U.S. stock futures are headed for a quiet open this morning. If buyers can maintain control, the market will extend its rally to a fifth day in a row.

Ahead of the bell, futures on the Dow Jones Industrial Average are up 0.02% and S&P 500 futures are higher by 0.09%. Nasdaq Composite futures have added 0.13%.

In the options pits, the inevitable return toward normalcy has taken hold with call volume returning to earth. It’s still high, mind you, and outpacing puts by a wide margin, but the absolute amount is receding. Specifically, about 24.8 million calls and 19.1 million puts changed hands on the session.

The snapback in the CBOE Volatility Index (VIX) single-session equity put/call volume ratio continued with a pop to 0.61. It wasn’t enough to halt the slide in the 10-day moving average, though. It fell to 0.59.

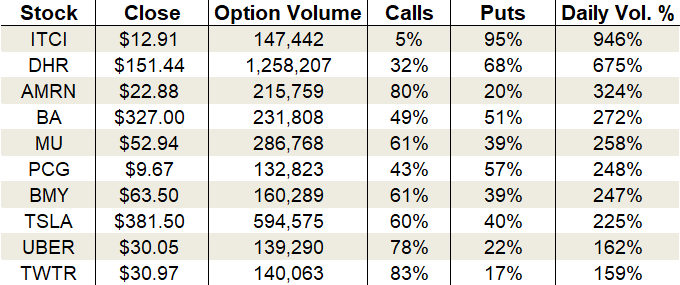

Options activity was buzzing in Boeing (NYSE:BA), Tesla (NASDAQ:TSLA) and Uber (NYSE:UBER), among others.

Let’s take a closer look.

Boeing (BA)

Boeing shares slid 4.3% Monday and are down another 1.3% in pre-market trading on reports that the aerospace giant is considering slowing or even halting production of its 737 Max airplane. The whack worsened what was already an ugly chart, ushering BA stock to the brink of a major breakdown.

This morning’s down open will test the lower end of its 2019 trading range. A breach of $320 support opens the door to a drop toward the next floor at $292. With so many other strong stocks to choose from, I see zero reasons to attempt a falling knife catch here. The headline risk is too dangerous right now.

On the options trading front, puts were favored over calls by a thin margin. Activity jumped to 272% of the average daily volume, with 231,808 total contracts traded. Puts accounted for 51% of the take.

The increased demand drove implied volatility higher on the day to 28% or the 17th percentile. If implied volatility had pushed north of the 50th percentile, then we could talk about fading the fear with a bull put spread, but despite Monday’s whack, we’re nowhere near panic levels. As mentioned previously, I don’t see a trade here.

Tesla (TSLA)

Did you know Tesla has doubled in value since June? The recovery reached a fever pitch Monday with a massive 7% moonshot. Over 18 million shares traded, making it the highest volume session since October’s earnings announcement reaction.

With the jump, TSLA stock is now testing a major resistance zone which has halted every single rally since 2017. Indeed, $390 has been a graveyard in the sky where Tesla bulls go to die. Given the momentum behind the stock’s current uptrend, however, this breakout bid has as good a chance as any to succeed.

That said, I wouldn’t fault tactical traders for tightening stops or taking partial profits into these prices.

Tesla’s rip lit a fire under options trading with calls driving 60% of the session’s sum. Total activity pushed to 225% of the average daily volume, with 594,575 contracts traded.

Fear has fled the premises and has implied volatility hovering at only the 6th percentile of its one-year range. Premiums are baking in daily moves of $9.38 or 2.5%.

If you’re willing to bet Tesla finally pops through long-term resistance, then the cheap options suggest bull calls are a solid choice.

The Trade: Buy the March $380/$400 bull call spread for around $8.20.

Uber (UBER)

Uber has been a serial disappointment since its IPO. From peak to trough, the popular ride-hailing service fell 46% with much of the damage coming after its last two earnings reports. But if Monday’s action was any indication, the stock may finally be bottoming.

UBER stock jumped 5.5% on 57.4 million shares, powering above the 50-day moving average in the process. It also brings Uber to the cusp of completing an ascending triangle bottoming formation, which confirms a shift in the balance of power from bears to bulls.

This morning’s strong open could clinch the breakout bid and set the stage for a run back to $34.

On the options trading front, traders came after calls with a vengeance. Activity swelled to 162% of the average daily volume, with 139,290 total contracts traded. 78% of the trading came from call options alone.

Implied volatility is close to a post-IPO low, suggesting premiums are cheap. Long calls or call spreads aren’t a bad way to go if you want to bet on a bottom.

The Trade: Buy the March $30/$35 bull call spread for $1.80.

As of this writing, Tyler Craig held bullish positions in UBER. For a free trial to the best trading community on the planet and Tyler’s current home, click here!