U.S. equities are holding near new record highs on Thursday, as investors continue to focus on familiar themes. Will China and the United States sign a trade deal? Will the Federal Reserve’s three quarter-point interest rate cuts be enough to re-energize the economy. And is the U.S. consumer ready to open their wallets for the upcoming holiday shopping season?

That last point will soon be answered with Black Friday just two weeks away. Bargain-hunting investors are already making their move, biting up a number of key retailer stocks. Here are four on the move.

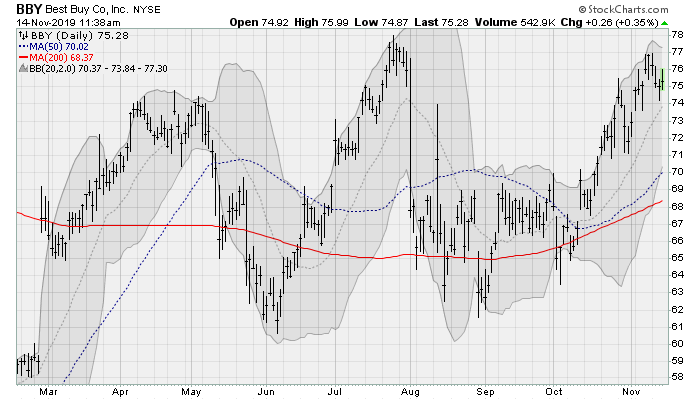

Retail Stocks to Buy: Best Buy (BBY)

Best Buy (NYSE:BBY) shares are rallying to test a massive multi-top overhead resistance level near the mid-$70 range that goes back to early 2018. The big catalyst is likely to be anticipation of the upcoming release of next-generation gaming consoles in 2020 from Microsoft (NASDAQ:MSFT) and Sony (NYSE:SNE). Those releases are expected to fuel another big upgrade cycle by avid gamers.

The company will next report results on Nov. 26 before the bell. Analysts are looking for earnings of $1.03 per share on revenues of $9.7 billion.

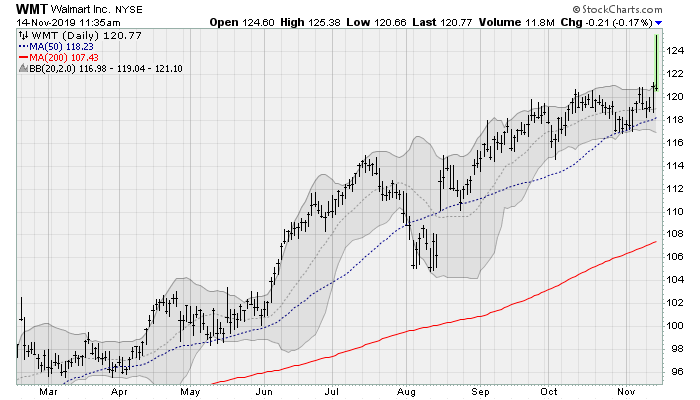

Walmart (WMT)

Walmart (NYSE:WMT) is of course another huge Black Friday shopping contender. WMT stock is enjoying a breakout above its uptrend channel resistance today to push shares to new highs. This after the company reported better-than-expected earnings of $1.16 per share on a 2.5% increase in revenues from the prior year. Analysts were calling for earnings of $1.09 per share.

U.S. comparable-store sales have grown by 2% for eight consecutive quarters while e-commerce sales growth has been clocking in at more than 30% annually.

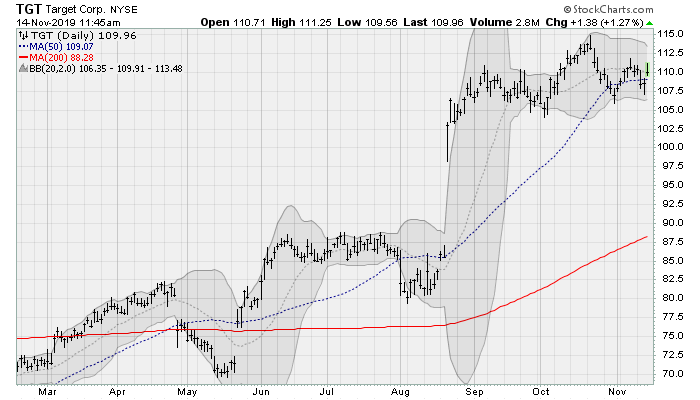

Target (TGT)

Target (NYSE:TGT) shares, another Black Friday favorite, is consolidating above its 50-day moving average and looks ready for a push to new highs after nearly doubling off of the lows set in late 2018. Watch for a move up and out of a four-month consolidation range.

The company will next report results on Nov. 20 before the bell. Analysts are looking for earnings of $1.19 per share on revenues of $18.5 billion.

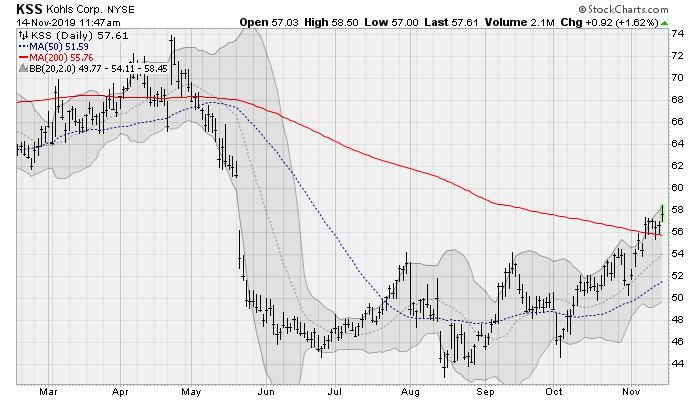

Kohl’s (KSS)

Kohl’s (NYSE:KSS) is our final name here, famous for its “Kohl’s Cash” promotions on Black Friday that link big discounts on game consoles and other electronics to gift cards that can be redeemed for other items. Shares are breaking over their 200-day moving average for the first time since late April, ending a seven-month basing pattern.

The company will next report results on Nov. 19 before the bell. Analysts are looking for earnings of 86 cents per share on revenues of $4.4 billion.

As of this writing, William Roth did not hold any of the aforementioned securities.