Bank of America (NYSE:BAC) stock may not be as great a bargain as some have hyped it to be. Yes, BAC stock is cheap. Or it appears to be. And yes, the recent quarterly earnings came in fairly positive and pleased the market.

But what lies underneath this story are some important hidden issues that investors need to consider.

Bank of America makes more money when interest rates rise, not when they fall. The Federal Reserve lowered rates twice in the third quarter. BAC was able to make up for lower net interest spread income by increasing its loan volume.

But if the Fed keeps lowering rates, that could take a toll on the bank’s super profitability. The recent Fed rate cuts may indicate we are nearing the end of the cycle.

On a deeper level, why is the Fed lowering rates? They must have concerns about the economic growth outlook in the U.S. Lower rates signal dampening economic activity, including loans. So BAC may not be able to “make it up in volume” if wages and jobs begin to falter.

What Happens If Interest Rates Go Negative?

Moreover, if the rates ever go negative as they have done in some European countries, the risks to banks increase. For example, Dr. Tenpao Lee, professor of economics at Niagara University, believes there are three general economic risks with negative interest rates.

The first is what happens when quantitative easing occurs, according to Dr. Lee., as stock prices rise, the dollar falls, trade deficits fall in the short term but eventually, inflation occurs.

Second, banks’ profit margins fall, as the Fed “would charge banks for their excess reserves” and net margins would be squeezed. Mergers and acquisitions in the banking sector would likely rise. However, other central banks would respond as well and there would be fallout effects from competitive rate drops.

Third, according to Dr. Lee, consumer behavior would be affected. He says it would be hard to predict this behavior. But no one likes to pay to have a bank keep your money. Most investors are used to having banks pay for consumers’ deposits.

The bottom line is that if rates keep on falling it will likely not bode well for Bank of America and BAC stock.

Are Loan Assets Really What They Seem?

And this brings up the most fundamental issue about bank assets. They are opaque. Loans make up the majority of the bank’s assets. No one really knows how well off the bank’s collateral really is.

All you really know is that when economic activity drops, many loans go bad as well. So what does it matter now that BAC is reporting good risk ratios and low charge-off volumes? What matters is the direction of economic activity, the amount of leverage that the bank has taken on and the quality of the loans on its books.

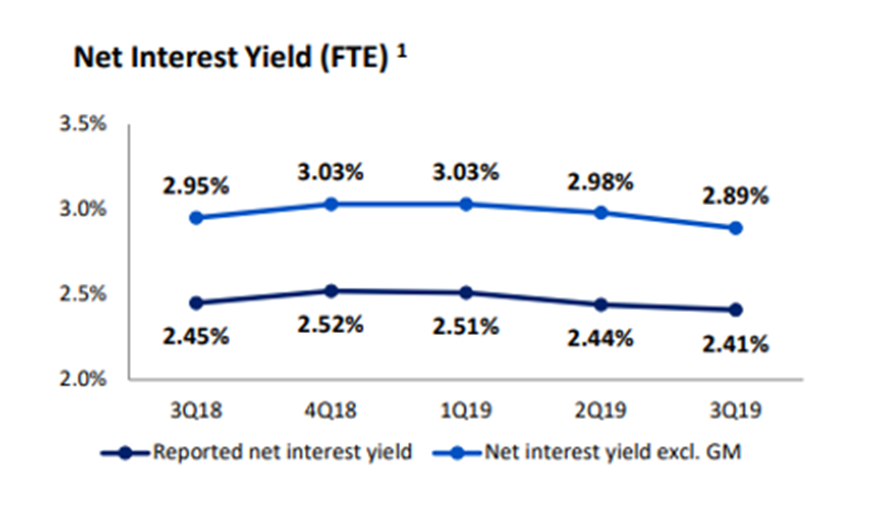

You can see in the chart from BofA’s recent earnings presentation that its net interest yield is actually falling. This shows that the net interest yield fell during Q3 2019, mainly as a result of the lower interest rate environment.

High Return on Equity Comes at a Cost

It turns out that Bank of America makes a very high return on tangible equity. The Q3 presentation showed that this was 15.6% on average over the past 12 months. Moreover, this is up from 7% a year ago.

However, shareholders don’t actually get that high a return. The reason is BAC stock trades at a price that is about 1.5 times the shareholders’ equity, or book value. So, in effect, the real return to shareholders is 15% divided by 1.5, or 10%, not 15%.

BAC Stock Is Not the Cheapest

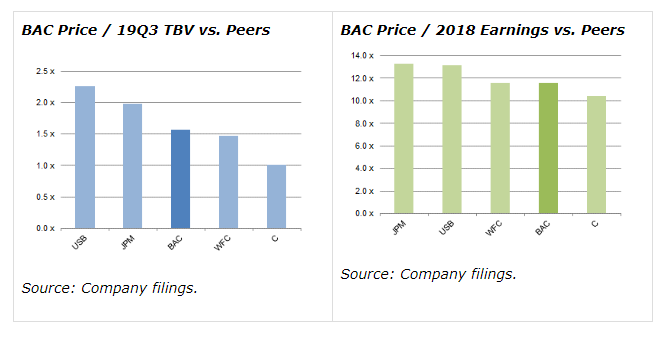

Moreover, Bank of America stock is not the cheapest large bank stock out there. The following chart from an insightful article in Seeking Alpha (“Bank Of America: Q3 Results Support Our 10-12% Annual Return Buy Case” by Blue Sky Capital Oct. 18, 2019) shows this.

The ratios for BAC stock’s price-to-tangible-book value (TBV) and price-to-earnings are compared with four other major banks. This shows that the BAC stock price is in the middle of the pack, both in terms of price-TBV and P/E.

Trading As a Group

This brings up another major risk for bank investors. Most of these bank stocks will trade as a group if a major economic slide begins to occur.

There will be very little differentiation between them. As rates continue to fall, they will all find it hard to make money. These stocks will fall as a group.

What This Means for Investors

Right now shareholders get paid a nice dividend. Bank of America stock has a 2.4% dividend yield. This helps reduce an investor’s risk of holding BAC stock.

Bank of America has also been consistently buying back its common stock. In the latest quarter, it repurchased $7.6 billion. Since the BAC stock market value is $282 billion, this represents 10.7% on an annualized basis. This helps investors gain a larger share of dividends in the future. The buybacks also help dividends per share to grow faster than otherwise.

In fact, that might be one reason why Warren Buffett recently applied to the Fed to allow Berkshire Hathaway (NYSE:BRK.A, NYSE:BRK.B) to raise its stake above 10%. Bank of America’s share repurchases helped push it above that threshold.

So with the dividend yield of 2.4% and the buyback yield of 10.7%, investors receive a return of capital total yield of about 13% annually. BAC stock has risen 26.6% so far this year. So the price seems to have discounted all the good news of the 13% total yield return of capital from Bank of America.

Investors might do well to wait until the present round of Fed rate cuts is through. Then BAC stock and other bank stocks won’t be in such a risky environment.

As of this writing, Mark Hake, CFA, did not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks. This includes stock with high yields and buybacks. Subscribers receive a two-week free trial period.