The streak of quiet opens continues for U.S. stock futures today. Investors are gearing up for today’s Federal Reserve rate cut decision. A quarter-point cut will lower the Fed funds rate range to 1.50%-1.75%. The market is baking in a 98% chance of it happening.

Ahead of the bell, futures on the Dow Jones Industrial Average are up 0.03% and S&P 500 futures are higher by 0.08%. Nasdaq Composite futures have added 0.21%.

In the options pits, the usual activity racked up with calls leading the charge. Throughout the session, 18.6 million calls and 14.9 million puts circled the tables.

With the distance between calls and puts narrowing, the CBOE Volatility Index (VIX) single-session equity put/call volume ratio climbed back from Tuesday’s depths to 0.55. At the same time, the 10-day moving average continued its push lower near 0.65.

Options activity rose dramatically in Morgan Stanley (NYSE:MS), General Motors (NYSE:GM) and Advanced Micro Devices (NASDAQ:AMD), among others.

Let’s take a closer look.

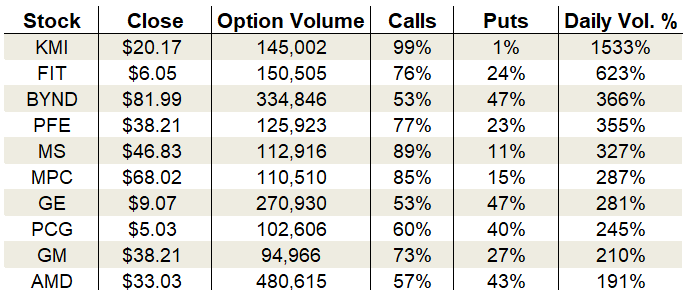

Morgan Stanley (MS)

Source: ThinkorSwim

Dividend payouts drove much of the heavy traffic in the options market yesterday. Morgan Stanley is our first example and provides an opportunity to zero in on the financial sector, which has been on fire lately. Earnings season delivered the goods for banks across the board, reigniting their uptrends with fresh breakouts.

The rocket ship rise in MS stock has been particularly steep, carrying the banking giant from $39 to $47 on a rope. While it’s flashing overbought signals, that hasn’t prevented buyers from continuing to push this week. Its 52-week high at $48.67 beckons like a beacon making it the obvious next target.

As mentioned, the real reason for the sudden boom in call demand is Wednesday’s ex-dividend date. The next quarterly payout of 35 cents (which translates into a yield of 3%) will go to shareholders of record as of yesterday’s close. So, many took to the options market using calls for short-term control of the stock to capture the dividend.

Total activity ballooned to over three times the average daily volume, with 112,916 contracts traded. 89% of the trading came from call options alone.

Implied volatility is dead at 24% or the 8th percentile of its one-year range. The dirt-cheap premiums decrease the appeal of selling options. Long option trades make more sense here.

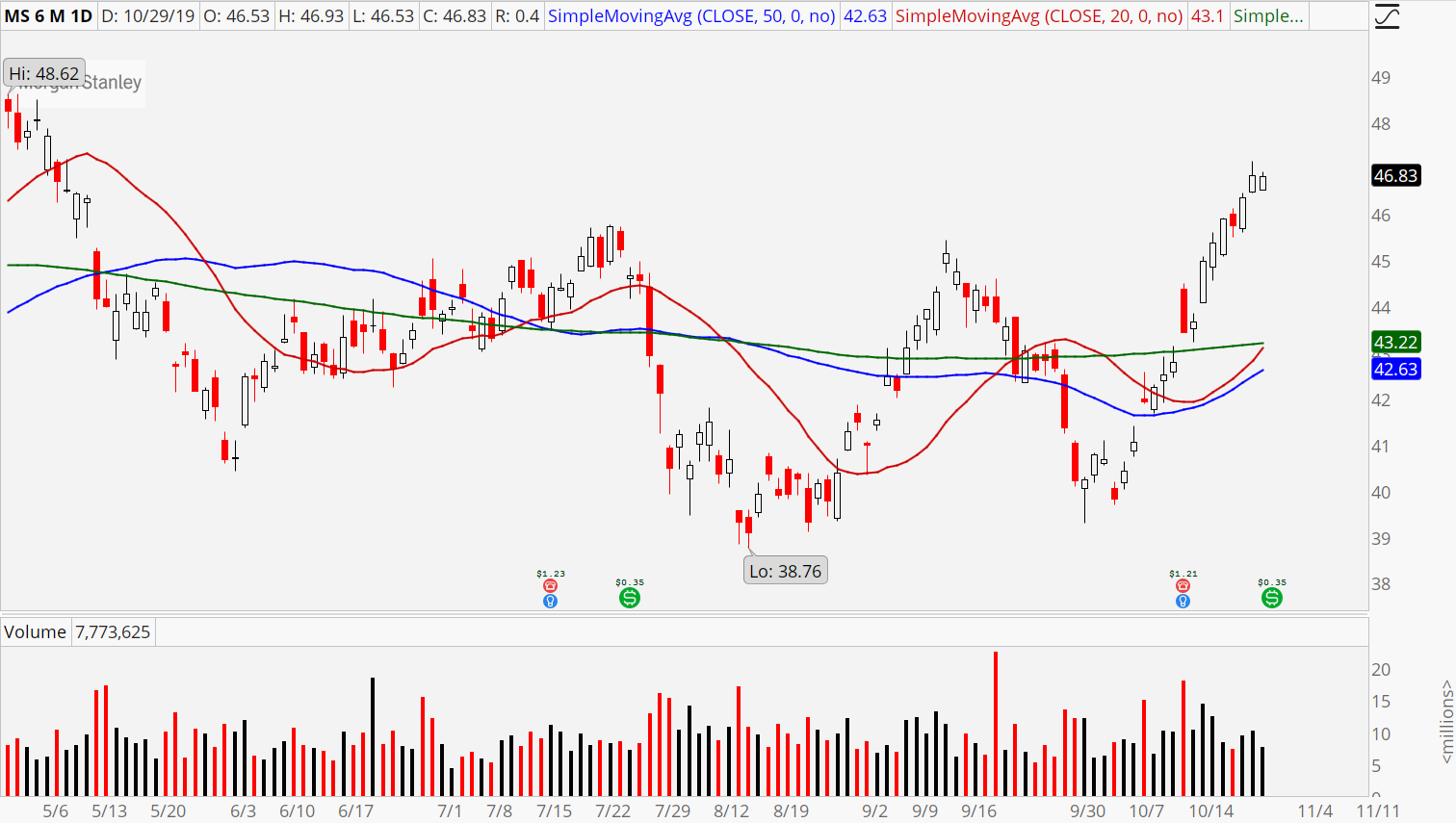

General Motors (GM)

Source: ThinkorSwim

Here’s the short version of Tuesday’s action in General Motors: GM reports earnings. The stock flies and implied volatility dies.

For the third quarter, the automaker earned $1.72 per share on revenue of $2.3 billion. The top line fell 8.7% versus the year-ago period, but was still better than expected given the company had to wrestle with a strike during the quarter that halted production in its U.S. factories.

GM’s stock jumped 4.3% on 18.6 million shares, clearing its 200-day moving average in the process. Its price trend remains a mess, though. The entirety of 2019 has been one sloppy trading range, a fistfight leaving both parties bloody but neither victorious. $40 is the next upside target.

On the options trading front, traders heavily favored calls. Activity swelled to 210% of the average daily volume, with 270,930 total contracts traded. Calls added 73% to the session’s sum.

The post-earnings volatility crush was in full force, driving implied volatility down to 25% or the 11th percentile. Premiums are baking in daily moves of 61 cents or 1.6%.

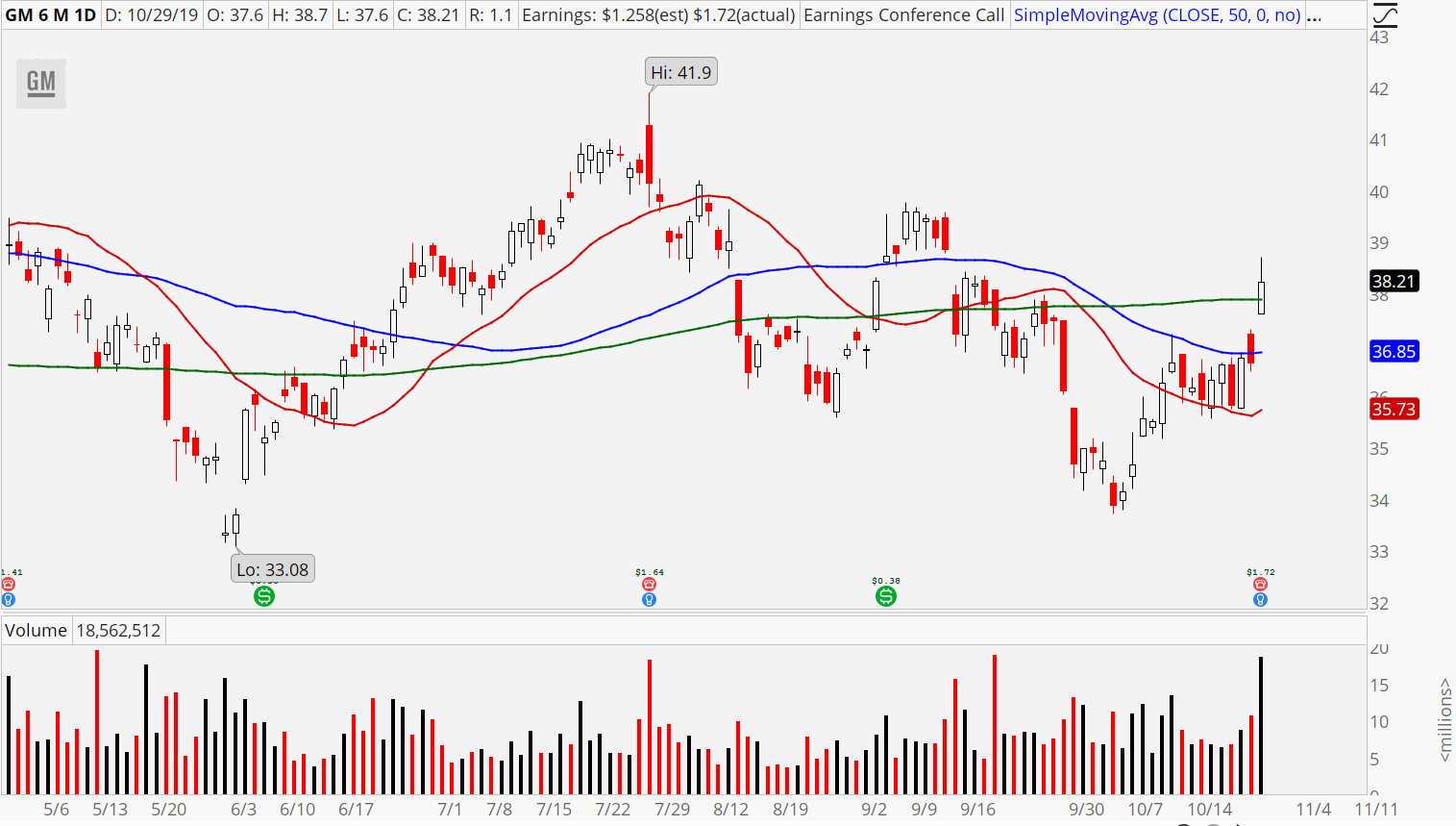

Advanced Micro Devices (AMD)

Source: ThinkorSwim

Advanced Micro Devices stepped up to the earnings plate last night. Investors tuned in to see if its recent 21% ramp was justified. Fortunately, it was. The numbers were good enough to keep AMD stock aloft. It’s heading for a small down gap at the open, but nothing significant enough to turn its newfound uptrend.

The company posted adjusted earnings of 18 cents per share on revenue of $1.8 billion. Both metrics arrive in line with analyst estimates. As long as the stock doesn’t push back below support at $30.80, its uptrend is intact, granting bull trades a green light.

As far as options trading goes, calls were the hot ticket ahead of the report. Activity jumped to 191% of the average daily volume, with 480,615 total contracts traded. Calls added 57% to the day’s take.

Option premiums were pricing in a $3 or 9% move after the event. So, this morning’s 1% drip will bring massive gains to traders swinging short volatility trades into the number. Look for implied volatility to drop dramatically this morning.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!