U.S. equities are backing away from their recent highs as investors worry about worsening U.S.-China trade tensions after the U.S. Senate passed a bill critical of Beijing’s handling of the protests in Hong Kong. China doesn’t like anyone to be critical of their security apparatus, and is threatening a worst-case scenario if Washington persists.

Of course, a daily drip of positive trade headlines has largely been responsible for the market’s run to new records. This threatens to undermine the bullish narrative just days after the Dow Jones Industrial Average bagged 28,000 for the first time.

Here are four Dow component stocks to sell that are weakening badly:

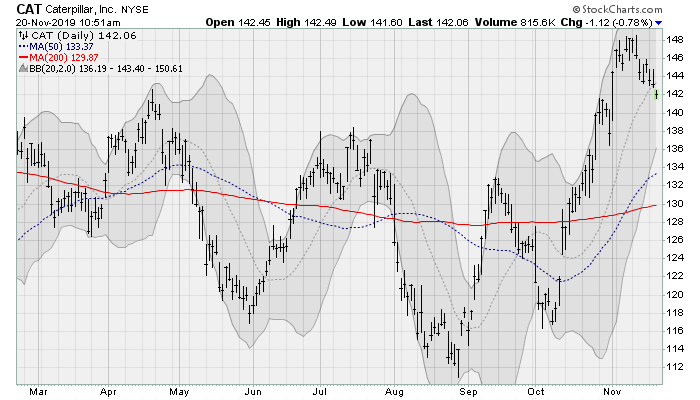

Caterpillar (CAT)

The first of our Dow stocks to sell is Caterpillar (NYSE:CAT). Shares of heavy equipment maker Caterpillar have crossed down below their 20-day moving average for the first time since early October after testing overhead support near the high set last September. This sets up a likely retest of the double-bottom lows near $115 — which would be worth a loss of nearly 20% from here.

The company will next report results on Jan. 28 before the bell. Analysts are looking for earnings of $2.40 per share on revenues of $13.5 billion.

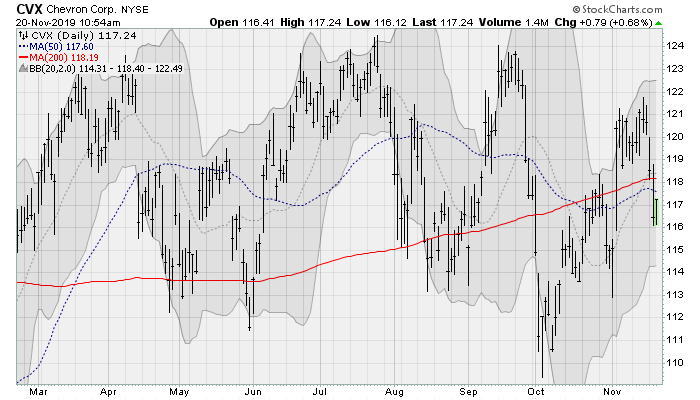

Chevron (CVX)

Energy majors like Chevron (NYSE:CVX) have been under renewed pressure this week as the sector overall remains in a three-year holding pattern. Crude oil prices have been stuck in the $50-a-barrel range since 2015, as U.S. shale supply is keeping the market well fed despite ongoing tensions in the Middle East. Worries of a global economic downturn are weighing on demand projections as well.

The stock does offer a nice dividend yield of more than 4%, but prices are likely to return to the early October low for a loss of nearly 6% from here.

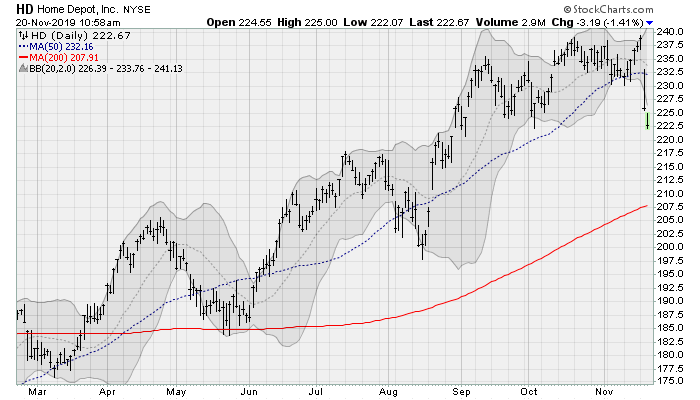

Home Depot (HD)

A post-earnings stumble sent shares of Home Depot (NYSE:HD) stumbling lower amid worries that all is not well for the U.S. housing market. Same-store sales growth of 3.6% missed analyst expectations of 4.7% badly while gross margins contracted.

Diluted earnings per share grew just 0.80% from the prior year, which is basically nothing for a stock that trades at a forward price-to-earnings multiple of roughly 22 times. And what’s worse, management cut its forward guidance.

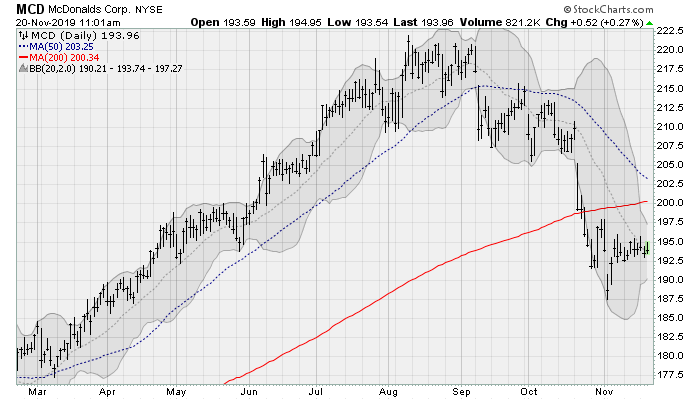

McDonald’s (MCD)

McDonald’s (NYSE:MCD) shares are in a pennant pattern that looks ready to resolve to the downside amid ongoing competitive pressures and a loss of its CEO after a relationship with a colleague was revealed. The stock is back under its 200-day moving average and looks set for a return to the summer 2018 trading range near $160, which would be worth a loss of roughly 20% from here.

Piper Jaffray research analysts downgraded the stock in the wake of its CEO departure, noting that it will take time for the company to regain leadership momentum.