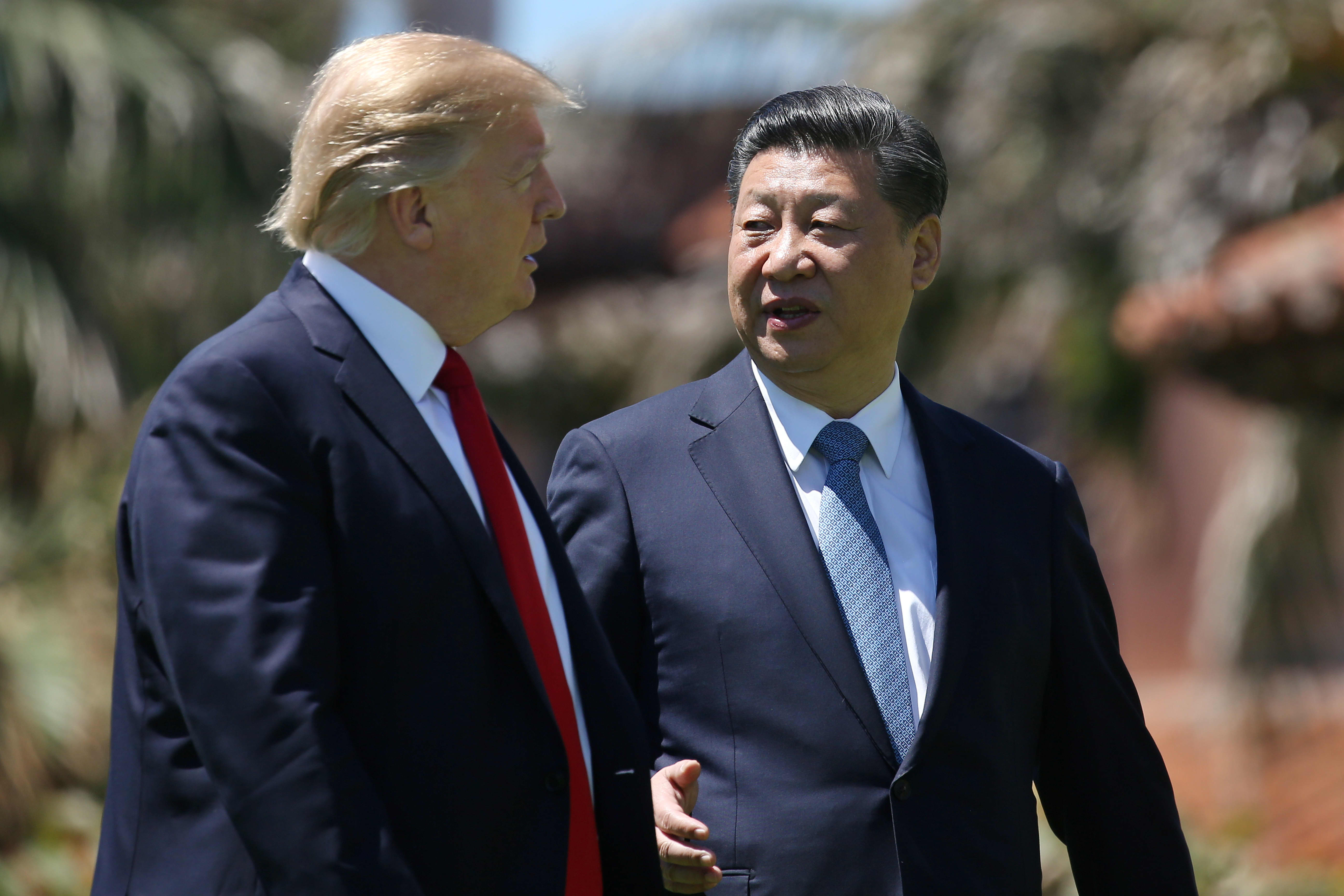

President Donald Trump and China’s President Xi Jinping chat as they walk along the front patio of the Mar-a-Lago estate after a bilateral meeting in Palm Beach, Florida, U.S., April 7, 2017.

Carlos Barria | Reuters

Ever since President Donald Trump said he and President Xi Jinping would meet to sign a trade deal, Wall Street has been hanging on every speculative word about where and when that signing might take place.

So it was not surprising when stocks sold off late Wednesday morning on a Reuters headline that quoted Trump administration sources who said the phase one trade deal could be delayed until December and that Europe is a likely venue. CNBC would later confirm the report.

A November deal was expected, and there were reports that a U.S. location was under consideration, like Iowa, as suggested by the administration, or Alaska and Hawaii, as proposed by China. An absolute deadline for a deal would be Dec. 15, the day a new round of tariffs on Chinese goods is set to go into effect.

Stocks have run up on optimism about trade progress, but have been languishing in the past two sessions, as the market digests recent gains to new highs, and no new information has materialized on the trade front. Trump and Xi had been expected to sign the agreement in Chile on the sidelines of the APEC meeting, but Chile announced last week that it could not host the Nov. 16 meeting due to protests in the country.

‘Booster shot’

“We basically used up the good news and we’re in this time where we need a booster shot. We need some news to keep us going,” said Art Cashin, director of floor operations at UBS.

Art Hogan, chief market strategist at National Securities, said investors are anxious for details on the signing. “Once you find the location, you slap a date on it. Things get signed, and we move on. This would remove a lot of the headwinds,” said Hogan.

Hogan said investors want to see a phase 1 deal that stops the escalation of tariffs and possible rollback of others. “If you stop the escalation, it puts certainty back into the economy and you might even get some cap ex spending which has been missing for the past 18 months,” he said.

Cashin said the market was not concerned about where the meeting will be held, but the report on the timing was key since the longer talks go on, the more chances there are they get derailed. Cashin said he did not believe Xi would come to the U.S. for a meeting because of it could look like he was giving ground to Trump.

No ‘state’ visit

Evercore analysts, in a note Wednesday, also said Xi won’t come to the U.S., and they hypothesized a list of possible trade outcomes.

“President Xi won’t come to the US —not Iowa, Hawaii, Alaska, DC or elsewhere. No ‘state’ visit. The ‘unpredictable’ (Trump) risk precludes this. Mistrust dominates,” the Evercore strategists noted. “The interim ‘Phase 1’ deal is insufficient to command presidential signatures. We expect ministerial-level signing at the ministerial level.”

As of now, Evercore sees only three points of agreement, and the Chinese request for a roll back of existing tariffs was not one of them. They see a delay in the Dec. 15 tariffs, agricultural sales to China and Chinese financial markets open further.

Other policy strategists believe a deal will be reached, including agricultural sales to China and U.S. relief on the blacklisting of Chinese telecom firm Huawei. Dan Clifton, head of policy research at Strategas, said U.S. exports of liquified natural gas have again become part of the discussion, and a source close to the discussions told CNBC energy was part of phase 1 talks.

‘Catastrophic for both sides’

“We’re at the end, and there’s volatility at the end of the discussions,” said Clifton. “But the cost of a blowup here would be catastrophic for both sides. I think you have a 15% chance of a blowup. We’re really trying to move the Rubic’s cube so both sides can walk away and be able to declare victory.”

Tom Block, Washington strategist at Fundstrat, said a deal will get done, and Trump may not need a signing ceremony as much as the opportunity to make a speech about the success of the deal.

“Whether it’s done with a phone call and sending their ministers to sign it, or they can figure out some signing ceremony. I don’t think that’s as important as that they seem to be closing in on a deal,” Block said.

Clifton said the Trump administration is eager to get a deal done because of a softening economy, but China is as well, since it has been concerned about rising food costs and a loss of exports. He said a deal will get done, regardless of whether Trump and Xi meet.

“I think everybody is giving each other an exit ramp. I can feel both sides preparing their part to sell their domestic audiences a deal. That’s why I think there’s going to be a deal,” he said.

Clifton said Trump’s re-election efforts are a factor. He noted that Commerce Secretary Wilbur Ross made the surprise announcement last weekend that he did not expect the U.S. to put tariffs on European autos. Europe was expected to be the next front int he administration’s trade wars.

“This is a major change in policy. Nobody in the administration gets in front of auto tariffs,” he said. “What you’re seeing is the president doesn’t want to put more tariffs in place ahead of the election. That should give you guidance on China.”