U.S. stock futures are galloping higher in a continuation of last week’s breakout to record highs. With resistance now finally felled, buyers are in full control and a run into year-end appears likely.

In early morning trading, futures on the Dow Jones Industrial Average are up 0.57% and S&P 500 futures are higher by 0.55%. Nasdaq Composite futures have added 0.72%.

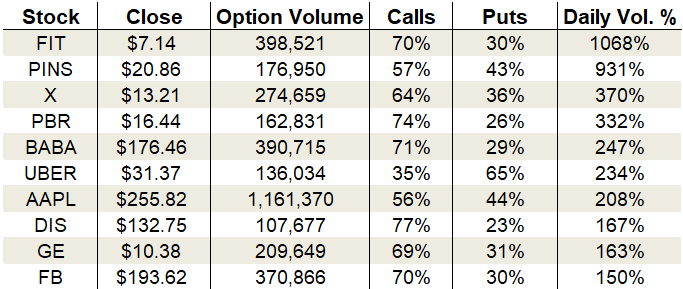

Friday’s ramp lit a fire under call volume in the options pits. By day’s end, 24.7 million call contracts traded versus just 18.6 million for puts. Calls dominated at the CBOE Volatility Index (VIX) as well, where the single-session equity put/call volume ratio slammed down to 0.53, close to its 2019 low. Meanwhile, the 10-day moving average slumped to 0.60 — a six-week low.

Options activity was buzzing in Pinterest (NYSE:PINS), Apple (NASDAQ:AAPL) and Disney (NYSE:DIS) among other big names.

Let’s take a closer look:

Pinterest (PINS)

Source: ThinkorSwim

Pinterest was one of the biggest losers on Wall Street Friday losing 18.6% after the technology company reported disappointing earnings. I’ll focus primarily on the technicals.

Since its April IPO, Pinterest has been trying to find its footing and establish a trend. Thus far all we’ve seen is a trading range establish between $24 and $36. Friday’s beatdown ushered PINS stock to a new all-time low, blasting through support in a big way. Because of its relatively short public life so far, and the fact that it’s now at a record low, there isn’t any previous price action to go off of.

While Friday’s intra-day rally did recoup some of the losses, rallies have to be viewed as suspect for now. Until we get back above $24, I suggest bulls shop elsewhere.

Options trading exploded to over nine times the average daily volume, with 176,950 total contracts traded. Calls drove 57% of the take. The typical post-earnings volatility crush was on full display, driving implied volatility back down to 54% or the 25th percentile of its range.

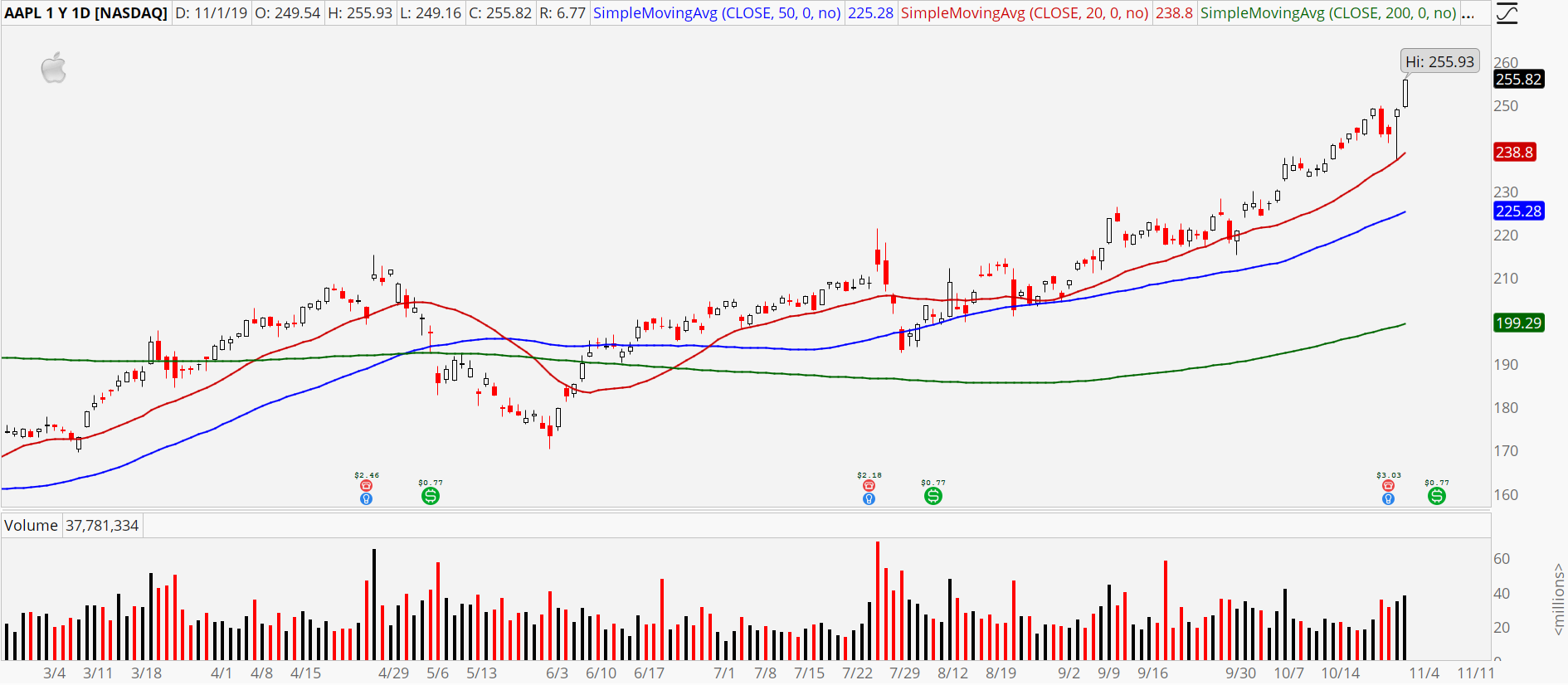

Apple (AAPL)

Source: ThinkorSwim

Apple is on fire. Initially, the reaction to its quarterly report was subdued. But the small, one-day jump was followed up on Friday with a massive 5% move to record highs. What’s more impressive is the volume seen on Friday outpaced that of the earnings day. Usually, the peak volume each quarter comes on the reaction day after the report. But not this quarter.

On the charting front, AAPL stock is firing on all cylinders. Momentum is surging and there aren’t any old resistance zones to get in its way. Seasonality should also lend a hand here with the holiday shopping season increasing interest for the stock.

Friday’s ramp generated renewed interest for AAPL options. Not surprisingly, calls led the way and accounted for 56% of the session’s sum. Activity swelled to 208% of the average daily volume, with 1,161,370 total contracts traded.

With earnings out of the way, implied volatility is sinking and now sits at 23% or the 13th percentile of its one-year range. Premiums are cheap, making long calls and call spreads attractive. January bull calls like the $260/$280 spread offer an easy way to bank on more upside into year-end.

Disney (DIS)

Source: ThinkorSwim

Disney shares have been languishing this quarter but just notched one of their best sessions of the three-month period. The 2.2% gain was important from a charting perspective because it allowed DIS stock to remain above the 200-day moving average. Perhaps the buying binge was due to optimism ahead of this week’s earnings announcement. Or maybe the shares were simply buoyed up alongside the S&P 500’s run to record highs.

In either case, the gains helped DIS avoid a breakdown and positioned the stock for an upside breakout over its 50-day moving average. We haven’t seen the north side of this area for the entire quarter so it will definitely mark a change in character.

Buyers’ enthusiasm was on full display in the options pits with calls accounting for 77% of the day’s tally. Total activity ticked up to 167% of the average daily volume, with 107,677 total contracts traded.

Implied volatility remains elevated ahead of Thursday’s earnings release. At 25%, the reading is around the 41st percentile of its one-year range.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!