U.S. stock futures are gunning for a green open to kick off the last trading session of the week.

Ahead of the bell, futures on the Dow Jones Industrial Average are up 0.69% and S&P 500 futures are higher by 0.67%. Nasdaq Composite futures have added 0.82%.

Yesterday felt like a holiday in the options pits. Overall volume came in way below average, reflecting a lack of excitement by bulls and bears. By day’s end, only about 15.2 million calls and 12.5 million puts had traded.

As for the action at the CBOE Volatility Index (VIX), the single-session equity put/call volume ratio zipped back up to 0.65 and finds itself in the dead center of its 2019 range. Remember, put/call ratios are most potent when they flash extreme readings. As long as the metric is fiddling in the middle there’s not really any actionable information. The 10-day moving average held its ground at 0.60.

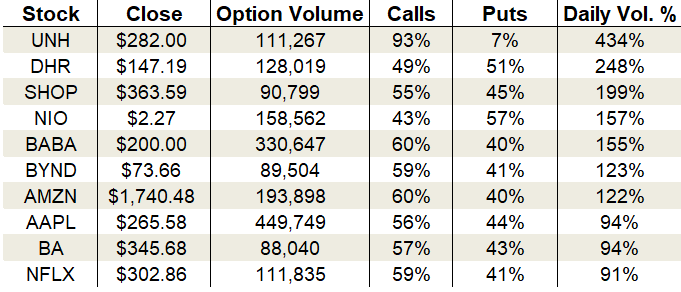

Options traders zeroed in on UnitedHealth (NYSE:UNH), Alibaba (NYSE:BABA) and Netflix (NASDAQ:NFLX), among others.

Let’s take a closer look.

UnitedHealth (UNH)

Source: The thinkorswim® platform from TD Ameritrade

Healthcare stocks awoke in a big way last month, and they haven’t looked back since. UnitedHealth is one of the best of the bunch and boasts a price pattern that should have buyers flocking. It’s a high base that has the stock chipping away at overhead resistance and primed for another upside breakout.

That said, the real reason UNH stock topped the most-active options trading list is Friday’s quarterly ex-dividend date. Shareholders of record as of Thursday’s close will receive $1.08 per share, which translates into a 1.5% annual yield.

Traders targeted call options for short-term control of the stock. Total activity ballooned to 434% of the average daily volume, with 111,267 contracts traded. 93% of the trading came from call options alone.

Implied volatility sits at 23% or the 18th percentile of its one-year range. Premiums are baking in daily moves of $4.17 or 1.5%. Bull call spreads offer a cheap way to bet on additional gains in the stock.

The Trade: Buy the Mar $280/$290 bull call spread for around $5.20.

Alibaba (BABA)

Source: The thinkorswim® platform from TD Ameritrade

Alibaba shares have awoken. After spending the last six months stuck in a range, the Chinese giant finally scored an upside breakout amid massive accumulation that signals a new uptrend has arrived. Bulls’ dominance was reaffirmed on Wednesday when BABA stock’s gap lower was gobbled up in short order. The subsequent upside follow-through has been impressive.

Yesterday, the stock rallied 3.2% on higher than average volume. Further gains seem inevitable, given the strong price action.

Enthusiastic buyers took to the options market to express their zeal. Call options dominated the session, accounting for 60% of the take. Total activity rose to 155% of the typical daily volume, with 330,647 contracts changing hands.

The uptick in demand pushed implied volatility up to 31% or the 24th percentile of its one-year range. The market now expects daily moves of $3.91 or 2%. Bull call spreads are my strategy of choice here if you’re betting with buyers.

The Trade: Buy the Feb $200/$210 bull call spread for around $4.60.

Netflix (NFLX)

Source: The thinkorswim® platform from TD Ameritrade

Netflix passed a support test on Thursday to keep the dream of higher prices alive. Its pullback was probing the rising 20-day moving average as well as significant old resistance to determine if buyers were willing to defend their newfound trend.

They were, and they did.

Thursday’s low provides a new line in the sand for your short-term bias. As long as it holds, bulls hold the upper hand. If you’ve been waiting for a low-risk entry for NFLX stock, this is it.

On the options trading front, calls outpaced puts by a healthy margin. Activity only grew to 91% of the average daily volume, though, with 111,835 total contracts traded. Calls drove 59% of the session’s sum.

Implied volatility drifted sideways at 38% or the 21st percentile of its one-year range. Premiums are pricing in daily moves of $7.22 or 2.4%, so set your expectations accordingly. The high price tag of NFLX stock coupled with its low volatility reading make bull call spreads a smart play.

The Trade: Buy the Feb $305/$315 bull call spread for around $4.80

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!