Earnings can be tricky, to say the least. Fortunately for investors, sometimes the aftermath can offer a stronger risk-adjusted buy decision. And right now large-cap stocks JPMorgan Chase (NYSE:JPM), Netflix (NASDAQ:NFLX) and Kinder Morgan (KMI) have paved the way towards this end both off and on the price chart.

It’s no secret that holding a company through an earnings event can be a very lucrative proposition. But with that potential for quick and favorable returns comes the risk of adverse price volatility which can expose investors to much larger-than-expected losses. From the smallest of small-caps to the largest of large-cap stocks, there’s no escaping this potential reality.

The fact is broader market sentiment and perception, earnings on an absolute basis, results versus consensus and whisper views, as well as guidance from the company can all play key factors in how Wall Street reacts to a company’s latest report. And which of those stimuli or combined influences holds the most weight is an elusive and losing battle.

The good news is it’s not time to put the cash under the mattress just because its earnings season. It’s actually a great period to watch for companies of interest, see if promises made were kept, as well as the reaction in shares following the report. And if the aftermath is in large-cap stocks JPM, NFLX and KMI it’s time to buy a stronger risk-adjusted position.

JPMorgan Chase (JPM)

JPMorgan is the first of our large-cap stocks to buy following earnings. The banker handily topped Street forecasts despite macro headwinds from rising interest rates and a softening global economy pinching both businesses and consumers alike.

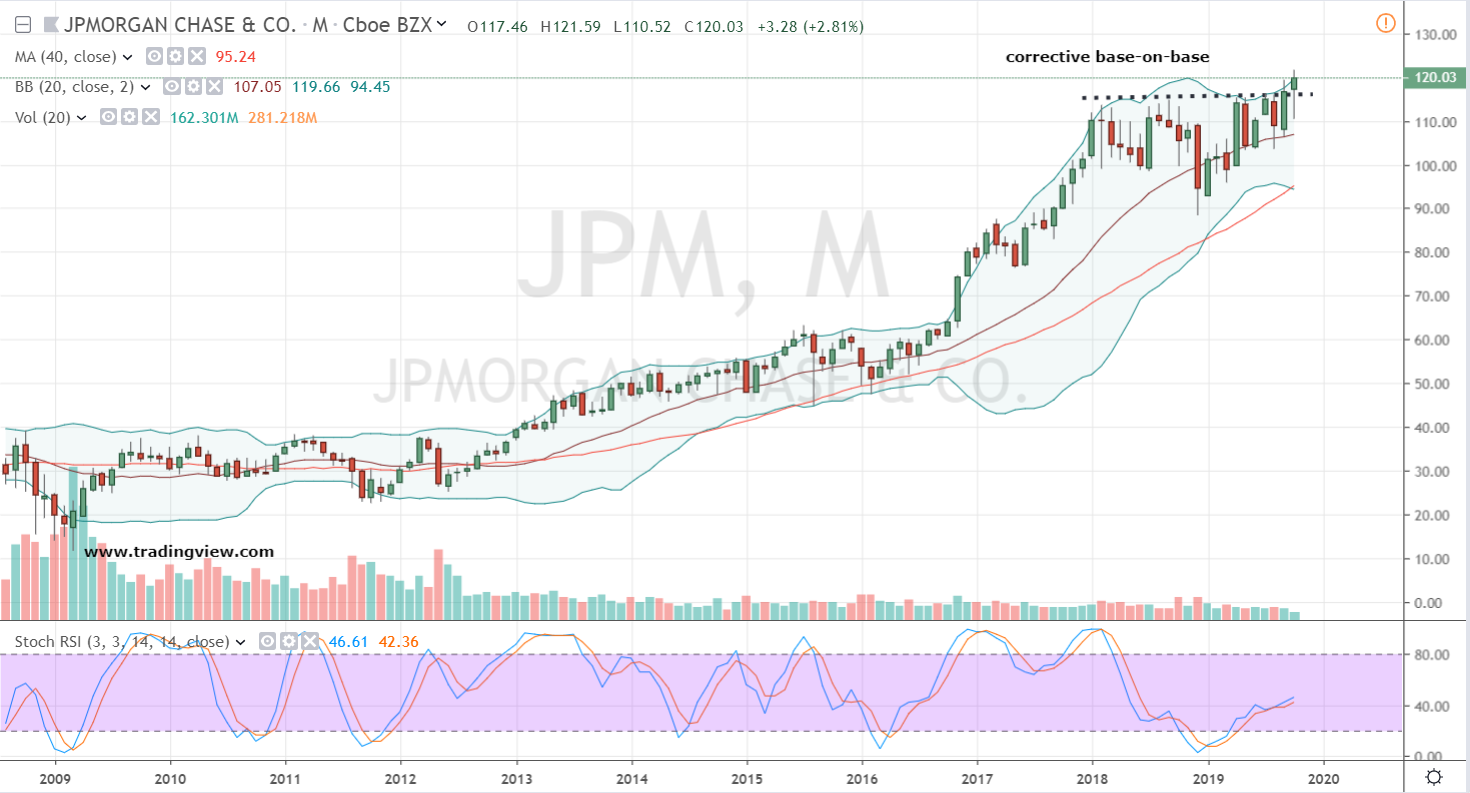

Technically, JPM stock is also second to none within the financial sector when it comes to leadership. On the price chart, shares have just broken out of a near two-year long base-on-base structure to fresh all-time highs. With the monthly stochastics trending nicely and confirming JPM’s breakout, there’s no time like the present on this large-cap stock.

Large-Cap Stock Strategy: Buy JPM stock today. Set a 7% stop-loss to contain downside risk and look to the area in-between $145 – $150 to peel off exposure and book partial profits.

Netflix (NFLX)

Netflix is our next large-cap stock to buy. The streaming video on-demand powerhouse didn’t deliver in spades, but the report was promising nonetheless. Profits easily topped analyst forecasts. And while the well-watched total subscribers’ metric fell short of views, the miss was a rounding error and marked a return to growth of 21% following last quarter’s egregious failure.

NFLX’s price chart isn’t a house of cards either. In fact it could prove to be quite bullish.

The monthly NFLX stock chart shows a higher-low candlestick pivot has formed and been confirmed on top of key Fibonacci support tied to the 2016 low in shares. The price action is also part of a double bottom formation tied to this large-cap stock’s corrective low from last December. Lastly, shares are on the verge of generating a bullish crossover in oversold territory vis-à-vis the monthly stochastics indicator.

Large-Cap Stock Strategy: Buy NFLX stock on a second attempt confirmation of the September pivot low if shares can clear $301.55 while maintaining the double bottom pattern low.

Kinder Morgan (KMI)

Kinder Morgan is the last of our large-cap stocks to buy following earnings. The $45 billion market cap mid-stream energy infrastructure play narrowly missed Street views with earnings of 22 cents falling short of forecasts of 24 cents and revenues of $3.21 billion below consensus estimates of $3.5 billion. The company also disappointed investors as it announced a delay in its Permian Basin pipeline project.

Following earnings KMI stock may not seem like a logical large-cap stock to purchase. But with a 5% dividend and favorable natural gas and liquids volume trends, beneath the surface there’s more to this large-cap stock. And on a price chart that’s been busy with its own construction project building a high-and-tight flat base at the 38% retracement level for the past five months, it’s time to put this large-cap stock on the radar.

Large-Cap Stock Strategy: Buy KMI stock above $21.46 and 1% through the pattern high. I’d recommend reducing exposure in-between the 50% – 62% levels and set an initial stop beneath $19.30.

Investment accounts under Christopher Tyler’s management do not currently own positions in securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits