U.S. stock futures pushed into the green after a Wall Street Journal report announced the U.S. would delay tacking on additional tariffs on Chinese products. They were originally scheduled to go in effect on Dec. 15.

Against this backdrop, futures on the Dow Jones Industrial Average are up 0.09% and S&P 500 futures are higher by 0.11%. Nasdaq Composite futures have added 0.21%.

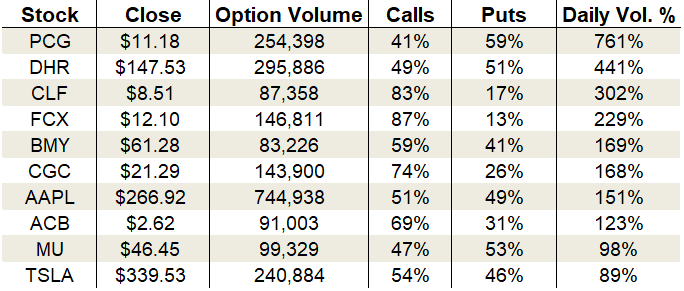

In the options pits, call trading led the way despite the market’s slide. Overall volume fell below average levels, though. Approximately 16.8 million calls and 14.3 million puts traded on the session.

As for the action at the CBOE Volatility Index (VIX), with the gap between calls and puts narrowing, the single-session equity put/call volume ratio rose to 0.64. Meanwhile, the 10-day moving average also curved higher to 0.61.

Options activity was buzzing in metal and cannabis stocks. Freeport-McMoRan (NYSE:FCX) saw renewed options interest alongside its rally to a new eight-month high. Canopy Growth (NYSE:CGC) rocketed 14% higher after the company named a permanent CEO. Finally, Aurora Cannabis (NYSE:ACB) benefited from its industry being thrust in the spotlight on the Canopy Growth news.

Let’s take a closer look.

Freeport-McMoRan (FCX)

Source: The thinkorswim® platform from TD Ameritrade

Metal and mining stocks have been serial underperformers this year, but the tide is finally turning. Freeport-McMoRan’s 4% jump on Monday thrust it center stage and had options traders swarming. The rally pushed FCX stock to a fresh eight-month high on a groundswell in volume. Over 31.8 million shares traded marking the highest volume session since Nov. 7.

Since bottoming at $8.43, FCX has now climbed 44%. The gains haven’t been enough to turn the weekly downtrend higher yet, but the daily trend is firmly in the bulls’ camp. I’m particularly impressed by the many accumulation days cropping up during its two-month run. Buyers are returning in a big way, and that could help the budding trend have staying power.

On the options trading front, traders favored calls by a huge margin. Activity swelled to 229% of the average daily volume, with 146,811 total contracts traded. 87% of the trading came from call options alone.

The increased demand drove implied volatility higher on the day to 43%, placing it at the 22nd percentile of its one-year range. Premiums are baking in daily moves of 33 cents or 2.7%.

With the stock up four days in a row, the risk-reward does not favor new entries, but the stock is an interesting naked put candidate into weakness.

Canopy Growth (CGC)

Source: The thinkorswim® platform from TD Ameritrade

Canopy Growth finally decided on a permanent CEO, and the market really likes its choice. CGC stock ripped 14% higher on substantial volume after the Canadian cannabis company named Constellation Brands’ (NYSE:STZ) CFO, David Klein, as its new head.

This year has been a terrible one for CGC stock, with it falling as much as 74% from its peak, so investors entered this week desperate for good news. The decision delivers a much-needed boost to the flagging stock, and its technical posture looks bullish for the first time in ages.

The rally carried CGC above its 50-day moving average for the first time since the downtrend began in May. Further upside now seems likely.

As far as options trading for the day, speculators aggressively bid for call options. Total activity ramped to 168% of the average daily volume, with 143,900 contracts traded. Calls accounted for 74% of the session’s sum.

Implied volatility rose to 92%, landing it at the 81st percentile of its one-year range. Premiums are juiced and baking in daily moves of $1.23 or 5.8%.

The low stock price and high implied volatility create a compelling combo for selling naked puts if you think the bottom is in.

The Trade: Sell the Jan $17.50 puts for around 90 cents.

Aurora Cannabis (ACB)

Source: The thinkorswim® platform from TD Ameritrade

CGC wasn’t the only pot stock popping on the day. The bulls’ buying binge spilled into Aurora Cannabis as well, driving the Edmonton-based cannabis producer up by 7.8%. But while CGC powered above resistance and turned its daily trend higher, ACB stock remains in an ugly looking downtrend.

Monday’s pop didn’t even carry it north of the 20-day moving average. More gains are needed before the stock comes anywhere close to a trend reversal. For now, I’d chalk up Monday’s gain as ACB stock simply riding Canopy Growth’s coattails.

On the options trading front, calls outpaced puts by a wide margin. Total activity rose to 123% of the average daily volume, with 91,003 contracts changing hands. Calls drove 69% of the day’s take.

Implied volatility fell to 128% or the 74th percentile of its one-year range. Premiums are baking in daily moves of 21 cents or 8%.

The super-low price of ACB stock makes it an unnecessary stock to trade options on. Keep it simple and play the underlying if you have an opinion. For now, the chart isn’t bullish enough to warrant bottom-fishing, and it’s too beaten-down to short. I prefer to scout elsewhere for trade ideas.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!