November is a great time to take an inventory of the markets and the prospects for the closing weeks of the year. And as 2020 gets ready to kick off, it’s an especially great time to make sure that your portfolio is set for the coming year.

As a conservative income-focused investor and Editor of Profitable Investing, a premium InvestorPlace monthly newsletter, I’ve prepared this report as an overall assessment of the stock and bond markets as well as a tax guide for 2020.

In this report, I will provide my overall view on the stock and bond markets as well as provide needed tax guidance to take advantage of 2020 and the rest of 2019.

Stocks Still Showing Value?

The S&P 500 Index is up more than 22% year to date as of Nov. 5. From November 2016 to date, it has returned over 56%.

That’s a big number. Is there value not only to defend that performance but also to justify more?

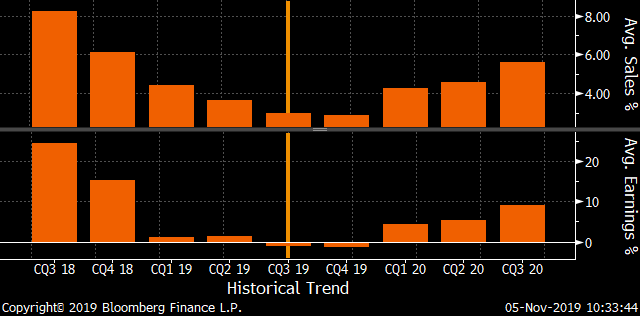

Let’s look at how the sales and earnings are shaping up for the third quarter.

So far, out of the 505 stocks of the S&P 500, 386 have reported. On average, those companies have surprised market estimates for sales gains by 0.56% and for earnings by 4.68%.

That’s pretty good considering that the compiled estimates of Wall Street analysts tracked by Bloomberg were pretty bearish for this reporting season.

But it gets a bit better. Overall average sales are up 2.97% while earnings, which were projected to drop by 4% or more, are down by only 1.15%.

And if we take a look at the compiled projections for the current fourth quarter and those into 2020, we see that average sales are expected to climb along with earnings, approaching sales gains nearing 6% and earnings approaching 10%.

You will notice that this plotted graph, for good reason, is U-shaped.

First, the drop-off through 2018 into 2019 reflected the fall from gains related to the 2017 Tax Cuts & Jobs Act (TCJA), which significantly bolstered sales growth and earnings.

Now that the impact of that is being felt less, normalcy is returning into 2020 gains, reflecting organic gains in sales and earnings after the tax-driven gains.

Second, I continue to notice optimistic calls by analysts on a regular basis.

This helps the investment banking and relationship managers with companies as well as helping to drive their fund management asset gathering.

By posting optimistic numbers short term, they can push out similar better numbers for future quarters.

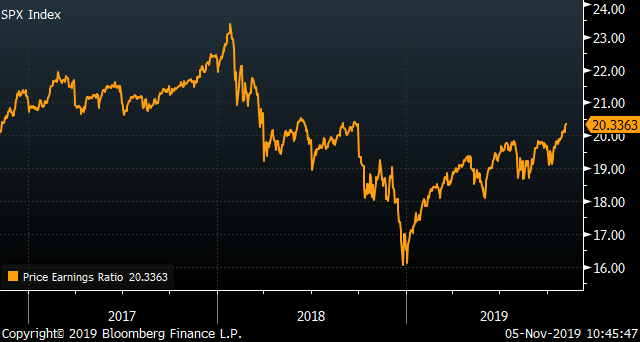

But what about stock valuations for the S&P 500?

The price to earnings (P/E) ratio is sitting at 20.34, which is up from the December 2018 low of 15.99, but it’s well below the high of 23.42 in early 2018. That means there’s still some value left.

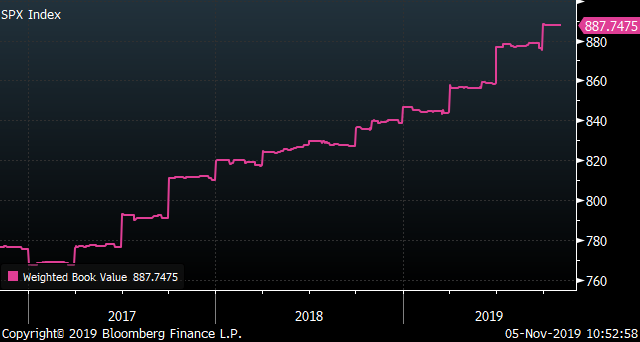

Then, if we look at more grounded valuation measures, the price to book (P/B) of the S&P 500 is sitting at 3.46, up again from late 2018 but not as high as in September of 2018.

But the key to note about the P/B is what has been happening to net company values inside the index.

This shows steady upward progress throughout 2017, 2018 and through 2019, gaining 16.07% from early 2017 to date.

So, the underlying companies have been building up net intrinsic value and not just experiencing stock price inflation.

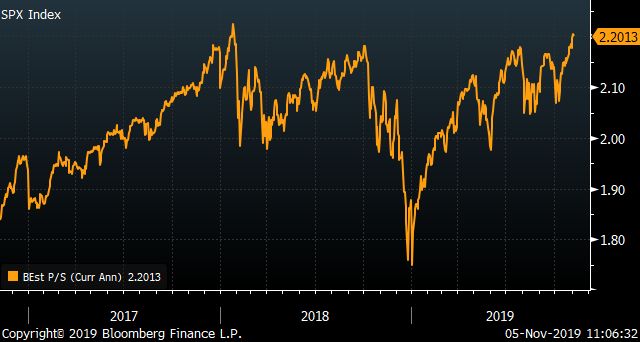

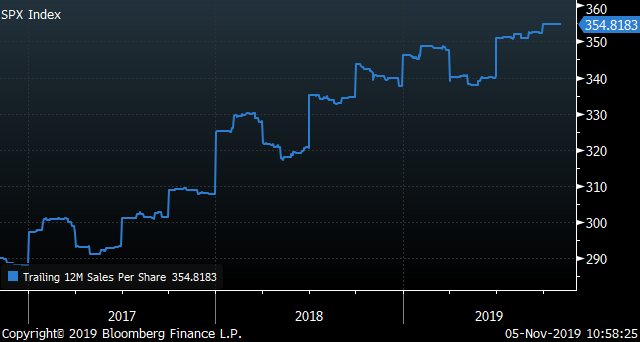

Price to sales (P/S) is another better metric than P/E since earnings can be manipulated. But sales are sales.

And the compiled P/S for the S&P 500 members is sitting at 2.20 times, up from the low of 1.75 at the end of 2018 but still not quite as high as in January 2018 (2.23 times).

The P/S shows the average price for the S&P 500 Index is a bit higher than does P/E or P/B.

But, the underlying sales of the 505 stocks continue to show relative steady gains over the past three years. This adds some justification for the market’s pricing.

While the S&P 500 Index has gained and returned quite a bit this year, there’s an argument for further gains into 2020.

And with some of the slower growth segments in the US (largely the Midwestern manufacturing and agriculture sectors) set to benefit from Phase I of the US/China trade deal, the results might bring further gains from the companies in those sectors and those that serve them.

That would certainly add to the value fundamentals of the S&P 500 Index.

Are Bonds Still Attractive?

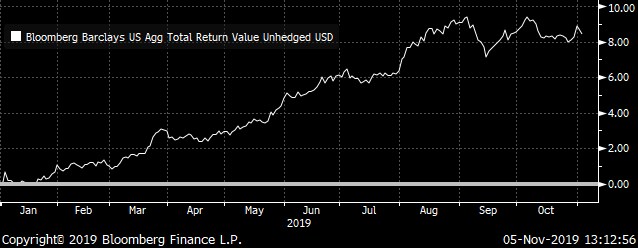

While stocks might get most of the headlines, bonds have also seen many great performances over the past 10 months.

The overall US bond market as tracked by the Bloomberg Barclays Aggregate Index has returned over 8.4% year to date as of Nov. 5.

There are specific reasons for the great returns on US bonds.

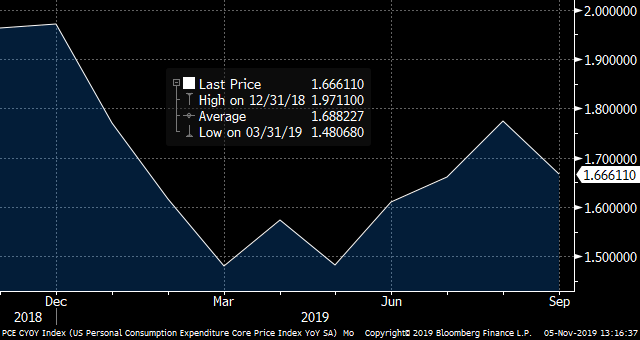

To start, inflation has fallen and remains very subdued. The Personal Consumption Expenditure (PCE) core index is down to 1.67%.

This measures the entire consumer spending and not just a contrived market basket like the Consumer Price Index (CPI).

And not only is the PCE the stated preferred metric for inflation by the Federal Reserve Bank and its Open Market Committee (FOMC), but it’s the barometer for inflation, which is cancer for bond investors.

With inflation low and falling, bonds continue to benefit. And the FOMC has stated that it would like to see the level of inflation at least at 2% and up to the mid-2% range.

This has aided further monetary easing by the FOMC in reducing the fed funds target rate and the rate paid on excess deposits.

It has further aided the bond market with a new version of quantitative easing (QE) whereby the Fed is buying new rounds of Treasuries as well as providing direct access to repurchase agreement (repo) refinancing.

Repos are transactions wherein banks and financials borrow money by selling Treasuries and agree to repurchase them at set prices, with the sell and buy prices reflecting an implied interest cost.

In addition, there continues to be waves of major bond buying from insurance companies, pension funds and other retirement investment funds that want bonds to cover rising liabilities from a growing number of retirees.

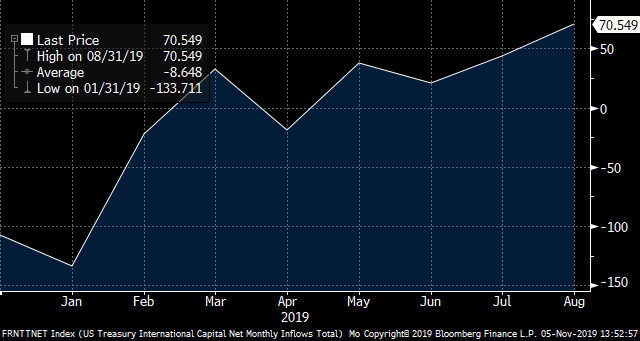

Then we come to the problems of the rest of the globe.

With Europe and Asia slowing down or actually in recession, central banks have driven interest rates into negative yields, which has extended into their bond markets.

Right now, there is over $13 trillion in negative yielding bonds outside the US market.

Negative yielding bonds mean that US bonds with positive yields are more attractive for global investors as well as US investors.

The result is a massive inflow of investment into the US markets, including bonds. And that demand continues to rise.

With expectations for low inflation, a supportive FOMC, and strong ongoing demand, overall US bonds should continue to be well bid by investors into 2020.

When looking specifically at sectors in the US bond markets, I continue to focus your attention on corporate bonds and municipals.

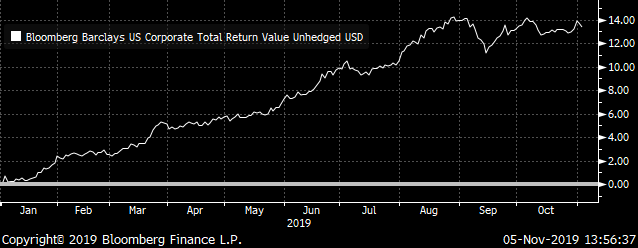

Corporate bonds as tracked by the Bloomberg Barclays Corporate Bond index have returned greater than 13% year to date as of Nov. 5.

Corporate bonds continue to benefit from the overall attraction of the US bond markets and from the continued economic expansion in the US, which is bringing rising corporate revenues that in turn are improving credit capabilities and ratings for existing and new bonds.

And while there are some cracks in the lesser credit sector of the corporate market, demand for core investment grade bonds continues to be well-supported.

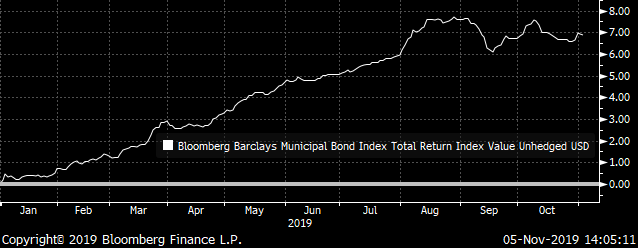

For municipal bonds, the market benefits just like for corporates; from the US’s overall positive conditions plus some other benefits.

To start, with tax revenues on the rise with the expanding US economy, state and local authorities are flush and have less need to borrow.

And voters are less inclined to approve a lot of newer issues. This means supply is more contained and that credit conditions of issuers are all the firmer. These conditions support higher bond prices and lower yields.

This is showing up with the return for US municipal bonds. The Bloomberg Barclays Municipal Bond Index has returned nearly 7% year to date as of Nov. 5.

Then we come to the Tax Cuts & Jobs Act of 2017 (TCJA). Inside the TCJA, it limits the deduction for state and local taxes (SALT) for federal income taxes.

This means more and more households want and need to shelter more income from both state and federal income taxes. This is driving demand for muni bonds, also adding to the ongoing demand.

With inflation showing no indications of a sustained rise, the FOMC remains supportive and underlying demand continues to thrive for bonds. That means US bonds, and especially US corporates and munis, should continue to deliver into 2020.

Be Tax Prepared

One of the most important things to address as 2019 winds down and we get set for 2020 is to be tax prepared.

There is still time to limit tax liabilities for this year while also getting into a better state for the next year. Here are some of my strategies to accomplish both.

Maximize Your Retirement Contributions

This may be the simplest piece of tax advice you’ll ever hear, and the most often repeated.

Yet, according to a 2017 survey by Gobankingrates, more than a third of Americans in the workforce aren’t setting aside anything for retirement and have not one penny in a retirement account.

Even worse, 55% of Americans surveyed have less than $10,000 saved for retirement. And the yield of the S&P 500 Index at 1.88% won’t make that sum work for a viable retirement. Nor shall US Treasuries with yields at best at a mere 2.26%.

Retirement Goals

This is unfortunate because Uncle Sam dangles some pretty enticing carrots for people who want to build up a retirement fund.

If your employer sponsors a 401(k) plan, you can kick in as much as $18,500 this year if you’re under 50, and $24,500 if you’re over 50.

Since 401(k) contributions chip away at your adjustable gross income, a worker over 50 in the top federal tax bracket can save more than $9,000 a year by shoveling the maximum amount into a 401(k).

And while those limits are set to be increased for 2020, they are still quite attractive for the 2019 taxable year.

Many people don’t realize it, but you can set up an IRA and contribute to it even if you already have a 401(k) at work.

For this taxable year 2019, you can funnel up to $6,000 into either a Traditional or a Roth IRA.

With a Traditional IRA, your contributions are tax deductible, but your withdrawals are taxed as ordinary income.

With a Roth, there’s no tax deduction on the way in, and no taxes on the way out.

But a word of caution on Roth plans: There’s no guarantee that politicos of the future might not change the rules on tax-free withdrawals.

The government does impose income limits for contributing to a deductible Traditional IRA or a Roth.

For traditional IRAs, the deduction phases out once your “modified adjusted gross income” climbs above $64,000 ($103,000 for couples).

For Roths, the phase out begins at $123,000 ($189,000 for couples). You can check all the fine print in IRS Publication 590.

A final incentive: Most leading discount brokers, such as Fidelity, Schwab and TD Ameritrade, charge no setup or annual maintenance fee for IRAs.

So what are you waiting for?

Offset Your Capital Gains With Tax Harvesting Losses

To minimize the bite when you’ve got a large gain, book some losses.

The tax code even lets you use up to $3,000 in net capital losses per year (losses in excess of gains) to shrink your ordinary income.

Where will you find losses to harvest to offset your gains? Some may be obvious, such as when you see a minus sign on your monthly brokerage statement. Others may take a little sleuthing.

Harvest Not Just for Crops

I’m always on the lookout for the best-performing investments that I can find.

Each month, I review the list of holdings in my portfolio and ask the question, “Would I buy it all over again, and at what price?”

And if I can’t answer the first question in the affirmative, or the price I would buy it at is below where the market is valuing the stock, then I sell that position. I also do the same within market segments.

Take, for example, consumer products companies.

Traditionally, consumer stocks have always been a defensive way to get gradual growth and dividend income, which are sustained even during general market woes.

But what I identified was that consumer tastes have been changing, particularly in the US market. Processed and packaged foods as well as other consumer goods like soap and household goods have competition from fresher and less prepared foods and alternative goods.

The consumer companies that were ahead of that learning curve have resumed their growth and income for investors. But those that were holding on to their traditional ways began to lag or worse. So, I began to weed out the laggards and recommended the change makers.

Same industry and market segment, different stocks. By selling the at-risk companies and swapping into the stronger companies, investors get better prospects.

And the sale of the struggling company stock generates a tax loss that can be used to offset other investment gains when they’re sold.

The only caveat is that the new company stock must be bought at least 31 days later to avoid the “wash sale” rule, since they would be similar stocks in the eyes of the IRS.

Often, a tax swap gives you a chance to upgrade the quality of your investment. By switching to a stronger company in the same industry, or a better-managed fund in the same sector, you can put yourself on a path to improved returns.

Another way to avoid the wash sale rule is to harvest a loss in a stock, bond or fund and redeploy the proceeds in a different security with much better prospects.

Use Appreciated Stock for Your Charitable Giving

If you’ve got a heart for charity, you can make your dollars go further by giving appreciated assets, such as stock that has risen in value, rather than cash. Some of my favorites charities are those supporting dogs, higher-education as well as Autism and Alzheimer’s research.

As long as you’ve held the asset at least a year and a day, you can take a deduction for the current market value, rather than your original purchase price. Note, however, that master limited partnerships (MLPs) don’t qualify for this generous treatment.

Giving Gives Back

What if you’re not sure which charities you want to help?

Open an account with Fidelity or Schwab’s charitable gift funds. Both of these funds will let you start with cash or securities valued at $5,000 or more.

You get an immediate tax deduction when you establish the account, and you can determine the gifts at your leisure. Meanwhile, your money will be invested in a mutual fund (or mix of funds) of your choice.

This allows strategic use of the donation in years where you can better maximize your income tax deduction. And in turn, you can decide when and where the donations are distributed.

For example, instead of making two smaller donations in two separate years, you can make the same donation amount to the fund in one year in order to get a bigger and more immediate tax deduction. From there, you can make subsequent distributions over the coming years.

The goal of this strategy is to get a bigger charitable tax deduction in a particular year when you have already earned a higher amount of current taxable income or are projecting that you will. Or if you project that the following year will be a bit leaner in your taxable earnings.

The only requirement is that all net income generated in the taxable year in the fund must be distributed in the taxable year for the fund.

Make Tax-Free Gifts to Family Members

Each year, many parents and grandparents make liberal use of this technique. Starting in 2018 and continuing into this tax year of 2019, each individual can give up to $15,000 a year to each beneficiary without eating into a lifetime exemption from estate or gift tax.

If you’ve got a child or grandchild you wish to help on the road to higher education, consider opening a 529 college savings account. The same gift-tax savings I mentioned above apply here.

In addition, for really big givers, our dear Uncle Sam allows you to bunch together up to five years’ worth of gift-tax exemptions. And for 2018, those 529 plans now allow for spending on private education costs for kindergarten through prep school.

Family Values

Thus, a husband and wife could channel as much as $140,000 into each of their children’s 529 accounts, without affecting the lifetime exemption.

Any earnings accumulate tax-free inside the account, and there’s no tax on withdrawals for legitimate educational expenses (tuition, fees, room and board, books, etc.).

Many states offer good 529 programs. These state-sponsored plans let you sock away cash for a child’s or grandchild’s college expenses without paying a penny of taxes on the interest, dividends and capital gains that build up in the account.

Starting last year in 2018, you can contribute up to $15,000 a year to a beneficiary’s 529 plan under your annual exclusion from federal gift tax.

For 529 plans, you can even bunch as many as five years’ worth of gift-tax exclusions into a single year—a pretty hefty “endowment” for a child’s education.

Each donor is entitled to make these gifts, so a husband and wife could theoretically contribute up to $150,000 at one time to a single beneficiary.

One of the more attractive plans is the New York 529 plan for its low operating costs and $25 minimum to set up an account.

The New York plan provides three age-based options (which shift automatically to a more conservative allocation as the beneficiary nears college age), as well as 12 individual portfolios made up of Vanguard stock and bond funds. There’s also a fixed-rate portfolio with a low, but guaranteed yield.

With the US stock market as high as it has been, I continue to recommend alternatives and 529 plans that offer choices beyond the broad domestic equity indexes.

For example, the TD Ameritrade 529 plan, sponsored by the state of Nebraska, includes a real estate investment trust (REIT) fund. No minimum contribution; no setup or maintenance fees.

The state of Nevada’s SSGA Upromise plan gives you even more control. You can pick from a palette of 15 exchange-traded funds, including both domestic and international real estate funds, two emerging-markets equity funds and a domestic high-yield (junk bond) fund.

Minimum to open an account: $250. No setup fee, but Nevada does charge a $20 annual maintenance fee.

Exercise Your Business Expenses

If you own a business or even just earn income as a consultant or under contract under IRS Schedule C, you can pull any number of strings to reduce your taxes.

For instance, you can contribute up to $7,000 to a Health Savings Account for your family ($8,000 if you’re 55 or older). That sum comes “off the top” of your adjusted gross income, so it’s one of the most efficient tax breaks available.

Expenses Save

Thinking about purchasing new office equipment? Ask a tax adviser about Section 179 expensing, which will let you write off the entire cost up to $1,000,000.

This also extends the maximum for capital equipment deductions to $2,500,000 for small-ish businesses, as larger companies lose this deductibility for investments exceeding $3,500,000.

The Code also lets you deduct up to $10,000 in organizational expenses for a start-up business as long as the business began operations this year.

In short, this is the time to nail down tax benefits you may have overlooked in years past. Don’t wait for year end when every accountant and tax advisor is up to their ears in business.

Get in touch with your tax advisor now and find out which of the breaks I’ve mentioned here will deliver the best results for you.

Cashflows, Tax-Free

The IRS always has its hands out on behalf of the US Treasury when it comes to taxes including income from your investments. And they are just the start, as state and local tax authorities are right behind the IRS looking for their cut as well.

And with the Tax Cuts & Jobs Act of 2017 (TCJA) discussed earlier, saving taxes is all the more important with the reduction in state and local tax deductions on federal tax filings.

For many higher tax-bracket investors, state and local tax rates can be increasingly onerous. And of course, if you can cut out federal tax liability, your net return will be even higher.

Tax-Free Cash

This is where tax-free money market funds come in. There are several national funds that are exempt from federal income taxes and there are individual state funds that are exempt from federal taxes and state taxes as well.

This is particularly advantageous for high-tax states including New York and California.

Vanguard and Fidelity offer many individual state tax-free money market funds that are open-ended meaning that you can buy in or out each day at the ending net asset values of the funds.

These funds invest in very short-term municipal bonds that often have just days or weeks to final maturities. This means very little to nearly no interest rate risk in these funds and the ease of being able to move money into and out of the funds easily on a day by day basis.

In addition, if you’re at risk of being caught in the alternative minimum tax (AMT), these and other fund companies including JP Morgan (JPM) also offer AMT tax-free municipal money market funds.

For a general national tax-free money market fund, check out the JP Morgan Tax Free Money Market Fund (JTFXX).

It has an average day to maturity count of 14 days, making for a very stable fund. And the tax-free yield is currently running around 1.27%, which includes the modest expense ratio of 0.20%.

On an after-tax basis, the funds taxable equivalent for the 37% bracket is 2.02%. And it also means one less line item on your taxable income list come tax reporting time.

Then there’s the longer-term municipal bond market, which adds to tax-free cashflows. I’ve been a big proponent of investing in muni bonds for some time.

A few great closed-end muni funds are the BlackRock Municipal Income Trust II (BLE), the Nuveen Municipal Credit Income Fund (NZF), and for AMT-liable investors, there’s the Nuveen AMT-Free Municipal Credit Income Fund (NVG).

Right now, they have an average taxable equivalent yield of over 7.00%.

All My Best,

Neil George