, landing it at the same spot as the 10-day moving average.

Options trading was buzzing in Barrick Gold (NYSE:GOLD), Advanced Micro Devices (NASDAQ:AMD) and Boeing (NYSE:BA), among other big names.

Let’s take a closer look.

Barrick Gold (GOLD)

With the bullish bonanza in equities, precious metals have been relegated to the “why bother?” bucket. Many gold miners, Barrick Gold included, have been dead money since August. But on Christmas Eve, the entire space suddenly surged. GOLD stock rallied 3.1% to a new three-month high, racking up average volume numbers despite the holiday-shortened session.

The price trend is now cruising higher above all major moving averages. Bullish volume patterns buttress the renewed ascent. I count five accumulation days forming in December alone, suggesting institutions are wading back into the waters. Consider $20.07 the next upside target.

On the options trading front, traders went cuckoo for call options. Activity boomed to 317% of the average daily volume, with 54,195 total contracts traded. 90% of the trading came from call options alone.

The increased demand drove implied volatility higher on the day to 30%, placing it at the 15th percentile of its one-year range. Premiums are baking in daily moves of 35 cents or 1.9%.

The Trade: Buy the Mar $18/$21 bull call spread for around $1.

Advanced Micro Devices (AMD)

Bulls are jamming Advanced Micro Devices shares higher into year-end. The buying reached a fever pitch just before Christmas with a rousing 2.4% jump that extended AMD stock’s rally to a fourth day. All told, the year-to-date gain now stands at 152%.

As you would expect with such a meteoric rise, all technical signals are firmly in bull territory. Trend, momentum and volume patterns are all confirming buyers’ dominance. In the short run, AMD has become overbought so I don’t suggest chasing new entries. But, given the strength of the trend, any weakness should be viewed as a gift.

As far as options trading goes, calls outpaced puts by a wide margin (69% versus 31%). Total activity zipped to 221% of the average daily volume, with 407,418 contracts traded.

Implied volatility climbed to 44% or the 15th percentile of its one-year range. Premiums are baking in daily moves of $1.30 or 2.8% so set your expectations accordingly. With volatility low and the stock extended, I don’t see any trades worth tossing out here. Wait for a pullback before pouncing.

Boeing (BA)

Boeing shares received a much-needed boost on Monday after announcing the resignation of its CEO, Dennis Muilenburg, who oversaw the fallout of the two Max 737 crashes. Unfortunately, the gains were short-lived and Tuesday saw BA stock’s slide begin anew. Shares are down another 0.4% in pre-market trading.

The chart of Boeing is limping into year-end with bears in the driver’s seat. Its peak-to-trough draw down has grown to -25% with all major moving averages turning lower in the process. The past week of upward progression has done nothing to restore an uptrend. Instead, it’s created a tasty bear retracement pattern that provides a lower-risk entry for spectators looking to short the stock.

On the options trading front, calls proved more popular than puts despite Tuesday’s slide. Activity pushed to 138% of the average daily volume, with 92,033 contracts crossing the tables. Calls accounted for 57% of the session’s sum.

Implied volatility curled higher on the day to 28%, placing it at the 22nd percentile of its one-year range. The expected daily move is $5.86 or 1.8%. With options still somewhat cheap and a bearish pattern forming, put spreads are attractive.

The Trade: Buy the Feb $330/$310 bear put spread for around $7.25.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!