Editor’s note: This column is part of our Best Stocks for 2020 contest. Charles Sizemore’s pick for the contest is Energy Transfer (NYSE:ET).

They say lightning never strikes twice. But that’s exactly what I’m betting on in InvestorPlace’s Best Stocks for 2020 contest.

Four years ago, in the 2016 contest, I recommended leading midstream pipeline operator Energy Transfer (NYSE:ET). It was a controversial pick, as the energy sector was in free fall at the time. The fracking boom had created a surge in domestic oil and gas production, and the resulting drop in prices showed just how fragile the industry was.

As Warren Buffett once said, it’s not until the tide goes out that you can see who was swimming naked. And once energy prices crashed, it became very obvious that a good chunk of the energy infrastructure industry was swimming in its birthday suit. Several large players — including large blue-chips like Kinder Morgan (NYSE:KMI) — were forced to cut their dividends. And Energy Transfer was locked into a poorly thought-out merger with rival Williams Companies (NYSE:WMB) that threatened to bury the company in debt.

But as a value investor, these are precisely the opportunities I look for. At the time of my recommendation, the shares were down by more than half from their 52-week highs … and they still had further to fall. The shares didn’t bottom out until the end of the first quarter of 2016. It looked bad.

And then, something funny happened. The stock finally hit bottom and then went on to enjoy an epic rally. Energy Transfer finished the year up 53%, taking the crown in the Best Stocks contest.

I expect something similar this time around.

Lightning Can Strike Twice

Today, as in late 2015, Energy Transfer finds its shares under attack.

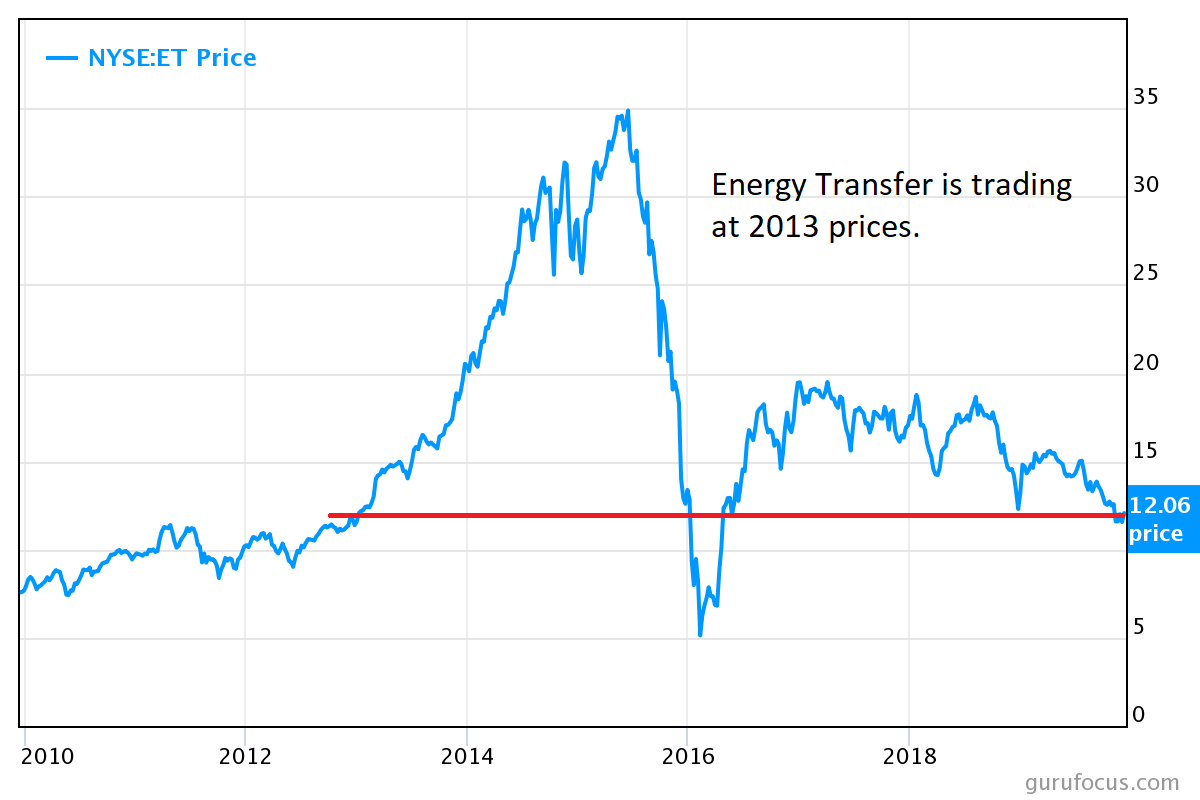

Energy Transfer’s share price is nearly 40% below its post-oil bust highs and is trading at levels last seen in 2013.

It’s hard to pinpoint a single reason why ET’s shares are struggling, but it essentially comes down to living in a rough neighborhood. Energy stocks in general have suffered of late, as a combination of poor oil and gas pricing and rising environmental activism has made the sector something of a pariah. Piling on, President Donald Trump’s corporate tax cuts made the MLP structure — which was never wildly popular with investors due to its quirky tax requirements — even less popular, as the lower partnership tax structure was less valuable in a world of low corporate taxes.

This is not to say that Energy Transfer doesn’t have some company-specific issues. Today, as was the case in 2016, an unpopular merger was part of the problem. Investors seem to be concerned that the company’s recent purchase of SemGroup risks saddling the company with too much debt.

And today, as was the case in 2016, those fears are grossly overdone. The SemGroup acquisition cost Energy Transfer a whopping $5 billion. As of its most recent quarterly numbers, ET had $92 billion in assets and $40 billion in annual revenues. With just the past two years of net income, Energy Transfer could pay for SemGroup in cold, hard cash.

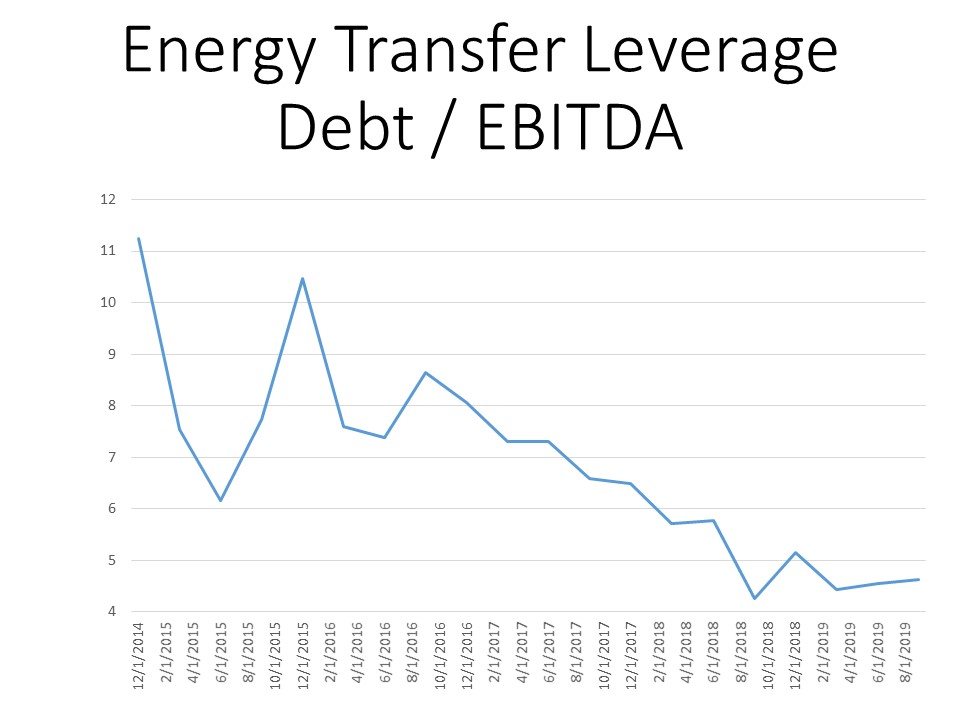

And while Energy Transfer’s leverage is still a little on the high side, management has done a fantastic job of bringing it down over the past several years.

While I wouldn’t mind seeing Energy Transfer lower its leverage even more, debt clearly isn’t the risk it was a a few years ago.

All About the Distribution

MLPs like Energy Transfer are first and foremost income investments. If you’re buying an MLP, it’s because you like the yield.

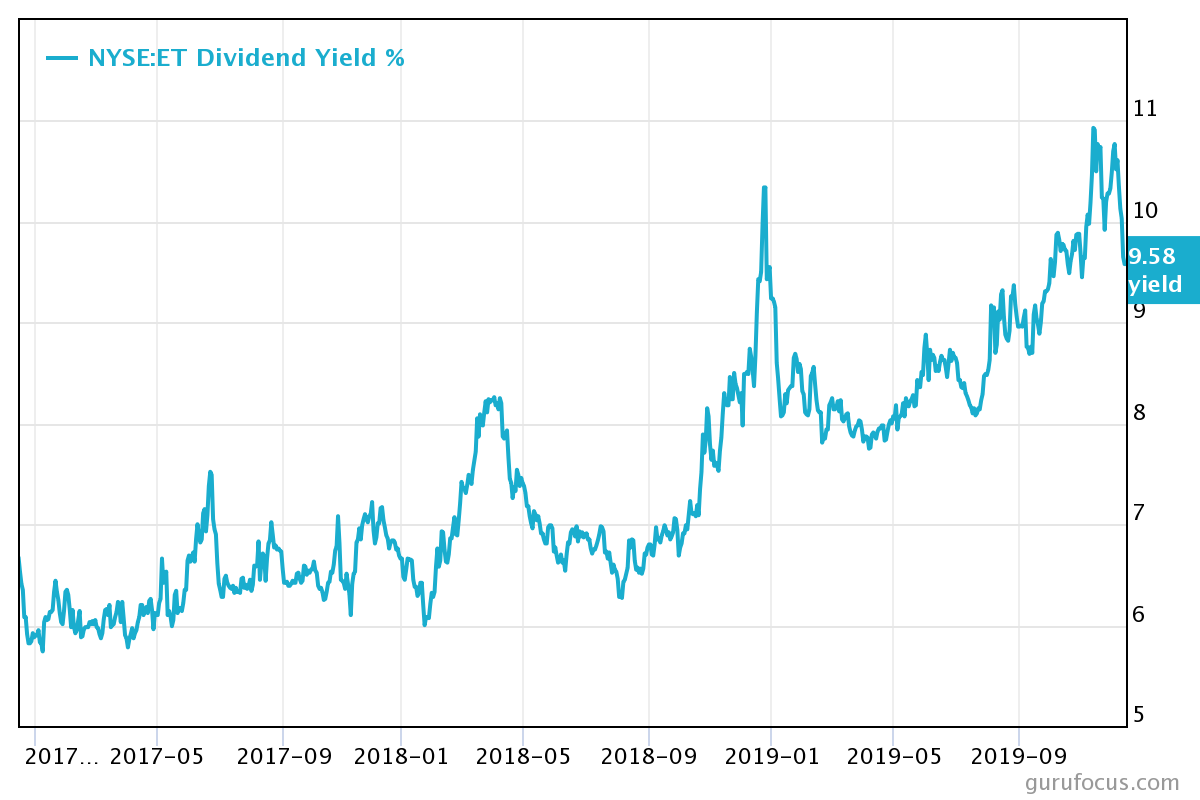

Well, in a world of pitifully low interest rates, Energy Transfer’s distribution yield looks almost too good to be true.

The shares yield nearly 10%. The only time in the company’s history that the yield exceeded these levels was during the darkest days of the oil bust in 2015 and 2016.

When I see a 10% yield, I’m naturally skeptical of its safety. In an efficient market, safe dividends at that level just flat-out shouldn’t exist.

Yet exist they do. ET’s distribution is well covered by current cash flows. As of the most recent quarterly earnings, the distribution coverage ratio (defined as distributable cash flow divided by the distribution) was 1.88, and for the nine months through Sept. 30, the coverage ratio was 1.98.

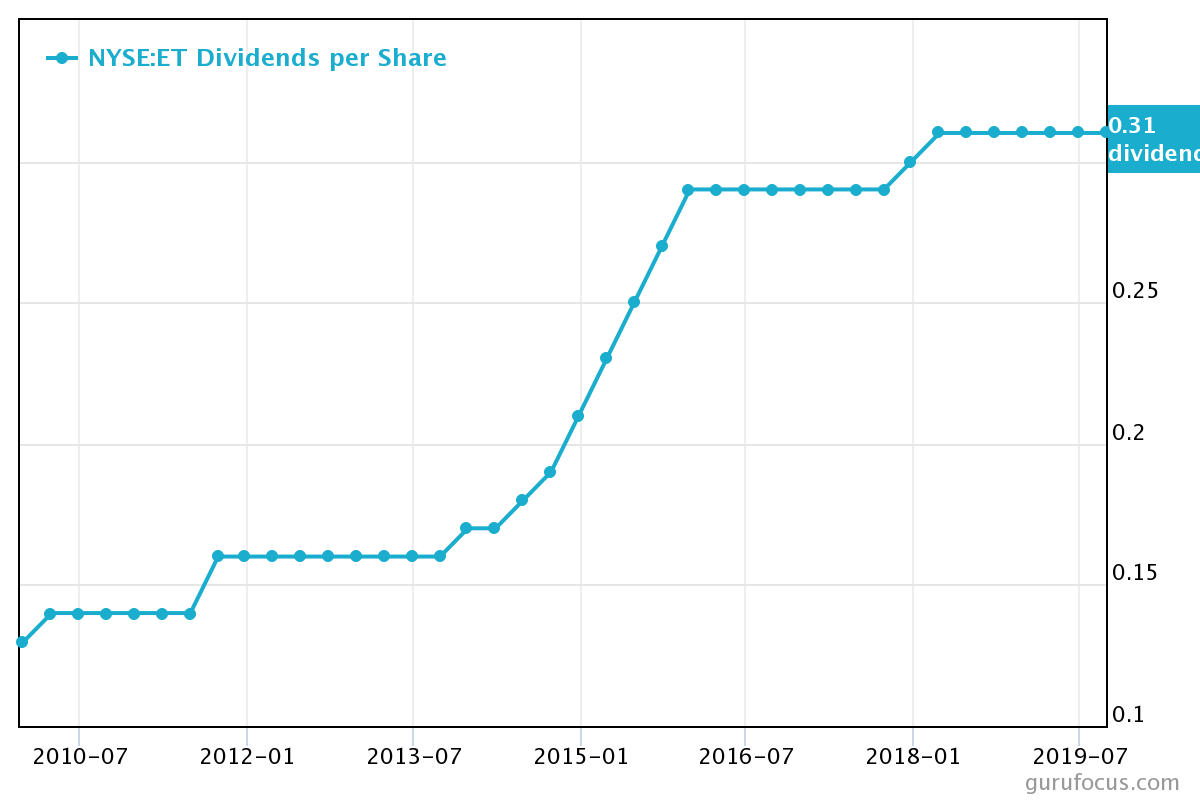

Despite the ample coverage, distribution growth has been somewhat muted in recent years. The distribution has barely budged since 2016.

Cash is never unlimited, and Energy Transfer has opted to use excess cash to pay down its debt load rather than raise its distribution. That was the right decision at the time, but the cycle of belt tightening has largely run its course. And I believe that after another quarter or two of debt reduction, Energy Transfer will be ready to aggressively raise its distributions again.

What Kinds of Returns Should We Expect?

Energy Transfer’s share price could jump by 50% and the shares wouldn’t be anywhere close to expensive. I have no way of knowing whether 2020 will bring those kinds of returns for Energy Transfer, but they’re certainly not unrealistic. And even if the capital gains end up being a little more modest, we still get to collect a current yield of close to 10%.

We’ll see what Mr. Market has in store for us in 2020. But my money is on Energy Transfer taking the crown.

As of this writing, Charles Sizemore was long ET.