U.S. stock futures are trading mixed ahead of the opening bell this morning. Volatility expectations are subdued ahead of today’s Federal Reserve meeting. The market is baking in a nearly 100% chance the Fed holds the target for its Fed Funds rate steady at 1.5%-1.75%.

In early morning trading, futures on the Dow Jones Industrial Average are down 0.13% and S&P 500 futures are higher by 0.13%. Nasdaq Composite futures have added 0.25%.

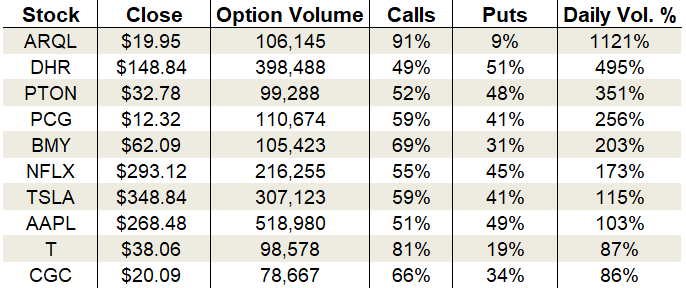

Total volume in the options pits fell off a cliff yesterday. The sleepy session saw calls lead the charge with 15.5 million contracts trading. Puts racked up 12.6 million contracts.

The dramatic drop in put demand made a huge impact in the CBOE Volatility Index (VIX)’s single-session equity put/call volume ratio. It ramped to 0.76 which is its highest reading since mid-October. With the jump, the 10-day moving average leapt to a new one-month high at 0.62. Fear has officially fled the building ahead of today’s Fed announcement.

Options traders focused on analyst actions yesterday. Peloton (NASDAQ:PTON) saw renewed options interest after Citron Research blasted the stock with a hilariously bearish price target of $5. Netflix (NASDAQ:NFLX) was downgraded by Needham on concerns over increasing competition in the streaming space. Finally, Tesla (NASDAQ:TSLA) scored an upside breakout that created a bump in call activity.

Let’s take a closer look.

Peloton (PTON)

Source: The thinkorswim® platform from TD Ameritrade

Peloton shares slid 5.7% after Citron Research issued a scathing research report that attached a price target of $5 to the stock. Even with Tuesday’s whack, $5 is so far away they might as well have set a target of zero. The bearish thesis was based on PTON stock’s unrealistic valuation and increasing competition in the space.

The timing of the note was unfortunate because PTON just triggered a clean bull retracement pattern that likely brought buyers to the yard. The stock is down another 2.4% in pre-market trading and is coming close to testing the $30.50 support zone. A break below that will officially reverse the daily uptrend.

On the options trading front, demand was split evenly between calls and puts on the session. Activity popped to 351% of the average daily volume, with 99,288 total contracts traded.

Implied volatility dipped to 87% but remained near the upper end of its range. Given the lofty premium levels, spreads are preferred over naked option trades here.

If after Citron’s report you want to join the bears’ bandwagon, then longer-term bear put spreads are a smart play.

The Trade: Buy the April $32/$22 put spread for around $4.80.

Netflix (NFLX)

Source: The thinkorswim® platform from TD Ameritrade

Peloton wasn’t the only momentum stock analysts aimed at. Netflix shares also tanked after Needham downgraded the stock to “underperform.” NFLX stock tumbled 3.1% and broke support for the first time since its uptrend kicked off in September.

Volume underscored the seriousness of the break, with 10.5 million shares changing hands. It’s the highest volume session since mid-October and reflects heavy distribution on the day.

Needham analyst Laura Martin cited increased competition as a primary reason why Netflix shareholders should be concerned. Apple (NASDAQ:AAPL) and Disney (NYSE:DIS) recently entered the space with low-priced services that undercut Netflix’s price by a large margin.

The downgrade lit a fire under options trading with calls leading the way. Total activity pushed to 173% of the average daily volume, with 216,255 contracts changing hands. Calls drove 55% of the tally.

The uptick in uncertainty jolted implied volatility up to 41%, placing it at the 26th percentile of its one-year range. Premiums are pricing in daily moves of $7.54 or 2.6%.

If you think the support break is likely to keep a lid on the stock for the next month, then bear call spreads offer a high probability path to profits.

The Trade: Sell the Jan $330/$335 bear call spread. Consider it a bet that NFLX will remain below $330 for now.

Tesla (TSLA)

Source: The thinkorswim® platform from TD Ameritrade

The short-term stalemate in Tesla shares has ended with bulls taking control. With the upside breakout, TSLA stock is on its way to filling the down gap that struck after the debut of its Cybertruck. The gains are continuing in pre-market trading with TSLA up another 1%.

A return to this year’s peak of $361.20 seems inevitable at this point. The posture of its moving averages supports a bullish bias across time frames. The 200-day, 50-day and 20-day readings are all trending higher.

Tuesday’s surge sparked renewed interest among options traders. Calls won the day by accounting for 59% of the total volume. Activity grew to 307,123 contracts or 115% of the usual daily run.

Implied volatility slipped to 42% or the 8th percentile of its one-year range. The daily expected move is now $9.15 or 2.6%.

Bull call spreads are worth a shot if you’re willing to bet on further upside. The strategy capitalizes on the lower implied volatility while containing the trade cost at a minimum for such a high-priced stock.

The Trade: Buy the Feb $350/$370 bull call spread for around $9.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!